Nvidia (NVDA) did something this week that many people, one or two years ago, thought would be impossible. The semiconductor company reached a $5 trillion valuation, becoming the first company to reach that mark. And it did so only 112 days after Nvidia became the first company to reach a $4 trillion valuation.

Clearly, Nvidia is achieving things that most companies can only dream of. And if you listen to CEO Jensen Huang, the future continues to be bright. “Our GPUs are everywhere,” he said Tuesday while attending Nvidia’s GTC D.C. conference in Washington, D.C. He described how Nvidia’s chips are used in AI models, telecommunications, manufacturing, autonomous vehicles, quantum computing, and more.

“This is all possible because Nvidia is everywhere.”

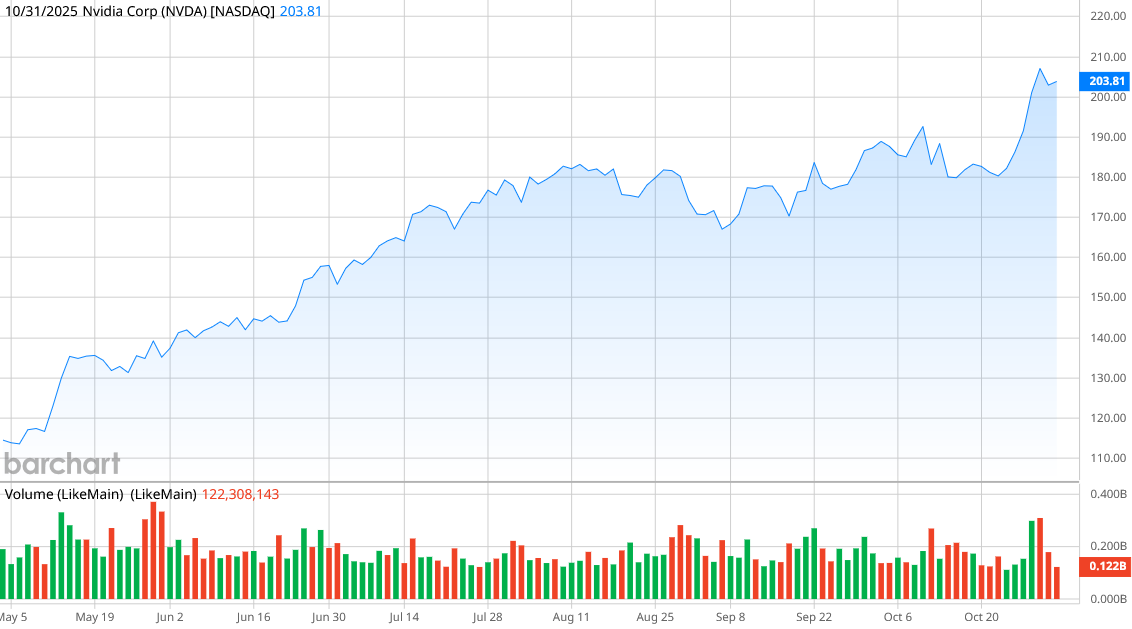

NVDA stock is up more than 51% this year and by an astounding 1,370% in the last three years. Taking a longer view: had you invested a scant $1,000 in Nvidia a decade ago, you’d be looking at a nest egg of $293,100. That’s life-changing money.

You might think that Nvidia’s best days are behind it, but this company still has a lot to offer—and more gains to provide its investors.

About Nvidia Stock

Headquartered in Santa Clara, California, Nvidia is a dominant semiconductor and computer technology company. Originally known for providing chips for state-of-the-art graphics on personal computers, Nvidia’s graphics processing units have become the industry standard for running high-level workloads necessary for machine learning, training large language models, and generative AI.

The company is surprisingly valued—you would think that a company with as much action as Nvidia would see a sky-high valuation. But its forward price-to-earnings ratio is only 44.8, which is much lower than its five-year P/E median of 68.

Also, Nvidia’s year-to-date (YTD) gain of 52% is over double the gain of the tech-heavy Nasdaq Composite ($NASX)—a remarkable achievement considering Nvidia stock sank badly in April amid fears that it would be badly affected by trade restrictions and tariffs.

In fact, Nvidia was restricted for much of the year from selling its H20 chips in China. The H20 was made specifically for the Chinese market in order to meet U.S. export restrictions; they are not as powerful as the company’s Hopper H100 chips, but they are capable of running some AI workloads up to 20% faster.

Then shortly after Nvidia announced it had a deal to ship its H20 chips to China, Beijing cut Nvidia out of the market, citing national security concerns. It was a big problem for Nvidia, because Chinese sales accounted for 17% of Nvidia’s revenue in the 2025 fiscal year, and Nvidia had an overwhelming 95% market share in that country.

Earlier this week, President Donald Trump ignited a frenzy among Nvidia shareholders when he announced he planned to talk to Chinese President Xi Jinping about Nvidia’s Blackwell chips, calling them “the super-duper chip.” Nvidia is working on a chip for China that runs on the Blackwell architecture. Trump’s statement was the triggering event that pushed NVDA stock over $5 trillion on Wednesday.

