Nvidia (NVDA) is at it again. This time around, it’s the first firm to breach the historic market capitalization of $5 trillion. This firm is at the forefront of the artificial intelligence era. More growth is anticipated as its latest line of chips called Blackwell picks up pace in data centers, cloud computing, and AI inference applications.

This optimism goes far beyond the headlines of Nvidia’s achievements. Big Tech customers such as Microsoft (MSFT), Meta (META), Alphabet (GOOGL) (GOOG), and Amazon (AMZN) continue to increase their spending on AI. This is a huge wind at the backs of the world’s leading semiconductor supplier. Revenue growth, profit margins, and stock buybacks continue to escalate. Shareholders could well be seeing the beginning of Nvidia’s next “Golden Wave.”

About Nvidia Stock

Santa Clara-based Nvidia (NVDA) is one of the world’s leading companies in designing and manufacturing graphics processing units (GPUs) and overall AI computing solutions.

Nvidia’s stock price has risen sharply over the last year with a 44% increase. The current stock price is near $201, close to its record high at $212.19. Its stellar performance is due to its leading position in the AI infrastructure market.

Valuation is rich but warranted. Nvidia is still at forward 47.9x price-to-earnings ratio with a price to sales of 37.7x and return on equity above 100%. While appearing rich, these metrics also reflect the firm’s inherent profitability with a 55.9% net margin and 72% gross margin. Also, a debt-to-equity ratio of 0.08x is a reflection of Nvidia’s highly fortified balance sheet.

Nvidia Beats on Earnings

Nvidia reported revenue of $46.7 billion for the second quarter of its 2026 fiscal year. This marked a 56% increase year-over-year (YOY) and 6% sequentially, exceeding Wall Street expectations. Data Center revenue, led by the Blackwell GPU platform, increased 17% sequentially as demand for AI infrastructure remained exceptionally strong.

The company achieved non-GAAP EPS of $1.05, compared with $0.68 in the same period last year. Gross margin reached 72.7%, or 72.3% excluding a one-time $180 million inventory benefit, highlighting the profitability of its AI product mix. Nvidia also generated significant free cash flow and returned $24.3 billion to shareholders through share repurchases and dividends during the first half of fiscal 2026.

Management emphasized that the Blackwell platform is now in full production and continues to see extraordinary demand across hyperscale and enterprise customers. The board of directors expanded the share repurchase authorization by $60 billion, reinforcing confidence in long-term growth.

The company’s next earnings release is scheduled for Nov. 19, 2025, when investors will be watching for updates on the Blackwell Ultra ramp and overall AI infrastructure backlog.

What Do Analysts Expect for Nvidia Stock?

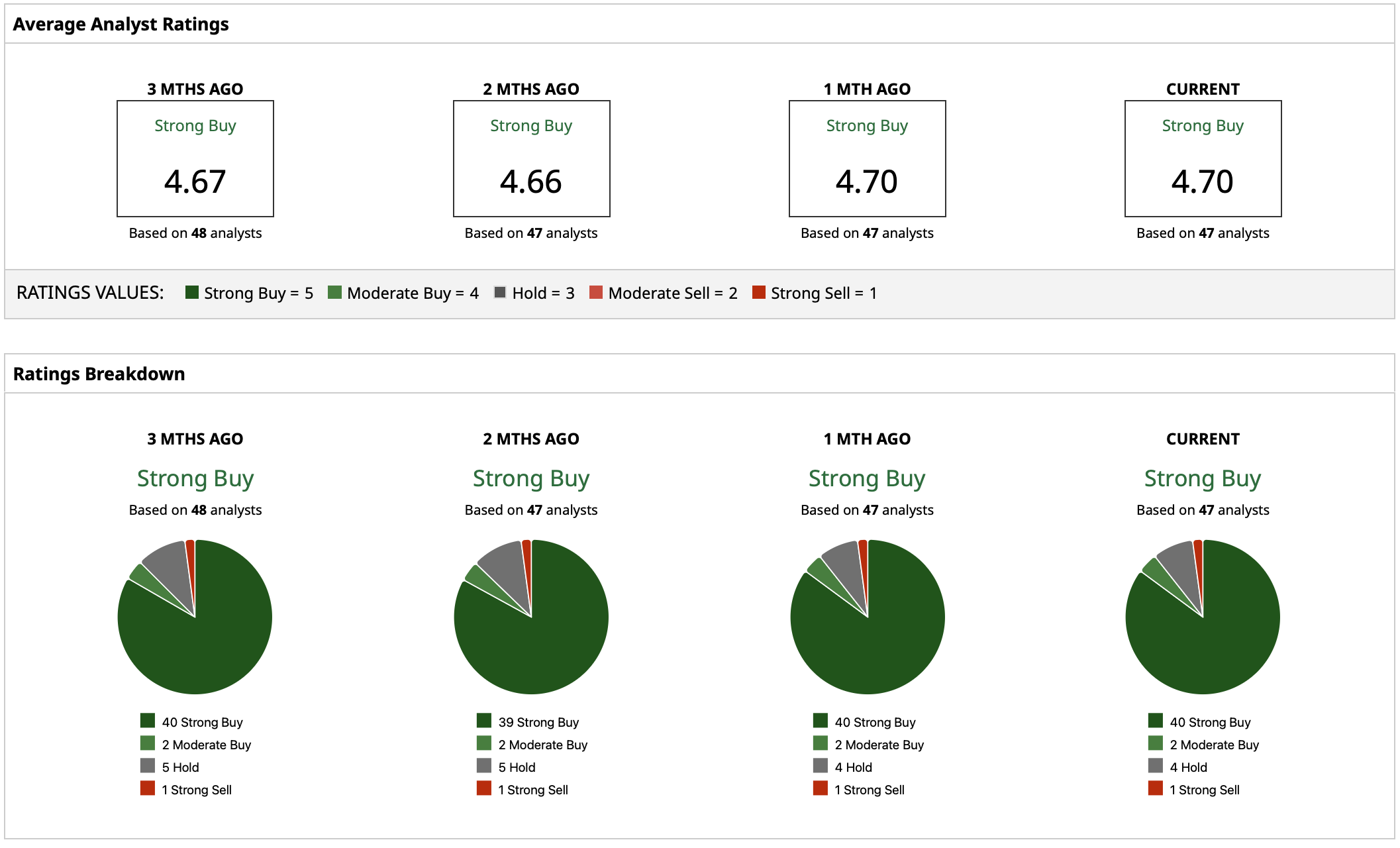

Analysts continue to be extremely bullish with a “Strong Buy” consensus rating. Loop Capital lifted its target price to a street high of $350 due to “the next Golden Wave of Gen-AI adoption.”

The mean target price for Nvidia is at $233.05, which is supportive of growth potential of approximately 14% at current prices. A comparison with the high target price suggests growth potential of approximately 70%.

Analysts believe that Nvidia’s unique AI platform is leading it forward against its competitions Advanced Micro Devices (AMD) and Intel (INTC).

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Alex Karp Says ‘We Were Right, You Were Wrong’ as Palantir Delivers Record Revenue. Should You Buy PLTR Stock Here?

- Cisco Just Got a New Street-High Price Target. Should You Buy CSCO Stock Here?

- Palantir Just Got a New Street-High Price Target. Should You Buy PLTR Stock Here?

- Buy Nvidia Stock Now for the Next ‘Golden Wave’ of AI