With a market cap of $66.6 billion, PayPal Holdings, Inc. (PYPL) is a global leader in digital payments, revolutionizing commerce for over 25 years through innovative, secure, and personalized financial solutions that empower consumers and businesses in nearly 200 markets. Operating a trusted two-sided network, it connects millions of merchants and consumers worldwide, simplifying how money is moved, spent, and received across the global economy.

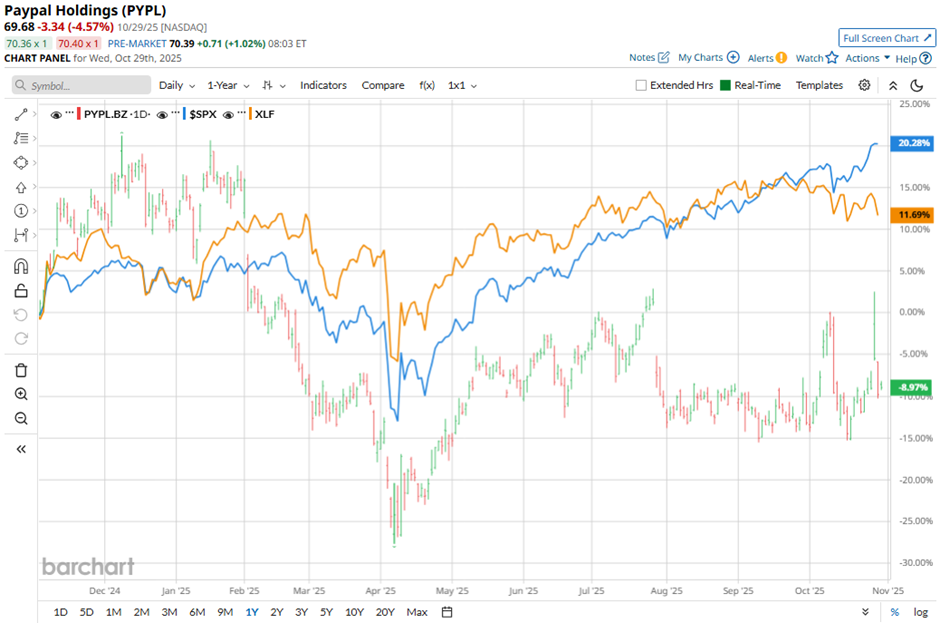

The technology platform and digital payments company's shares have lagged behind the broader market over the past 52 weeks. PYPL stock has decreased 13.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 18.1%. Moreover, shares of the company are down 18.4% on a YTD basis, compared to SPX’s 17.2% gain.

In addition, shares of the San Jose, California-based company have also underperformed the Financial Select Sector SPDR Fund’s (XLF) over 11% return over the past 52 weeks.

Shares of PayPal rose 3.9% on Oct. 28 after the company reported strong Q3 2025 results, with adjusted EPS of $1.34 and revenue of $8.42 billion, both exceeding expectations. Investor sentiment was further boosted by PayPal’s new partnership with OpenAI, enabling ChatGPT users to buy products through its platform, and by the company’s decision to raise its full-year adjusted EPS forecast to $5.35 - $5.39.

For the current fiscal year, ending in December 2025, analysts expect PYPL’s adjusted EPS to grow 14.8% year-over-year to $5.34. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

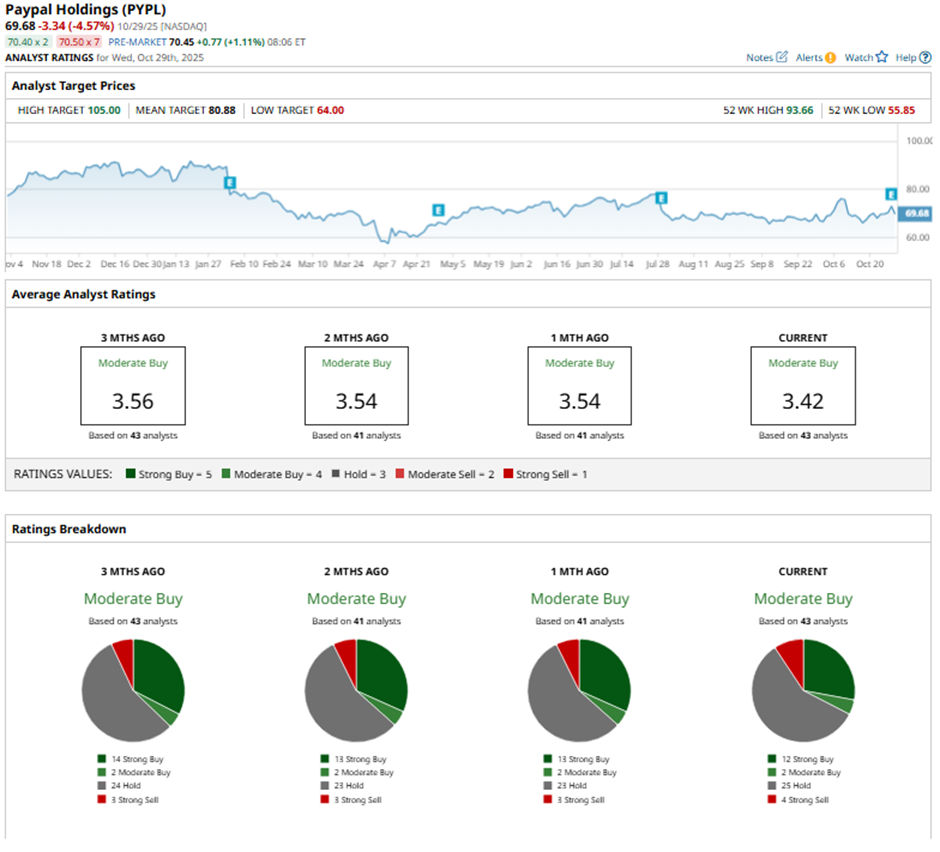

Among the 43 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, two “Moderate Buys,” 25 “Holds,” and four “Strong Sells.”

This configuration is less bullish than it was three months ago, when PYPL had 14 “Strong Buys” in total.

On Oct. 29, Bank of America Securities analyst Mihir Bhatia reiterated a “Buy” rating on PayPal Holdings and maintained a price target of $93.

The mean price target of $80.88 represents a 16.1% premium to PYPL’s current price levels. The Street-high price target of $105 suggests a 50.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ashes to Alpha: Adobe’s (ADBE) Implosion Offers an Opportunity for a Rebound

- It's 'Going to Be Like a Shockwave' When Tesla's AI Innovations Hit. Should You Buy TSLA Stock First?

- Adobe Systems Bear Put Spread Could Return 233% in this Down Move

- Stocks Fall Before the Open After Mixed Big Tech Earnings, Trump-Xi Summit