Nvidia’s (NVDA) rise has been nothing short of remarkable. What began as a niche graphics chip maker has evolved into one of Wall Street’s most influential powerhouses, shaping the very core of modern technology. Its processors now drive everything from next-generation vehicles to massive data centers, turning Nvidia into a name synonymous with innovation and scale. The artificial intelligence (AI) chip stock continues to climb, reflecting investor confidence in its global reach and execution.

And just when it seemed the company had reached every corner of tech, CEO Jensen Huang added another power move to the story. In a landmark deal, Nvidia is set to supply over 260,000 AI chips to South Korea’s biggest names – Samsung, Hyundai, NAVER Cloud, and SK Group – under an initiative led by the nation’s Ministry of Science.

It’s part of a national push to make South Korea the “AI capital of Asia.” From Samsung’s massive AI factory to Hyundai’s autonomous dreams, Nvidia’s chips are everywhere. Hence, NVDA stands out as a smart, future-proof portfolio addition for investors betting on the next wave of AI dominance.

About Nvidia Stock

Santa Clara-based Nvidia hardly needs an introduction as the spark plug of the modern tech era. Once the king of gaming graphics, it reinvented itself as the driving force behind the AI boom, transforming its GPUs into the engines powering data centers, robots, and digital worlds. Its CUDA platform locked in a generation of developers, turning Nvidia’s ecosystem into the industry’s gold standard.

With a market capitalization nearing $4.9 trillion, Nvidia stands as the world’s most valuable company and the first to reach such heights. Each time skeptics question its worth, Jensen Huang’s powerhouse accelerates harder, redefining speed and scale, and providing a true picture of tech world dominance. Momentum, after all, is Nvidia’s natural state.

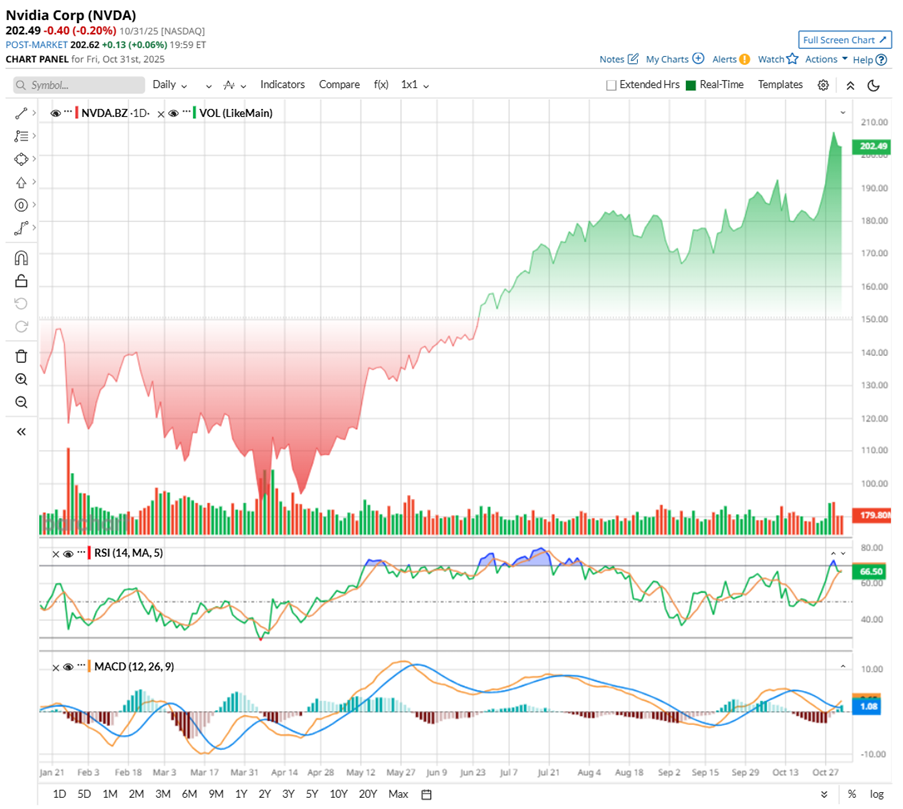

Shares of the AI chip maker have been on a relentless run this year – up 45.4% year-to-date (YTD) and soaring 71.5% over the past six months alone, cementing its place among Wall Street’s strongest momentum plays. The stock crossed above the $200 mark on Oct. 28, and notched a fresh high of $212.19 on Oct. 29, marking yet another milestone in its rally.

Technically, the chart suggests a moment of pause. The 14-day Relative Strength Index (RSI), which hovered near the overbought territory at 80 in July, once again flirted with that level at 70 on Oct. 29 before easing to around 66, a sign that momentum may be leveling off.

Meanwhile, the MACD oscillator tells a different story. The orange MACD line remains above the blue signal line, holding at bullish momentum. The slight narrowing gap suggests the pace is cooling, but the trend stays upward. For now, the bulls are still steering the wheel, just slowing down to catch their breath while the bears quietly line up for a chance.

NVDA stock doesn’t come cheap, priced at roughly 48x forward earnings, standing tall above most of its sector peers and even its own historical average. Yet, for a company delivering double-digit earnings growth and maintaining strong profit margins, the price tag begins to make sense. Growth at this scale rarely comes at a discount.

In fact, Nvidia’s forward PEG ratio of 1.25x is below the sector average, and its own historical median, suggesting the valuation, while rich, remains grounded in genuine growth strength.

A Closer Look At Nvidia’s Q2 Results

Nvidia’s fiscal Q2 2026 earnings report, released on Aug. 27, was impressive, posting $46.7 billion in revenue, up 56% year-over-year (YOY), while adjusted EPS surged 54% annually to $1.05, comfortably beating Wall Street’s forecasts.

The data center division stole the spotlight, delivering a record $41.1 billion in sales. Nvidia’s Blackwell architecture proved to be the game-changer, with data center revenue jumping 17% sequentially. The company began shipping its GB300 chips and saw strong traction for the Blackwell Ultra platform, which raked in tens of billions and redefined AI inference efficiency. Its networking arm also delivered a record $7.3 billion, driven by soaring demand for Spectrum-X Ethernet and InfiniBand products.

Profitability stayed robust, with gross margins at 72.7%, boosted by the release of reserved H20 inventory. Nvidia even logged around $650 million in H20 sales to a non-China customer, a timely buffer amid export curbs.

Looking ahead, management estimates Q3 revenue around $54 billion, plus or minus 2%, excluding uncertain H20 sales to China amid export curbs. Non-GAAP gross margin for the quarter is projected to be around 73.5%, plus or minus 50 basis points. It also unveiled a massive $60 billion share buyback plan, underscoring its faith in future growth.

Nvidia is now gearing up to release its fiscal Q3 2026 earnings report on Wednesday, Nov. 19, after the market closes and expectations couldn’t be higher. Analysts tracking the AI chip stock remain firmly bullish, projecting the company’s EPS of $1.17, up 50% YOY, on revenue of roughly $54.7 billion.

Looking further ahead, consensus forecasts call for annual EPS growth of 44% to $4.22 in fiscal 2026, followed by another powerful 41.2% YOY surge to $5.96 in fiscal 2027. With momentum building and estimates climbing, Wall Street sees Nvidia’s growth story as far from finished.

Nvidia’s 260,000-Chip Deal in South Korea

The mega deal to supply over 260,000 AI accelerator chips to South Korea’s biggest names cements Nvidia’s global dominance. The pact, brokered with the nation’s Ministry of Science, marks a defining moment in South Korea’s mission to build sovereign AI infrastructure and become the “AI capital of the Asia-Pacific.”

At the heart of it, Samsung will use over 50,000 Nvidia chips to create a massive “AI factory,” while also working with Nvidia on next-gen HBM4 memory. Hyundai plans to deploy an equal number of Blackwell chips to fuel autonomous driving and manufacturing innovation. Meanwhile, SK Group will launch Asia’s first “industrial AI cloud,” powered by Nvidia’s RTX Pro 6000 Blackwell servers.

