Dell Technologies (DELL) stock rallied as much as 8% on Wednesday morning even though the artificial intelligence (AI) server company came in shy of revenue estimates for its fiscal Q3.

Investors seem to be responding partially to its earnings that printed at $2.59 per share in the third quarter, handily exceeding the consensus at $2.47.

Thanks to the post-earnings rally, Dell stock is now challenging its 100-day moving average (MA) at the $136 level. A decisive break above that price could accelerate bullish momentum in 2026.

Versus their year-to-date high in October, DELL shares are still down some 20% at the time of writing.

Should You Buy Dell Stock After Q3 Earnings?

Despite the revenue miss, there was plenty in Dell’s earnings release that signals it may push higher and break above its 100-day MA in the days ahead.

For one, management raised its revenue guidance for the full year to nearly $112 billion today, citing strong artificial intelligence tailwinds.

This suggests the top-line weakness in Q3 perhaps reflects a delay in realizing some of the revenue, not a systemic slowdown in overall demand for the company’s products.

Moreover, the aforementioned better-than-expected outlook doesn’t include its multibillion-dollar deal with Iren (IREN) either.

Together, this suggests DELL stock’s fundamentals remain strong as ever, and it’s well-positioned for continued upward momentum heading into 2026.

Why Jim Cramer Recommends Owning DELL Shares

Dell stock has had a blockbuster year, but at a forward price-earnings (P/E) multiple of less than 15x, it still isn’t expensive to own for an AI name.

That’s why Jim Cramer continues to recommend owning DELL for the long-term.

In a recent segment of Mad Money, the famed investor said concerns of tariffs complicating Dell’s access to raw materials like semiconductors next year are severely overblown.

“This is Dell, for heaven’s sake. I’m not worried. Michael Dell will source them right and get them at good prices,” he told the viewers last week.

According to Cramer, the company will remain a “terrific” performer within the data center and enterprise space, which warrants owning it heading into 2026.

Note that DELL shares have their relative strength index (100-day) at nearly 51 currently, signaling the upward momentum is far from exhaustion for now.

Wall Street Agrees With Cramer on Dell Technologies

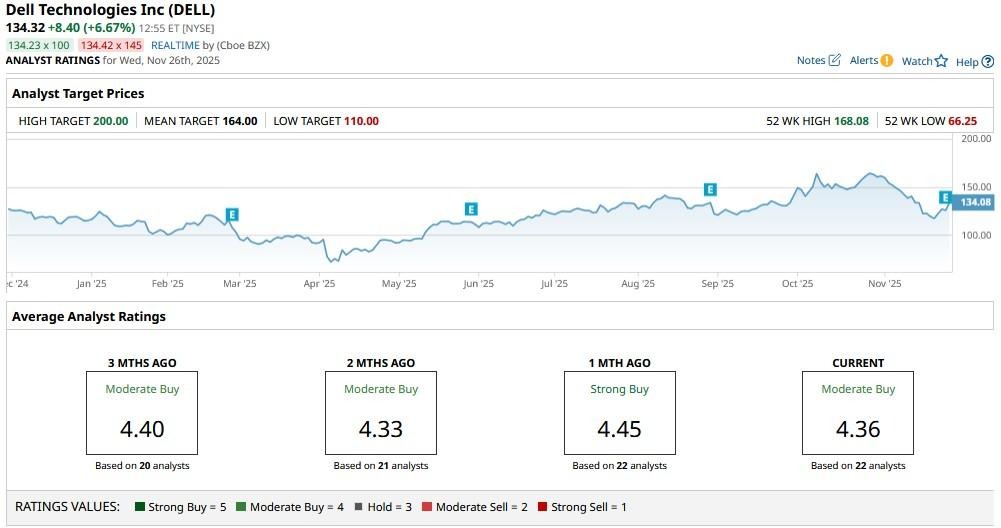

Wall Street analysts also remain bullish on Dell shares for the next 12 months.

The consensus rating on DELL stock currently sits at “Moderate Buy” with price targets going as high as $200, indicating potential for another 48% upside from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip

- These Stock Charts Filter Out the Noise So You Can Focus on Price. Here’s What Trend Traders Need to Know.

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?

- Google Is Getting the AI Spotlight, But Nvidia Says Its GPUs Are a ‘Generation Ahead.’ How Should You Play NVDA Stock Here?