The Procter & Gamble Company (PG) is a global consumer goods leader founded in 1837 and headquartered in Cincinnati, Ohio. The company’s portfolio spans hair and skin care, grooming, health care, fabric & home care and baby/family care, with many household-name brands sold globally. PG’s market cap is around $343.9 billion, reflecting its position as a mega-cap player in the consumer staples sector.

Shares of Procter & Gamble have underperformed the broader market over the past 52 weeks. PG has declined 10.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.5%. On a year-to-date (YTD) basis, PG is down 12.2%, compared to SPX’s 15.1% rise.

Narrowing the focus, the leading consumer products maker has also lagged behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 5.5% dip over the past 52 weeks and 3.3% YTD.

PG stock is under pressure because it reported essentially muted net sales growth amid challenging consumer and geopolitical environment. Rising input and commodity costs, worries about tariffs and weak consumer spending have spurred concern about future growth and leading to a less favorable sentiment.

For the fiscal year ending in June 2026, analysts expect PG’s EPS to grow 2.6% year-over-year to $7.01. The company’s earnings surprise history is promising. It beat or met the consensus estimates in the last four quarters.

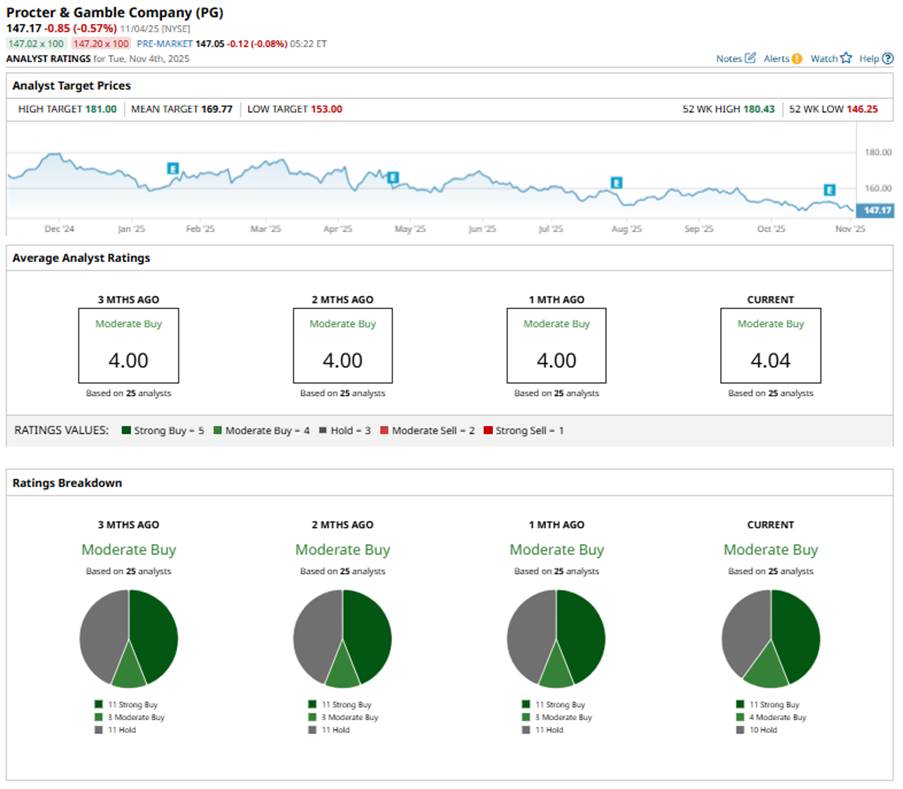

Among the 25 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, four “Moderate Buys,” and 10 “Holds.”

This configuration has remained largely consistent over the past few months.

Last month, UBS reiterated its “Buy” rating on Procter & Gamble with a $176 price target after the company’s strong quarterly earnings. Also, UBS noted that the company “continues to have greater earnings flexibility than most.”

Its mean price target of $169.77 suggests an upside of 15.4%. The Street-high price target of $181 implies a potential upside of 23% from the current price.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart