As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the specialized consumer services industry, including 1-800-FLOWERS (NASDAQ: FLWS) and its peers.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

While some specialized consumer services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.1% since the latest earnings results.

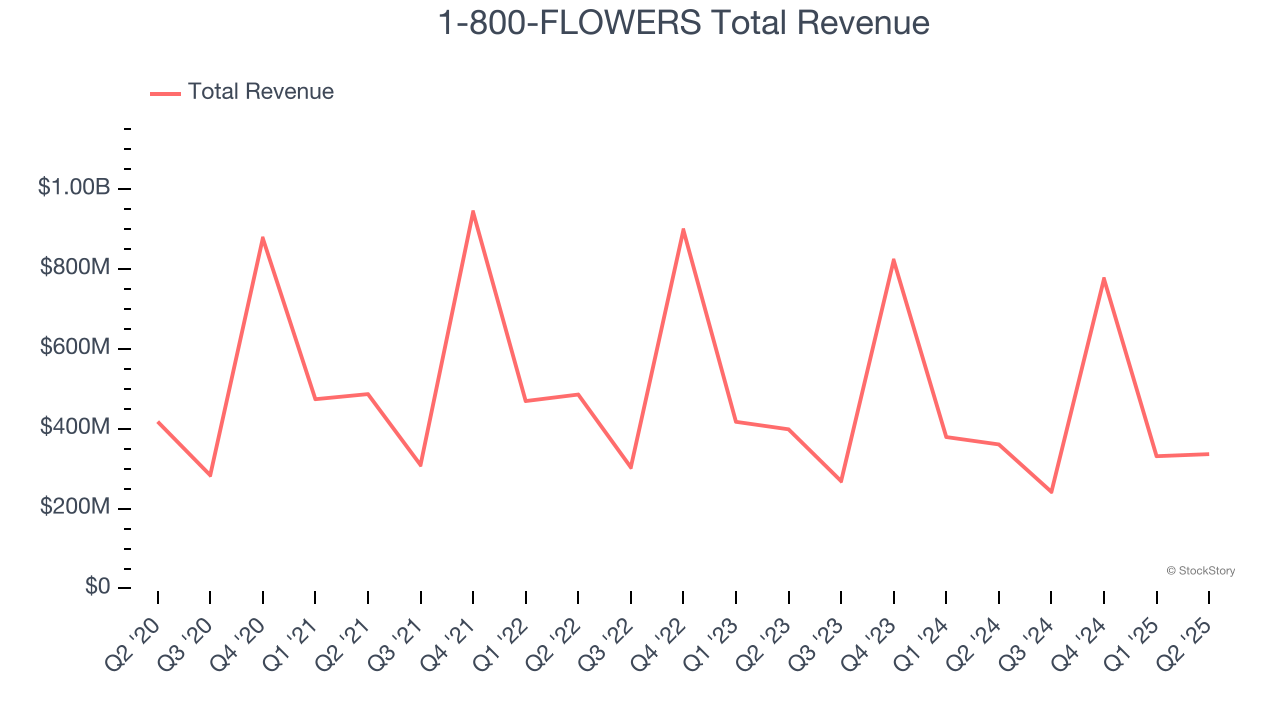

1-800-FLOWERS (NASDAQ: FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ: FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $336.6 million, down 6.7% year on year. This print exceeded analysts’ expectations by 2%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EPS and EBITDA estimates.

“I’m excited to have joined 1-800-FLOWERS.COM, Inc. at such a pivotal moment. This is an iconic brand with products people love, but we haven’t fully lived up to our potential in recent years. Customer expectations are shifting, technology is moving fast, and competition is evolving. That creates real opportunity. We’re making the company leaner and more agile, putting the customer at the center of everything we do, and using data to make smarter decisions. We’re sharpening how we attract and retain customers, broadening our reach beyond our e-commerce sites, and modernizing the customer experience. At the same time, we’re driving operational discipline, efficiency, and accountability. These changes will position us to get back to growth, deliver a better experience for our customers, and create long-term value for shareholders,” said Adolfo Villagomez, Chief Executive Officer.

Unsurprisingly, the stock is down 10.6% since reporting and currently trades at $4.77.

Read our full report on 1-800-FLOWERS here, it’s free for active Edge members.

