With a market cap of $265.8 billion, Wells Fargo & Company (WFC) is one of the largest U.S. multinational financial services institutions, offering a broad range of banking products spanning retail and commercial banking, lending, mortgages, wealth management, and investment services. Founded in 1852 and headquartered in San Francisco, the bank has grown into a major player in the U.S. financial system with trillions in assets and a nationwide reach.

Companies valued at $200 billion or more are generally considered “mega-cap” stocks, and Wells Fargo fits this criterion perfectly. Through its diversified business model serving individuals, small businesses, and large corporations, Wells Fargo remains a central pillar in consumer and corporate finance, providing essential financial infrastructure and credit across the economy.

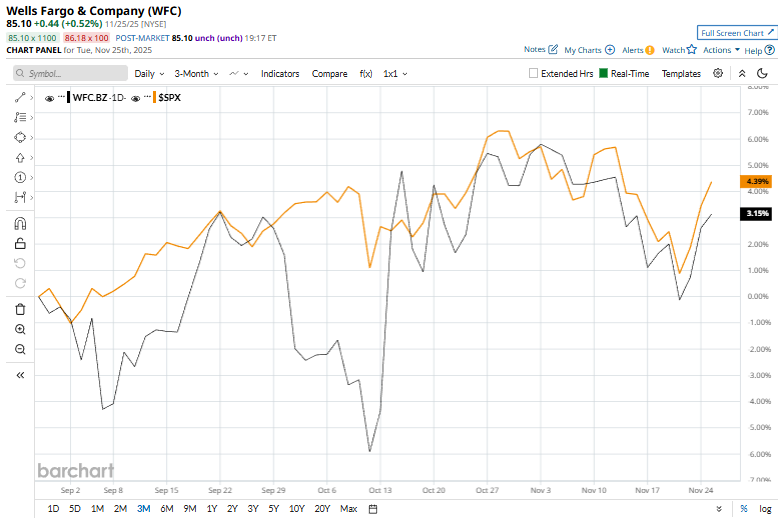

The company's stock has declined 4% from its 52-week high of $88.64 met recently on Nov. 12. Shares of Wells Fargo have gained 6.1% over the past three months, surpassing the S&P 500 Index ($SPX) 5.1% surge during the same time frame.

Additionally, WFC stock is up 21.2% on a YTD basis, outperforming the S&P 500’s 15% gain. However, shares of WFC have climbed 10.7% over the past 52 weeks, compared to SPX’s 13% over the same time frame.

Despite a few fluctuations, the stock has traded mostly above its 200-day moving average since last year and has climbed above its 50-day moving average since mid-October, indicating a bullish trend.

On Oct. 17, Evercore ISI analyst John Pancari reiterated a “Buy” rating on Wells Fargo and set a price target of $98, reflecting confidence in the bank’s fundamentals and earnings outlook. The bullish call helped lift investor sentiment, and Wells Fargo’s shares climbed 3.3% in the following trading session as markets reacted positively to expectations of continued profitability and operational momentum.

Additionally, WFC stock has underperformed its rival, Citigroup Inc. (C). Citigroup stock has soared 43.7% on a YTD basis and 43% over the past 52 weeks.

Despite Wells Fargo’s underperformance relative to its industry peers, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 26 analysts' coverage, and the mean price target of $95.54 is a premium of 12.3% to current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart