Live sports and TV streaming service fuboTV (NYSE:FUBO) announced better-than-expected revenue in Q3 CY2024, with sales up 20.3% year on year to $386.2 million. Its GAAP loss of $0.16 per share was also 10.4% above analysts’ consensus estimates.

Is now the time to buy fuboTV? Find out by accessing our full research report, it’s free.

fuboTV (FUBO) Q3 CY2024 Highlights:

- Revenue: $386.2 million vs analyst estimates of $376.8 million (2.5% beat)

- EPS: -$0.16 vs analyst estimates of -$0.18 ($0.02 beat)

- EBITDA: -$27.56 million vs analyst estimates of -$36.61 million (~$9 million beat)

- Gross Margin (GAAP): 14%, up from 6.1% in the same quarter last year

- Operating Margin: -15.2%, up from -26% in the same quarter last year

- EBITDA Margin: -7.1%, up from -19.1% in the same quarter last year

- Free Cash Flow was -$3.33 million compared to -$29.5 million in the same quarter last year

- Domestic Subscribers: 1.61 million at quarter end

- Market Capitalization: $573 million

Company Overview

Originally launched as a soccer streaming platform, fuboTV (NYSE:FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Sales Growth

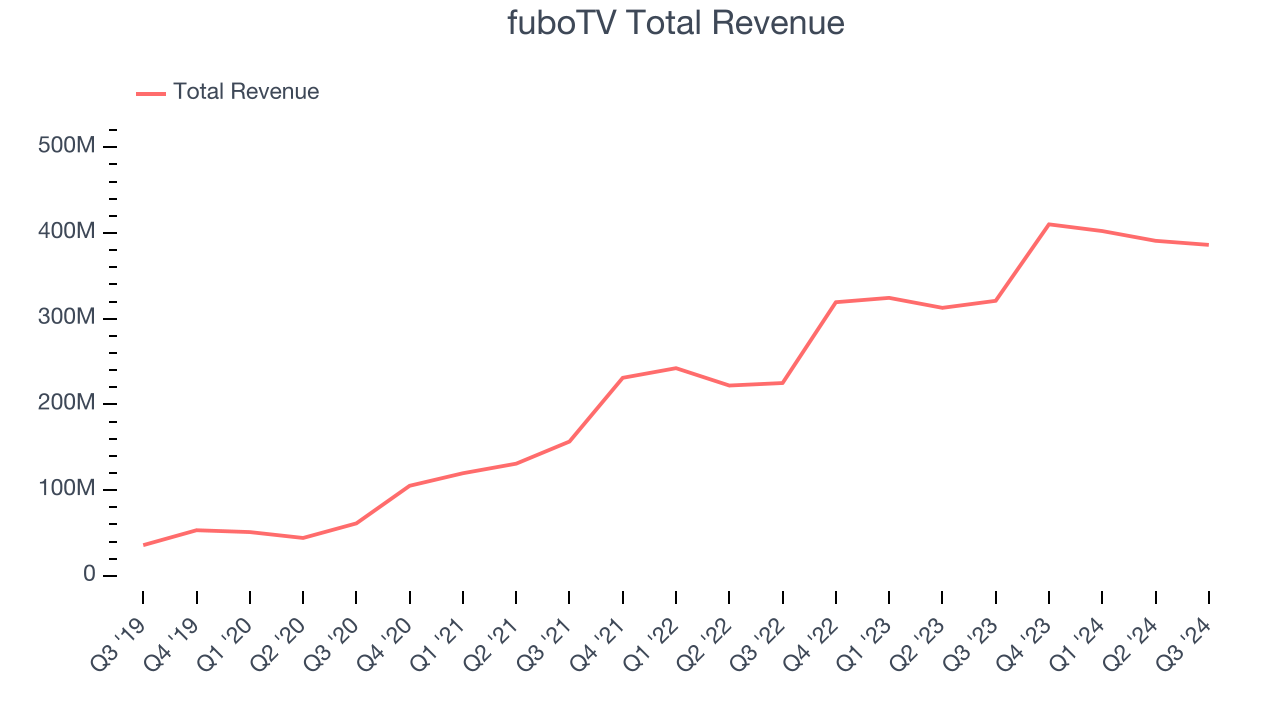

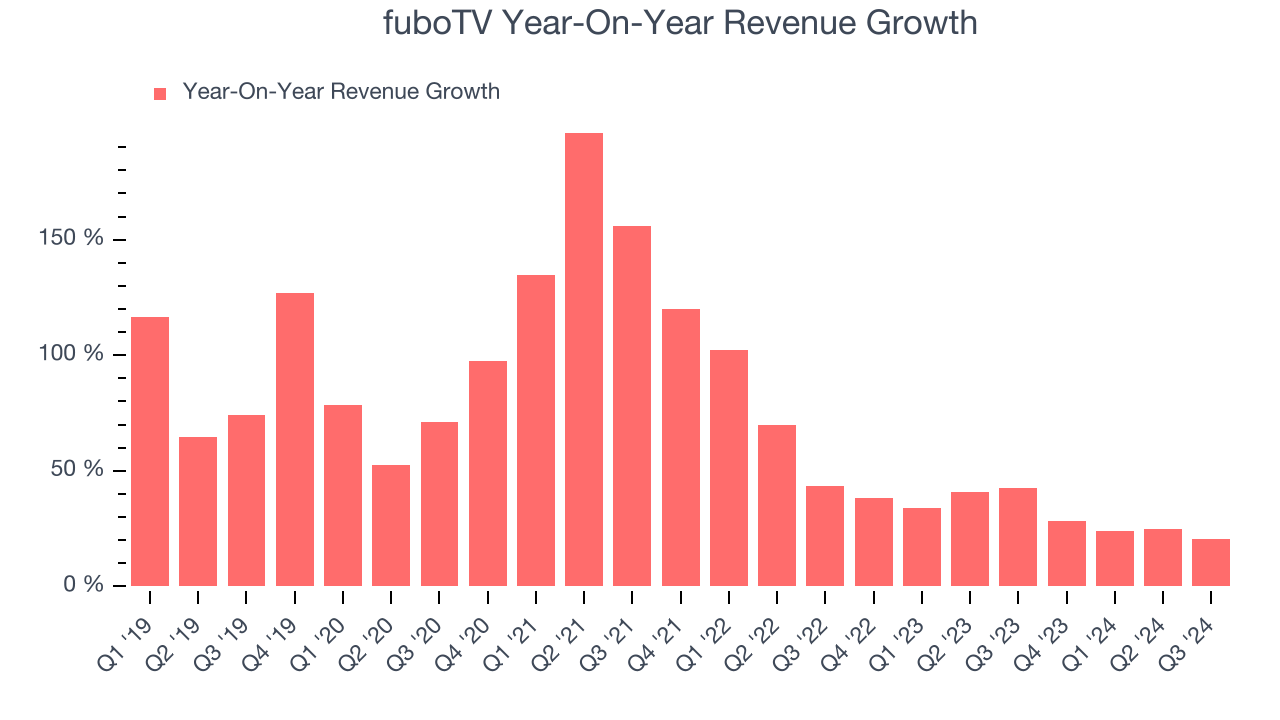

