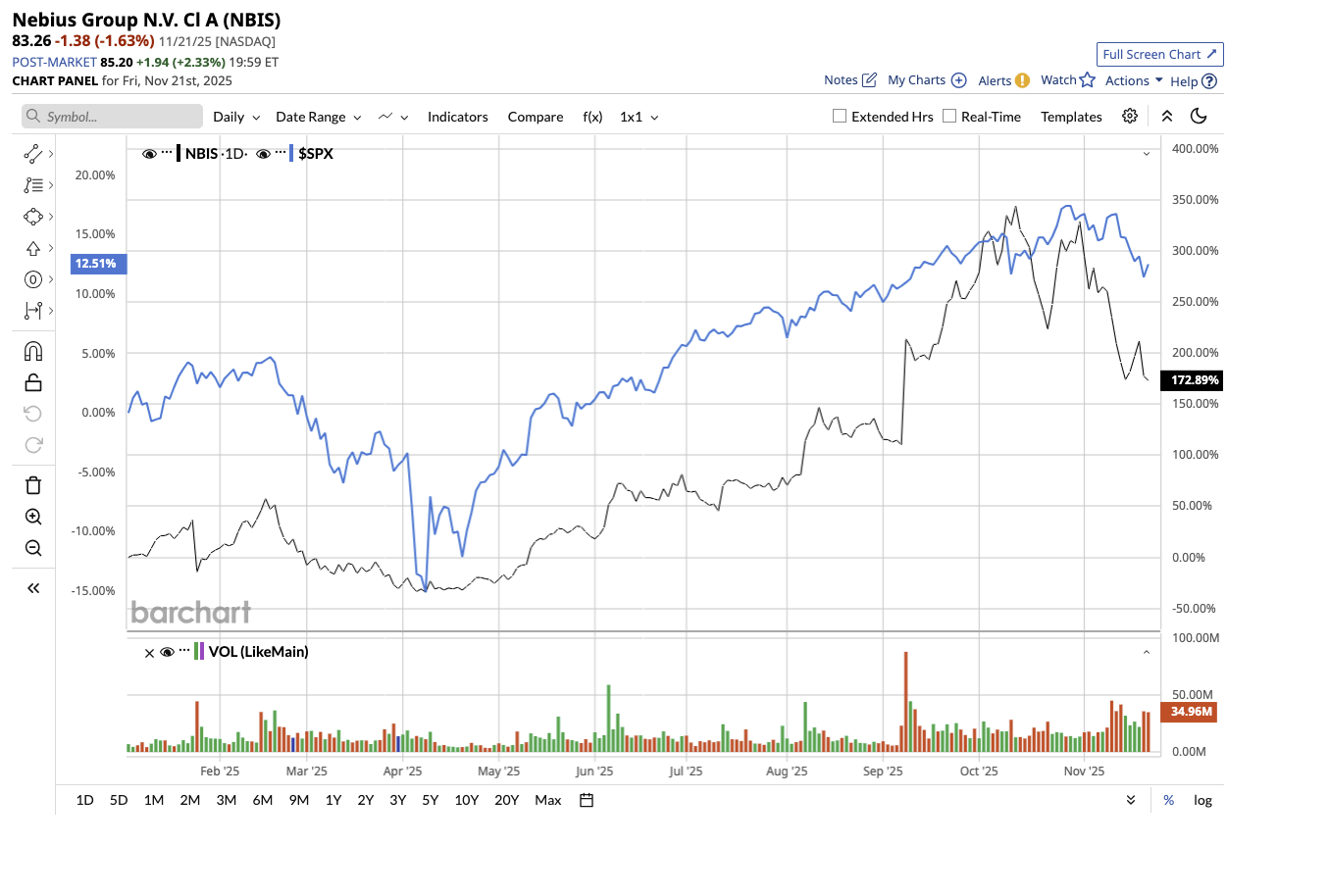

Nebius (NBIS) is quickly becoming one of the hottest names in artificial intelligence (AI) infrastructure, selling out every bit of cloud capacity it brings online. Investors are paying heed, as Nebius stock has soared 218% year to date, well exceeding the tech heavyweights. With multibillion-dollar contracts already secured with Microsoft (MSFT) and Meta Platforms (META), the company may be at the beginning of a massive growth story.

Let’s find out if now is the right time to buy Nebius stock.

About Nebius

Nebius builds full-stack AI infrastructure and operates a cloud platform designed specifically for intensive AI workloads. Its AI cloud capacity is powered by Nvidia hardware. It sells cloud capacity to Big Tech companies and AI startups, helping them train and run large AI models.

Alongside its core business, it also owns and operates brands such as Avride, an autonomous driving company, and TripleTen, a tech education firm. Nebius also holds equity stakes in other companies including ClickHouse and Toloka.

Nebius Delivers Explosive Growth in Q3

Nebius' Q3 results showed a fast-scaling AI cloud company racing to keep up with extraordinary demand. Group revenue reached $146 million, up 355% year-over-year and 39% sequentially. The core infrastructure business, which accounts for over 90% of revenue, increased 400% year-over-year, with adjusted EBITDA margins rising to nearly 19%. According to management, revenue growth was limited only by the rate at which additional capacity came online.

