What a brutal six months it’s been for Apple. The stock has dropped 21.5% and now trades at $196.06, rattling many shareholders. This might have investors contemplating their next move.

Following the drawdown, is now the time to buy AAPL? Find out in our full research report, it’s free.

Why Does AAPL Stock Spark Debate?

Creator of the iPhone and App Store, Apple (NASDAQ: AAPL) is a legendary developer of consumer electronics and software.

Two Things to Like:

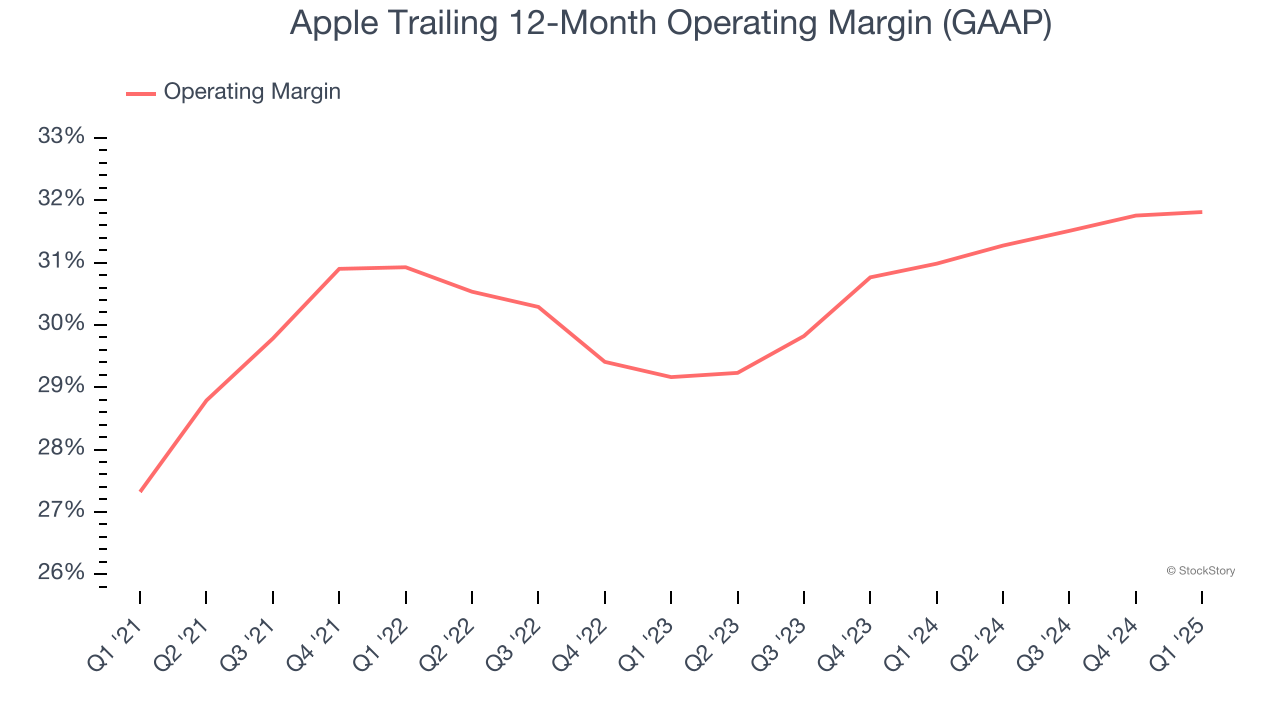

1. Operating Reveals a Well-Run Organization

Operating margin is an important measure of profitability for Apple. It’s the portion of revenue left after accounting for all operating expenses – everything from the cost of sales we talked about earlier to salaries, product development, and administrative expenses.

Apple has been a well-oiled machine over the last five years. It demonstrated elite profitability for a consumer discretionary business, boasting an average operating of 30.1%. This was especially robust given its large hardware revenue component.