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, fuboTV grew its sales at an incredible 68.6% compounded annual growth rate. This is a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. fuboTV’s annualized revenue growth of 31.4% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, fuboTV reported robust year-on-year revenue growth of 20.3%, and its $386.2 million of revenue topped Wall Street estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and shows the market believes its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

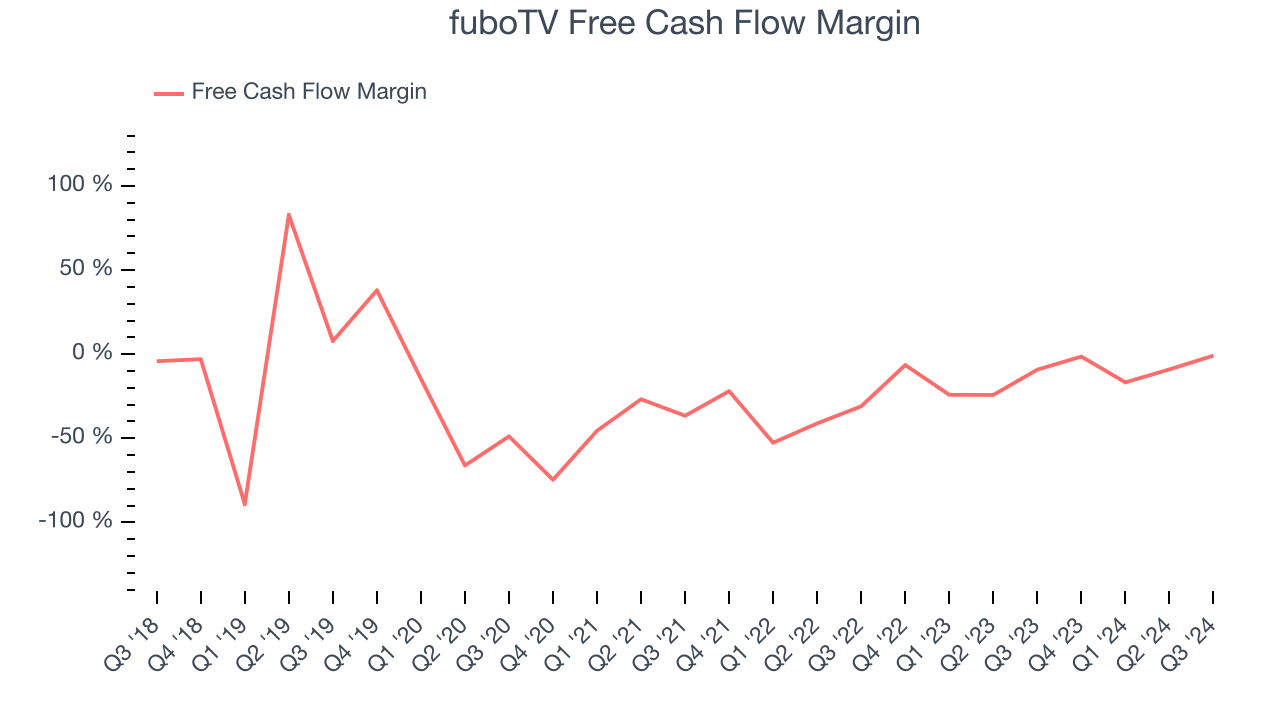

While fuboTV’s free cash flow broke even this quarter, the broader story hasn’t been so clean. Over the last two years, fuboTV’s demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin averaged negative 11%, meaning it lit $11.02 of cash on fire for every $100 in revenue.

fuboTV broke even from a free cash flow perspective in Q3. This result was good as its margin was 8.3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict fuboTV’s cash conversion will improve to break even. Their consensus estimates imply its free cash flow margin of negative 7% for the last 12 months will increase by 7.9 percentage points.

Key Takeaways from fuboTV’s Q3 Results

We were impressed by how significantly fuboTV blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock traded up 2.3% to $1.78 immediately after reporting.

fuboTV had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.