Nvidia May Not Need China

It’s still unknown if Nvidia will get access to China’s market again. Trump acknowledged after the meeting that Nvidia’s Blackwell chips didn’t even get discussed in Trump’s meeting with Xi. But if you heard Huang in Washington on Tuesday, you walked away convinced that Nvidia’s futures won’t rise and fall directly on politicians’ actions.

That’s because Nvidia has deep ambitions to develop its GPUs to power the next generation of computers, which are quantum computers. Huang said that Nvidia is working with 17 quantum computing companies to build accelerated quantum computers. "We now realize it is essential to connect a quantum computer to a GPU system to control the errors and have the two computers working side by side," he said. "This is the future of quantum computing."

And the company is creating and building out the AI Factory Research Center, which will be powered by the company’s Vera Rubin platform to create the groundwork for AI gigafactories that can use tokens to run AI applications.

"Tokens are the vocabulary of AI," he said. "You can tokenize nearly anything—the spoken word, videos, images, chemicals and even proteins and genes."

"This is a factory that produces tokens that need to be as valuable as possible at incredible rates and cost-effective. These factories never existed before. And what's inside these factories are thousands and thousands of chips."

What Do Analysts Expect for NVDA Stock?

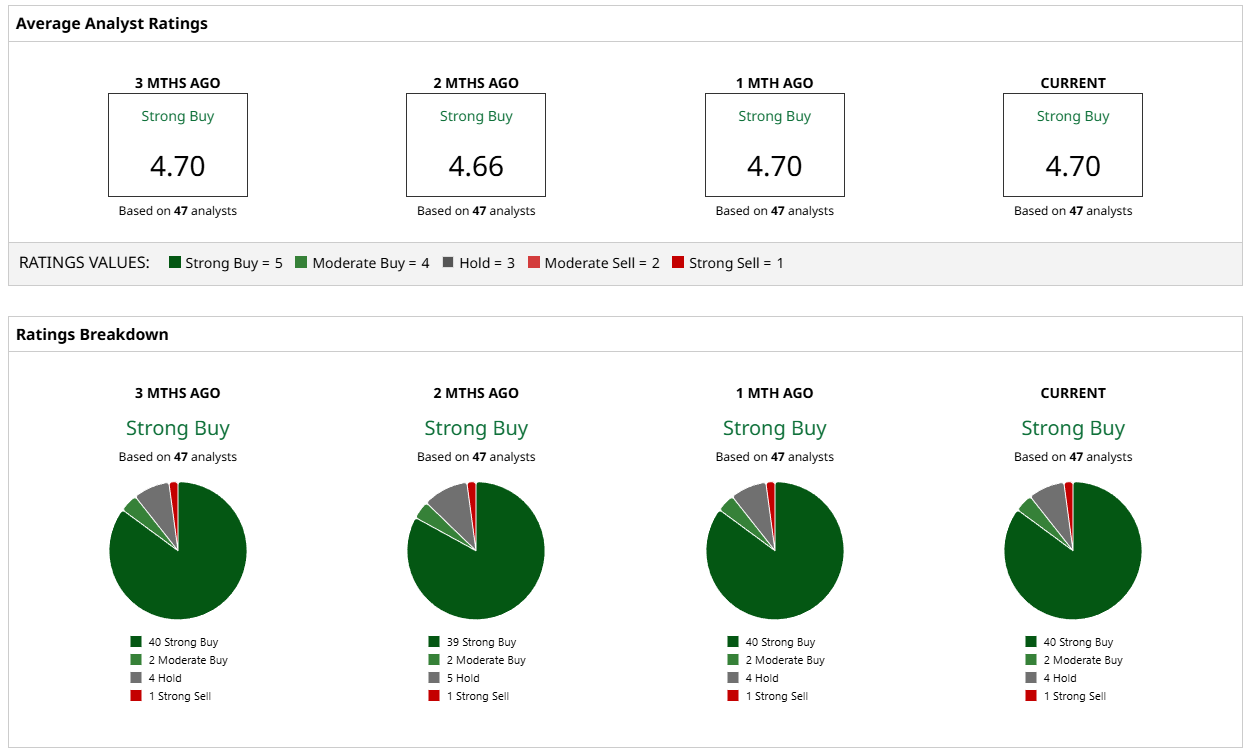

Unsurprisingly, analysts are exceptionally bullish on the stock. Forty of 47 analysts who cover NVDA stock rate it as a “Strong Buy,” while two others give it a “Moderate Buy” rating. Four others recommend holding, and only one is on record with a “Strong Sell” rating.

NVDA stock is already close to its mean price target of $225.86, but the most bullish target of $320 suggests a possible 58% increase. If that were to happen, Nvidia would be looking at a market cap of $7.77 trillion.

Is it possible? Well, we’ve already seen Nvidia reach levels in 2025 that were once thought unattainable. So I wouldn’t rule anything out for NVDA stock.

On the date of publication, Patrick Sanders had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Pair of New 2X ETFs Goes Double or Nothing on Big Tech. Should You Chase the Volatility in Apple, Nvidia, and Microsoft Now?

- Analysts Say You Should Ignore ‘Short-Term Blips’ and Keep Buying Microsoft Stock

- This Penny Stock Just Reported a 1,000% Increase in Revenue. Should You Buy It Here?

- Netflix Just Announced a 10-for-1 Stock Split. Should You Buy NFLX Stock Here?