Cryptocurrency’s latest slide hit the market like a sudden cold wind, sparked by a gap in economic data after the historic government shutdown. With the Fed now seen as less likely to cut rates in December, risk assets recoiled. Bitcoin (BTCUSD) cratered by more than 30% from its October peak, Ethereum (ETHUSD) followed, and another wave of liquidations swept across the sector. Rumors of a forced seller only deepened the pressure, leaving crypto-treasury firms scrambling as their balance sheets shrank overnight.

But just as the screens turned red, Cathie Wood moved in the opposite direction. While most investors pulled back, Ark Invest quietly loaded up, buying the dip across crypto-linked names.

The ARK Innovation ETF (ARKK) led the activity, acquiring 181,774 shares of Bitmine Immersion Technologies (BMNR), while 260,651 shares were added to the ARK Next Generation Internet ETF (ARKW) and ARK Fintech Innovation ETF (ARKF). Despite falling Ethereum (ETHUSD) and sliding miner valuations, Wood has scooped up shares of the crypto mining and treasury firm on various occasions in November, leaning into the weakness rather than running from it.

Her confidence is why traders watch every ARK transaction – buys, sells, all of it – because her timing has often shaped trends before the crowd catches on. Should you follow her lead and snag Bitmine Immersion Technologies (BMNR) now?

About Bitmine Stock

Founded in 2019, Las Vegas-based Bitmine has grown into a hybrid Bitcoin and Ethereum network company with a clear long-term mission to accumulate digital assets through mining, advisory services, and strategic capital raising. Now valued at $11.10 billion by market capitalization, the firm operates across multiple verticals – from traditional Bitcoin mining to synthetic hashrate products, corporate mining services, and broad Bitcoin consulting.

Its facilities stretch across low-cost energy hubs in Trinidad, Pecos, and Silverton, Texas, giving it a structural edge in power-intensive operations. In mid-2025, BitMine unveiled the world’s largest ETH treasury, marking a major shift in focus and establishing the company as a rising force in Ethereum-centric infrastructure and treasury strategy.

Bitmine’s NYSE listing on June 5 began at $8 per share, until the company made its pivotal move on June 30. By declaring ETH its core treasury asset, securing a $250 million private placement, and bringing in respected strategist Tom Lee as chairman, Bitmine ignited one of the market’s most dramatic surges. BMNR stock skyrocketed 695% in a single session, hitting $161 by July 3 and vaulting the company into mainstream visibility almost overnight.

But that initial euphoria has since cooled. BMNR has slid about 83.9% from its peak, mirroring the turbulence across digital assets. Over the past month alone, the stock has fallen 42.65%, with another 10.44% drop in just the last five days. The company’s shift toward a crypto-treasury model – heavily weighted toward ETH – has tethered its stock closely to the broader crypto sell-off. And as the market grapples with liquidity shocks and sliding Ethereum prices, BitMine Immersion shares have been swept into the same storm.

BMNR, with a towering valuation, priced at 103 times sales, trades far above sector norms, looking pricey even after its pullback. Still, Bitmine’s massive ETH reserves, non-dilutive cash flows from ancillary operations, and backing from heavyweights like Cathie Wood could be factors shaping its place in a fast-moving crypto landscape.

The company recently declared an annual dividend of $0.01 per share, payable on Dec. 29, making it the first large-cap crypto company to take that step, a clear signal of its commitment to shareholder value. Earlier in July, the firm also approved a share buyback program, positioning it among the few digital-asset treasuries pairing buybacks with ongoing ETH accumulation.

Cathie Wood’s Steady Accumulation of BMNR

Cathie Wood keeps pouncing on every pullback in BMNR, pouring millions into Ethereum-rich BitMine Immersion Technologies as a bet on the next leg of crypto infrastructure. Her conviction shows across Ark Invest’s major funds. As of Nov. 21, ARKK now holds 5.5 million shares, worth $143.2 million; ARKW carries 1.59 million, valued at $41.3 million; and ARKF owns 791,771 shares worth $20.6 million. Together, the stakes signal Wood’s steady accumulation strategy – turning each dip into an opportunity to deepen her position in Bitmine’s long-term story.

A Closer Look at Bitmine’s Fiscal 2025 Financials

Bitmine Immersion released its fiscal 2025 earnings report on Nov. 21, and that was the kind of headline numbers that usually light up a trading screen. Its revenue rose 84% year-over-year (YOY) to $6.1 million, driven mostly by self-mining and leasing. Plus, the company generated a striking $328.16 million in net income and EPS of $13.39, compared to last year’s losses.

Bitmine’s balance sheet has swelled to $11.8 billion in crypto and cash assets, underscoring the company’s growing weight in the digital-asset ecosystem. It now controls roughly 2.9% of all Ethereum in circulation, a scale rarely seen among publicly traded firms. As of Nov. 16, its treasury includes 3,559,879 ETH valued at $3,120 per token, alongside 192 Bitcoin, a $37 million position in Eightco Holdings (ORBS), and $607 million in unrestricted cash. These figures, detailed in a recent press release, highlight the depth of BitMine’s reserves and its influence within the broader crypto market.

But the market did not quite throw a celebration after the report. Instead, BMNR stock slipped as investors parsed the fine print – specifically, the company’s slow move into staking. Unlike Bitcoin, Ethereum can be staked natively, allowing holders to earn a steady yield simply by validating transactions. For a firm sitting on billions in ETH, staking could be a lucrative, low-friction way to grow its treasury. Yet Bitmine has not deployed those assets meaningfully, and with ETH’s recent price drop, that hesitation has stirred fresh debate about strategy and timing.

Bitmine’s answer came with a forward-looking pitch. The company is building out its Made-in-America Validator Network (MAVAN), a homegrown ETH staking infrastructure slated for launch in early 2026. To set the foundation, Bitmine has already lined up three pilot partners to test staking capabilities using a small slice of its ETH reserves. It is a move designed to shift the story, showing that BitMine isn’t avoiding staking but preparing to scale it in a controlled, institutional-grade way.

Backed by major investors and positioned at the intersection of ETH infrastructure and U.S.-based digital-asset innovation, Bitmine is trying to reassure the market that short-term volatility does not define its long-term playbook. And if crypto prices rebound once liquidity pressures ease – as many expect – the company’s massive treasury could quickly flip from a worry to a weapon.

What Do Analysts Expect for Bitmine Stock?