CEO Arkady Volozh remarked that Q3 saw a further increase in capacity demand, with every unit of infrastructure brought online promptly selling out. He went on to say that, while demand is high, supply is the sole limiting factor for revenue.

What has piqued investors' interest is that the demand is now translating into multibillion-dollar partnerships. In the quarter, Nebius announced a new $3 billion, five-year arrangement with Meta Platforms after the previously revealed Microsoft pact. Volozh pointed out that the Meta deal's size was limited solely by available capacity, showing the amount of unmet demand for Nvidia-powered AI infrastructure, particularly as the new Blackwell generation arrives.

Before this, in September, Nebius announced a multi-year arrangement with Microsoft. According to the agreement, Nebius will provide specialized AI capacity from its new data center in Vineland, New Jersey, commencing later this year. Volozh anticipates the deal to accelerate Nebius' AI cloud business growth in 2026 and beyond.

While all eyes are on the megadeals, Nebius stressed that its core AI cloud platform remains its long-term value driver. The company recently announced two key product releases: Aether 3.0, an enterprise-ready cloud platform designed for trust and control, and Nebius Token Factory, a production-grade inference solution for running open-source models at scale.

Nebius also anticipates reaching 2.5 GW of contracted power by 2026, surpassing its initial target of 1 GW. It intends to have between 800 MW and 1 GW of fully operational capacity connected to data centers by the end of 2026. This accelerated buildout supports Nebius in meeting its goal of an annualized run rate (ARR) of $7 billion to $9 billion by the end of next year. The company intends to fund its aggressive development with a combination of corporate debt, asset-backed financing, and a new at-the-market equity program worth up to 25 million shares. However, it highlighted that it will avoid diluting existing shareholders' ownership.

For the full year, the company expects between $500 million and $550 million in revenue, which will represent a year-over-year increase of 346% at the midpoint. Analysts expect revenue growth in the same range, with another 454% increase in 2026 to $3.07 billion. Looking ahead, management reaffirmed it will reach $900 million to $1.1 billion ARR by the end of 2025, with Microsoft and Meta revenue ramping significantly in 2026.

What Does Wall Street Say About Nebius Stock?

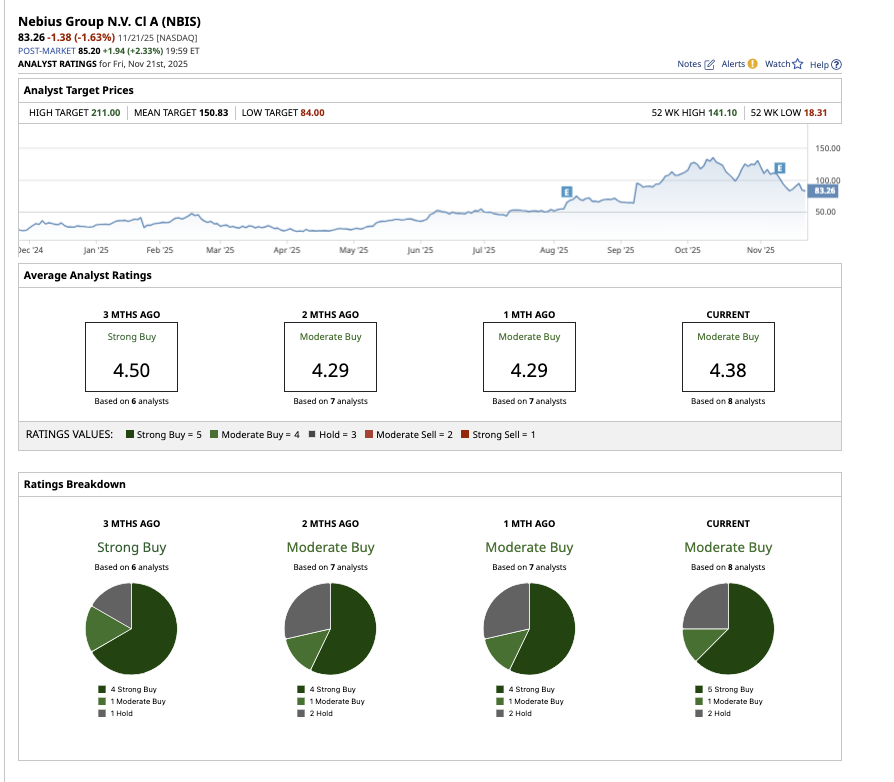

Overall, Nebius stock has earned a “Moderate Buy” rating on the Street. Out of the six analysts covering the stock, five have a “Strong Buy” recommendation, one rates it a “Moderate Buy,” and two rate it a “Hold.” Wall Street sees a potential upside of 81% from current levels based on its average target price of $150.83. Plus, the high price estimate of $211 implies an upside potential of 153.4% over the next 12 months.

The company sees a massive, expanding AI cloud market ahead of it and is creating infrastructure, signing clients, and scaling products at a breakneck pace to capitalize on it. While sales growth is impressive, Nebius remains unprofitable and may be better suited for investors with a high risk tolerance.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart