Looking back on home builders stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Toll Brothers (NYSE: TOL) and its peers.

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

The 12 home builders stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 4.1%.

Luckily, home builders stocks have performed well with share prices up 10.9% on average since the latest earnings results.

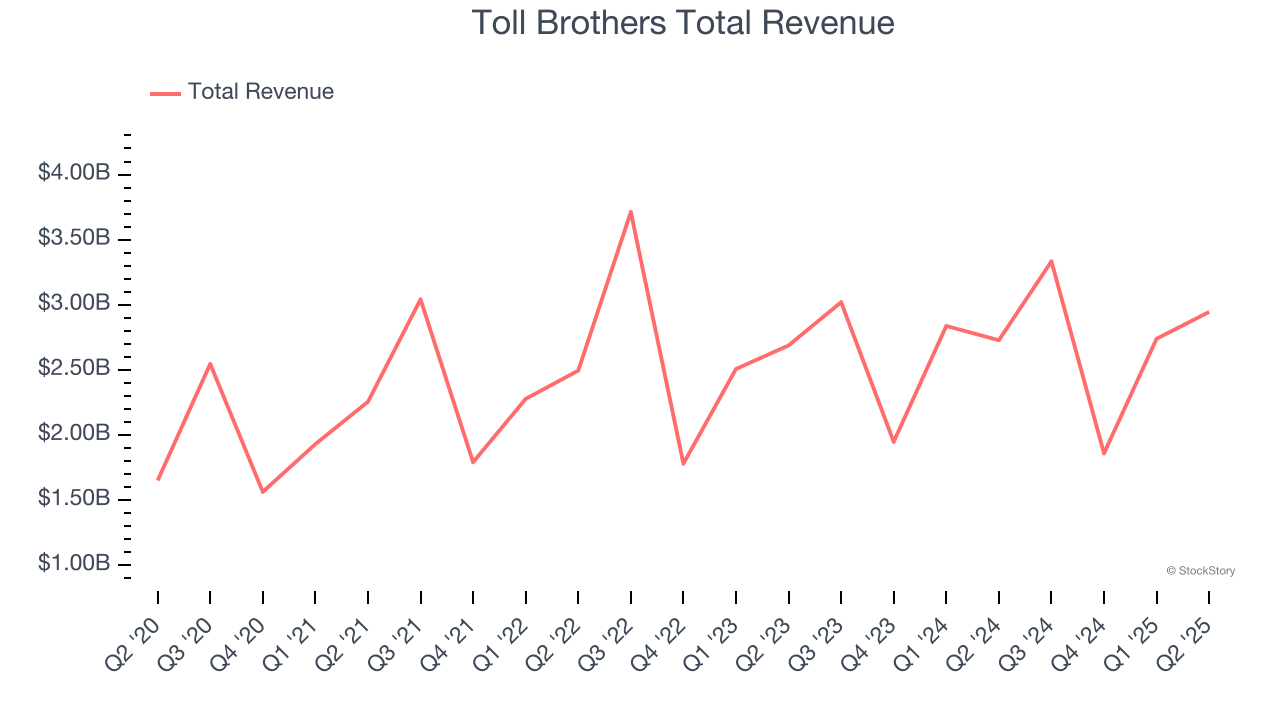

Toll Brothers (NYSE: TOL)

Started by two brothers who started by building and selling just one home in Pennsylvania, today Toll Brothers (NYSE: TOL) is a luxury homebuilder across the United States.

Toll Brothers reported revenues of $2.95 billion, up 8% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates.

Douglas C. Yearley, Jr., chairman and chief executive officer, stated: “We are pleased to report another strong quarter. We delivered 2,959 homes at an average price of $974,000, generating record third quarter home sales revenues of $2.9 billion, a 6% increase over last year. We achieved an adjusted gross margin of 27.5%, or 25 basis points above guidance, and our SG&A margin of 8.8% was 40 basis points better than guidance. We earned $370 million after taxes, or $3.73 per diluted share, and returned $226 million to stockholders through share repurchases and dividends, positioning us for another year of healthy profitability and solid returns."

Interestingly, the stock is up 4.4% since reporting and currently trades at $138.

Is now the time to buy Toll Brothers? Access our full analysis of the earnings results here, it’s free.

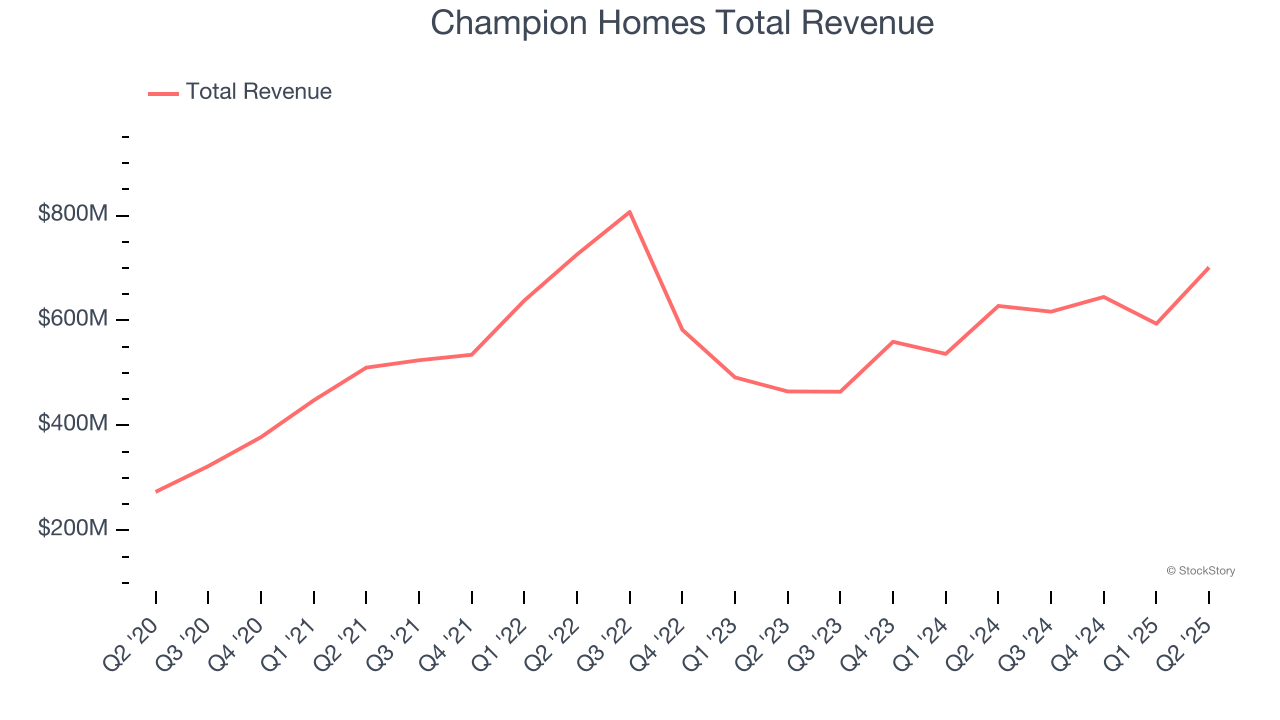

Best Q2: Champion Homes (NYSE: SKY)

Founded in 1951, Champion Homes (NYSE: SKY) is a manufacturer of modular homes and buildings in North America.

Champion Homes reported revenues of $701.3 million, up 11.7% year on year, outperforming analysts’ expectations by 9.2%. The business had an incredible quarter with an impressive beat of analysts’ sales volume estimates and a beat of analysts’ EPS estimates.

Champion Homes delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 12.6% since reporting. It currently trades at $74.56.

Is now the time to buy Champion Homes? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Lennar (NYSE: LEN)

One of the largest homebuilders in America, Lennar (NYSE: LEN) is known for constructing affordable, move-up, and retirement homes across a range of markets and communities.

Lennar reported revenues of $8.38 billion, down 4.4% year on year, exceeding analysts’ expectations by 1.1%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 21.1% since the results and currently trades at $132.55.

Read our full analysis of Lennar’s results here.

Meritage Homes (NYSE: MTH)

Originally founded in 1985 in Arizona as Monterey Homes, Meritage Homes (NYSE: MTH) is a homebuilder specializing in designing and constructing energy-efficient and single-family homes in the US.

Meritage Homes reported revenues of $1.63 billion, down 4% year on year. This print surpassed analysts’ expectations by 3%. Taking a step back, it was a mixed quarter as it also produced a decent beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ backlog estimates.

The stock is up 2% since reporting and currently trades at $76.28.

Read our full, actionable report on Meritage Homes here, it’s free.

TopBuild (NYSE: BLD)

Established in 2015 following a spinoff from Masco Corporation, TopBuild (NYSE: BLD) is a distributor and installer of insulation and other building products.

TopBuild reported revenues of $1.30 billion, down 5% year on year. This result was in line with analysts’ expectations. It was a strong quarter as it also produced full-year EBITDA guidance beating analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

TopBuild had the weakest performance against analyst estimates among its peers. The stock is up 7.8% since reporting and currently trades at $417.52.

Read our full, actionable report on TopBuild here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.