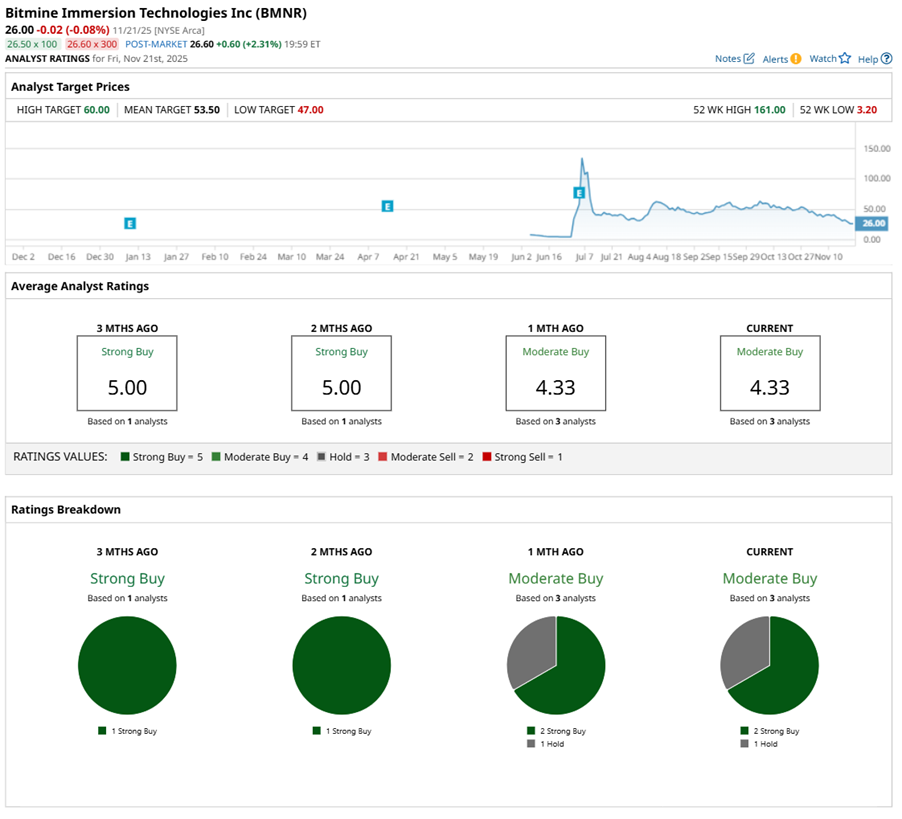

BitMine may not be a Wall Street favorite just yet, but the momentum around the stock is taking shape. Investor interest has steadily grown, and while the stock previously held a “Strong Buy” rating from the single analyst on Barchart, expanded coverage has shifted the consensus to a “Moderate Buy.”

Although a downgrade overall from a couple of months back, among the three analysts now following BMNR, two maintain “Strong Buy” ratings while one recommends a “Hold,” reflecting cautious optimism rather than unqualified enthusiasm.

The average price target of $53.50 signals an upside potential of 85% from current levels. Plus, with a Street high target of $60, the forecast hints at a potential 107.54% upside from current levels, signaling that quiet confidence is gradually turning into firmer expectations for Bitmine’s longer-term trajectory.

Final Thoughts on Bitmine

ETH’s extended slide has been a defining force across the crypto landscape, and Bitmine’s CEO, Mr. Lee, offered a pointed explanation for the turbulence. He highlighted the massive liquidity shock on Oct. 10 – the largest single-day liquidation event in crypto history – noting that similar disruptions, including the post-FTX freeze in 2022, took several weeks to unwind but ultimately snapped back in classic V-shaped recoveries. In his view, the recent drawdown was not a verdict on Ethereum or Bitcoin fundamentals, but a temporary dislocation driven by thinning market liquidity and mechanical positioning. That distinction matters when gauging whether the stress is cyclical or structural.

Bitmine itself sits squarely at the center of this liquidity story. BMNR stock, like much of the crypto-equity sector, has stalled under the weight of ETF outflows, market-maker selling, and cautious sentiment. Yet Lee’s framing suggests the pressure reflects the market's underlying plumbing. For investors trying to decipher the signal from the noise, this perspective may offer reassurance – if the timeline he outlines holds, liquidity pressures could begin easing in the weeks ahead, setting the stage for a more normalized environment.

At the same time, Bitmine continues signaling stability and discipline in its own right, becoming the first large-cap crypto company to declare an annual dividend – a rare move in a sector known for volatility.

As markets wobble, Cathie Wood keeps buying Bitmine, viewing it not just as a miner but a “digital asset treasury” with the makings of an on-chain asset manager. Its massive ETH reserves clearly draw ARK’s confidence, even as ETH-linked swings make it a high-volatility play.

In essence, it shows a company pushing through a tough liquidity stretch, backed by management confidence and smart-money support, and now it is up to investors to decide if this moment is a setback or the start of a setup.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?

- Down 66% From Its All-Time High, Should You Buy the Dip in Bullish Stock? Cathie Wood Is.

- Bitcoin Prices Are Falling, But MicroStrategy Is Not Sweating the Selloff. MSTR Stock Has a 71-Year Runway, According to Management.

- Cathie Wood Keeps Buying the Dip in Circle Stock. Should You?