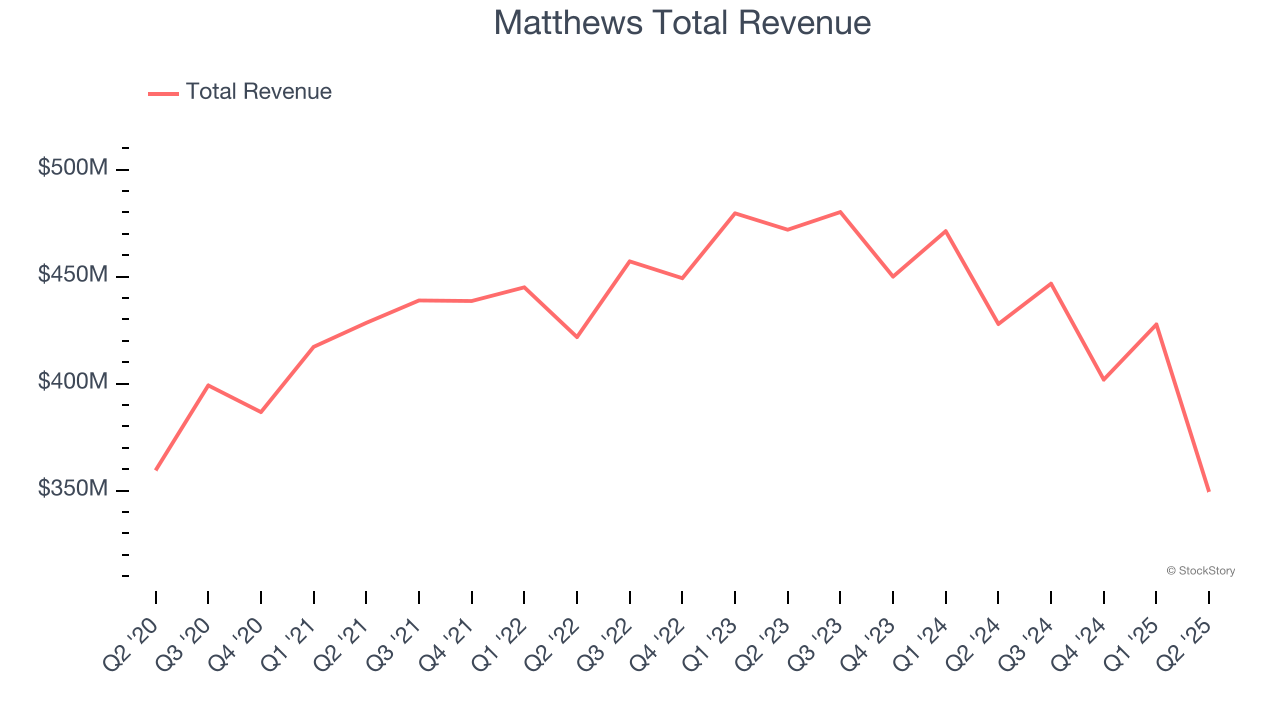

Best Q2: Matthews (NASDAQ: MATW)

Originally a death care company, Matthews International (NASDAQ: MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews reported revenues of $349.4 million, down 18.3% year on year, outperforming analysts’ expectations by 8.5%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and full-year EBITDA guidance beating analysts’ expectations.

Matthews scored the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 2.9% since reporting. It currently trades at $24.76.

Is now the time to buy Matthews? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: LKQ (NASDAQ: LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ: LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.64 billion, down 1.9% year on year, in line with analysts’ expectations. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 18.4% since the results and currently trades at $31.51.

Read our full analysis of LKQ’s results here.

Service International (NYSE: SCI)

Founded in 1962, Service International (NYSE: SCI) is a leading provider of death care products and services in North America.

Service International reported revenues of $1.07 billion, up 3% year on year. This result topped analysts’ expectations by 1.3%. Aside from that, it was a satisfactory quarter as it also recorded full-year EPS guidance topping analysts’ expectations.

The stock is up 10.9% since reporting and currently trades at $83.86.

Read our full, actionable report on Service International here, it’s free for active Edge members.

WeightWatchers (NASDAQ: WW)

Known by many for its old cable television commercials, WeightWatchers (NASDAQ: WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

WeightWatchers reported revenues of $189.2 million, down 6.4% year on year. This number surpassed analysts’ expectations by 6.2%. It was a very strong quarter as it also produced a beat of analysts’ EPS and EBITDA estimates.

WeightWatchers had the weakest full-year guidance update among its peers. The stock is down 29.2% since reporting and currently trades at $26.98.

Read our full, actionable report on WeightWatchers here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.