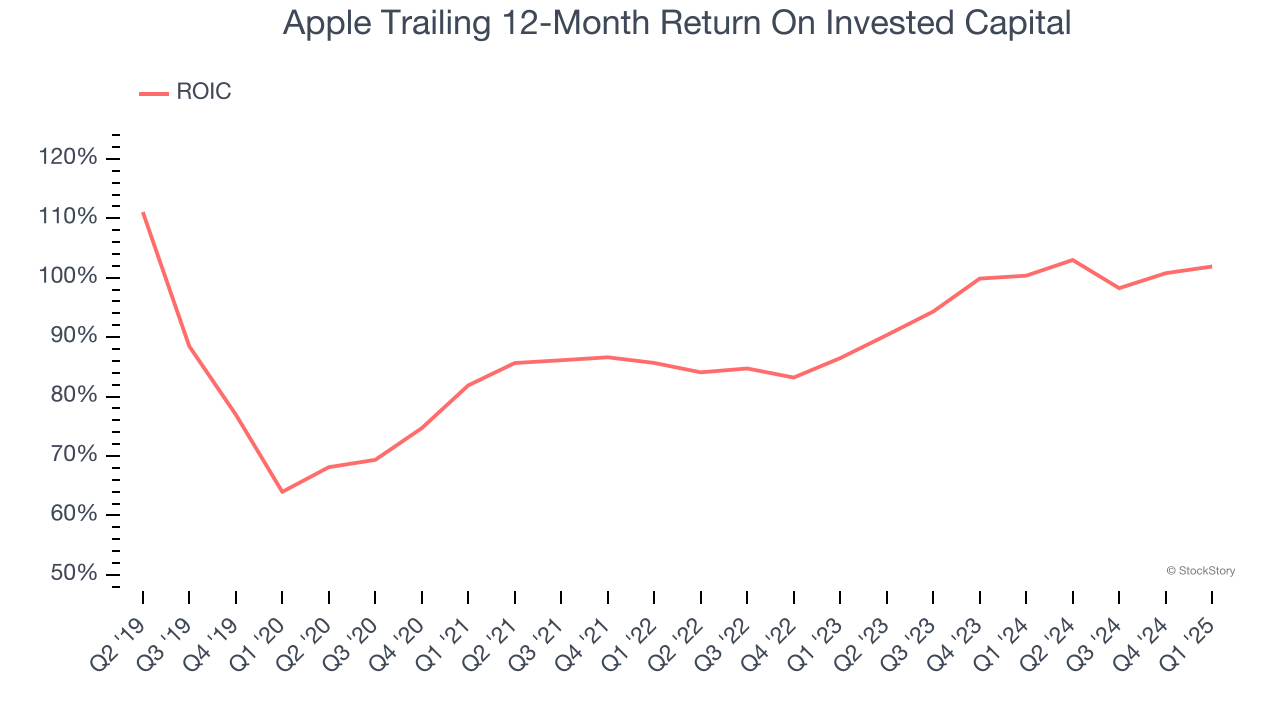

2. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Apple’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

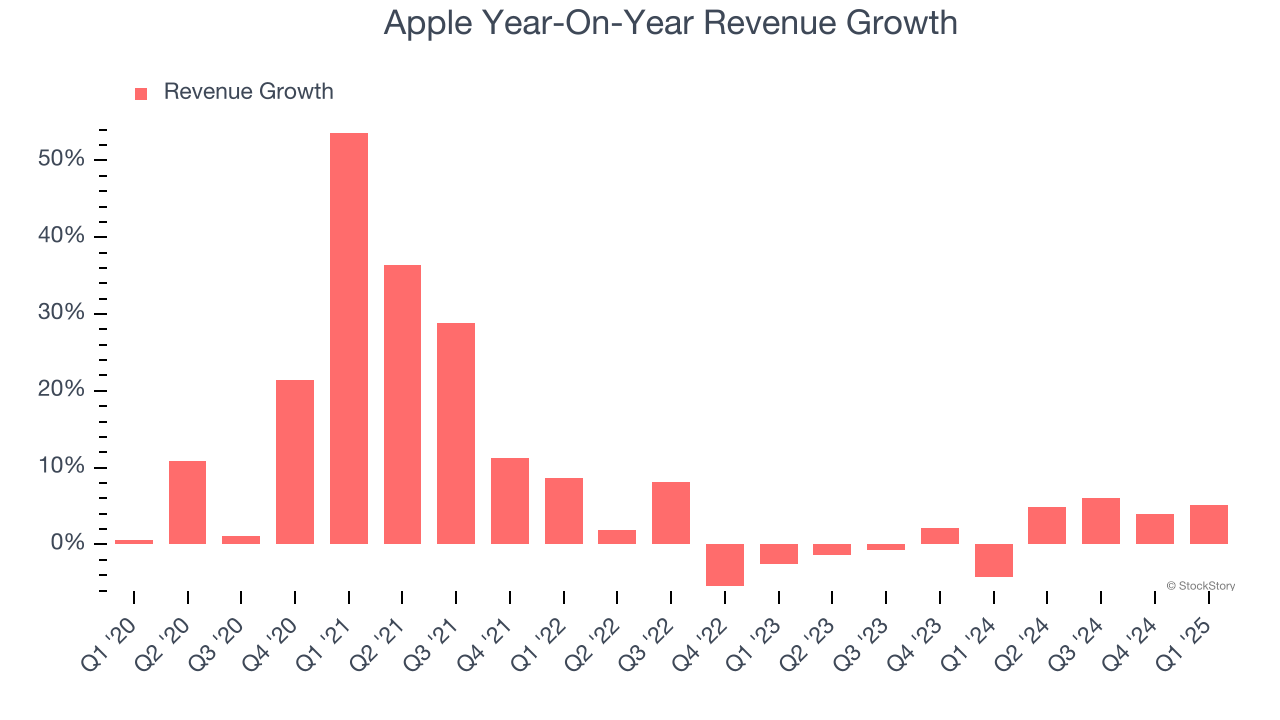

Long-term growth reigns supreme in fundamentals, but for big tech companies, a stretched historical view may miss emerging trends in AI. Apple’s recent performance shows its demand has slowed as its annualized revenue growth of 2% over the last two years was below its five-year trend.

Final Judgment

Apple has huge potential even though it has some open questions. With the recent decline, the stock trades at 26.2× forward price-to-earnings (or $196.06 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.