For CEO Jensen Huang, this isn’t just another deal, it’s a strategic coup. With South Korea’s tech ambitions soaring, Nvidia’s chips are becoming the foundation of an AI-powered nation.

What Do Analysts Expect for Nvidia Stock?

Wall Street can’t stop talking about Nvidia, and for good reason. Fresh off making history as the world’s first $5 trillion company, analysts think the story’s only getting started. Loop Capital just dropped jaws with a Street-high $350 price target, calling it the start of a “Golden Wave” for generative AI, a rally that could send Nvidia’s valuation toward $8.5 trillion.

Analyst Ananda Baruah says the company’s upcoming Blackwell GPU ramp could double shipments in the next year while pushing prices higher, the perfect storm of demand and dominance.

Meanwhile, Rosenblatt Securities raised the target to $240, backed by a jaw-dropping $500 billion in Blackwell orders through 2026.

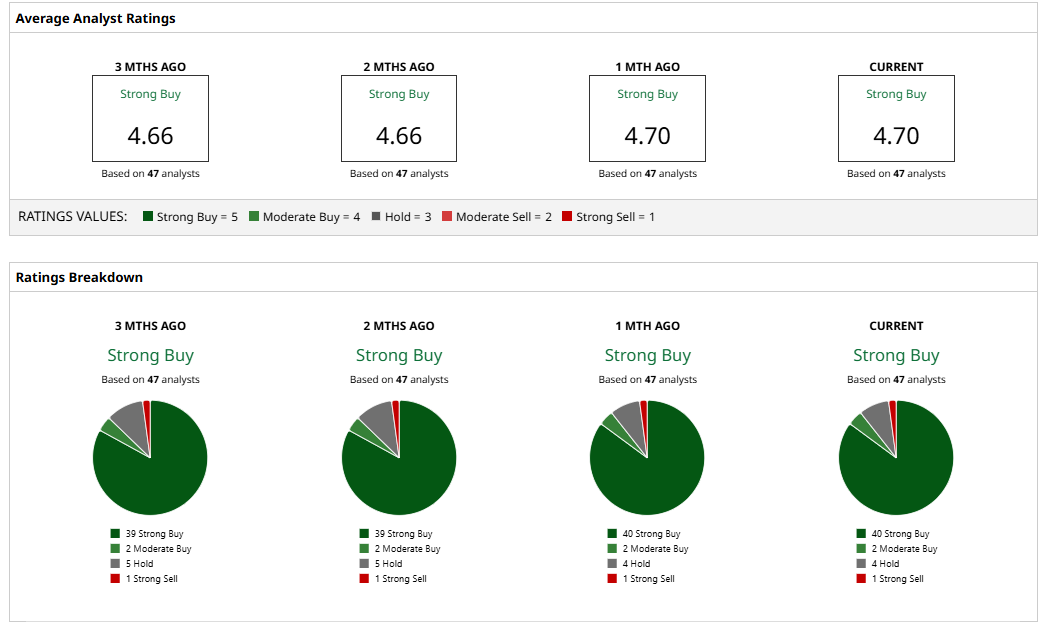

Overall, analysts are bullish about NVDA’s growth prospects, giving the stock a consensus rating of “Strong Buy.” Of the 47 analysts covering the stock, 40 advise a “Strong Buy,” while two suggest “Moderate Buy,” four advise a “Hold,” and only one suggests a “Strong Sell.”

The average analyst price target for NVDA is $233.05, indicating a potential upside of 19%. Loop Capital’s Street-high target price of $350 suggests that the stock could rally as much as 80% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Apple’s Record Quarter Hints at Something Huge Coming: Is AAPL Stock a Buy Now?

- 2 Chart Indicators to Confirm Stock Breakouts & Reversals with Heikin Ashi Candlesticks

- Dear Opendoor Stock Fans, Mark Your Calendars for November 6

- Apple Stock ‘Won’t Work’ Until This 1 Thing Happens, According to Analysts