With a market cap of $455 billion, Johnson & Johnson (JNJ) is a global healthcare conglomerate headquartered in New Brunswick, New Jersey. Founded in 1886, the company has grown into one of the world’s largest and most diversified healthcare companies, with operations spanning innovative prescription medicines, advanced surgical and medical technologies, and legacy consumer brands.

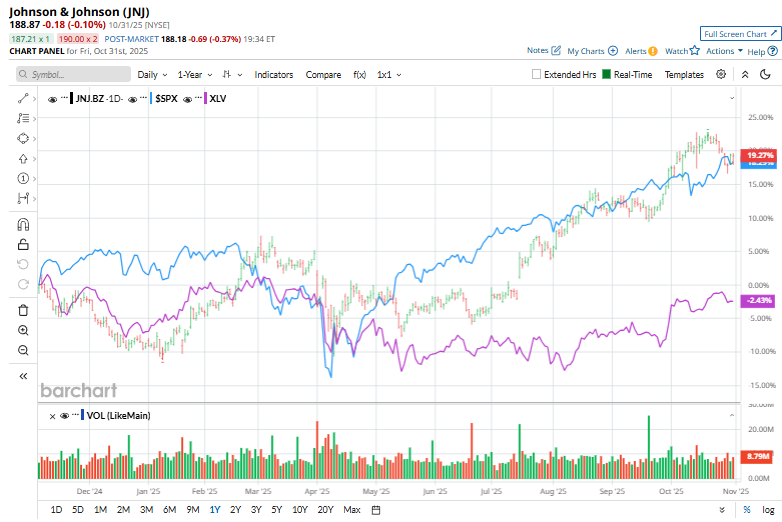

Johnson & Johnson has delivered a strong performance, outperforming the broader market this year. JNJ stock has gained 30.6% on a YTD basis and 17.6% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.3% gains in 2025 and 17.7% returns over the past year.

Looking specifically at the healthcare space, JNJ has also pulled ahead of the Health Care Select Sector SPDR Fund (XLV), which has risen 4.9% in 2025 and 2.6% drop over the past 52 weeks.

On Oct. 14, JNJ shares dipped marginally after the company announced results for the third quarter of 2025. With a revenue growth of 6.8% year over year to $24 billion and an adjusted EPS rise of 16% to $2.80, JNJ delivered solid topline and bottom-line growth. Based on the strong quarter, the company raised its full-year 2025 revenue guidance midpoint to about $93.2 billion, while maintaining its full-year adjusted EPS guidance at approximately $10.85.

For fiscal 2025, ending in December, analysts project adjusted EPS of $10.86, representing an 8.8% year-over-year increase. It also boasts a strong track record of execution, having exceeded Wall Street’s earnings expectations in each of the last four quarters.

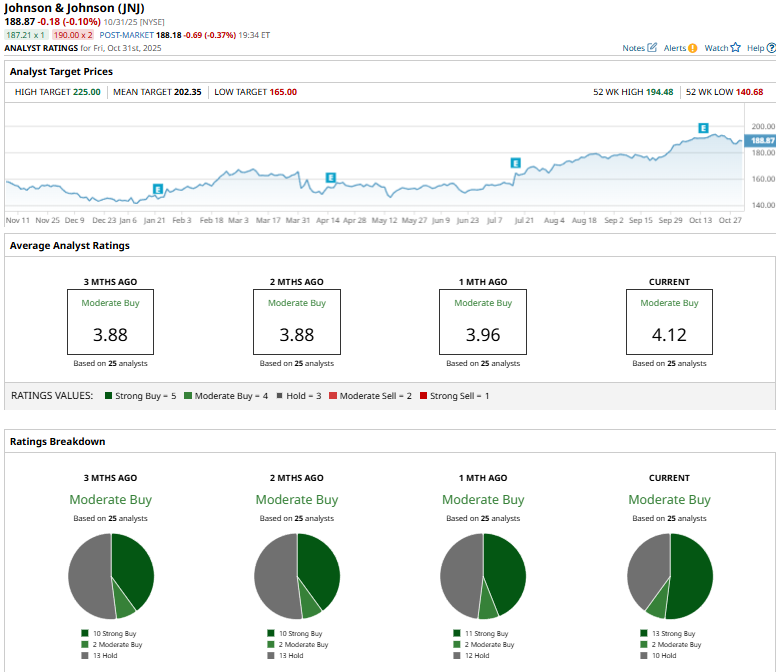

The stock maintains a consensus “Moderate Buy” rating overall. Of the 25 analysts covering the stock, opinions include 13 “Strong Buys,” two “Moderate Buys,” and 10 “Holds.

This configuration is slightly more bullish than a month ago, when 11 analysts gave “Strong Buy” recommendations.

On Oct. 16, J.P. Morgan analyst Chris Schott reiterated a “Hold” rating on Johnson & Johnson and set a $205 price target.

JNJ’s mean price target of $202.35 represents a modest 7.1% upside potential. Meanwhile, the Street-high target of $225 suggests a notable 19.1% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart