- IQST Delivers Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

- Partnership with Call Center in U.S. Health Services to Implement Next-Generation AI Solutions Using IQST Proprietary AI Technology.

- 2025 Plan Toward $15 Million EBITDA Run Rate in 2026 and $1 Billion Revenue Goal in 2027.

- Fintech Division Accelerates EBITDA Growth with Globetopper Contribution.

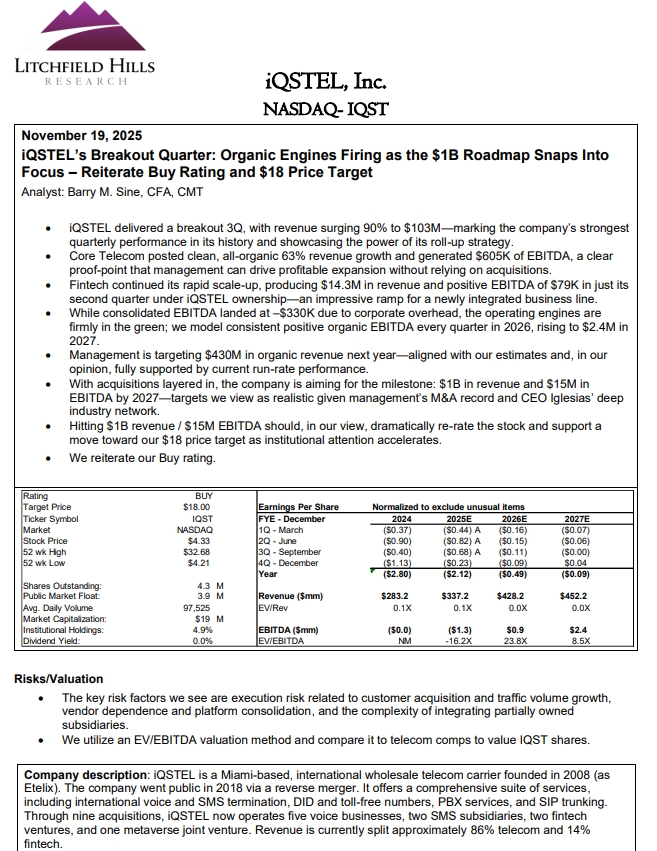

- Litchfield Hills Research Issues Recommendation and Detailed Report on IQSTEL (IQST) with $18 Price Target.

- $500,000 Shareholder Dividend to Be Paid on December 30th in Free-Trading IQST Common Shares as Part of Its Long-Term Shareholder Value Strategy.

- Q3 2025 Delivers $102.8 Million Quarterly Revenue with 42% Sequential Growth.

- $12.23 in Assets per Share and $4.66 in Equity Per Share, Reinforcing One of the Strongest Balance Sheets Among Emerging Tech Corporations on NASDAQ.

- Completed Phase One of Next-Generation Cyber Defense Rollout with CYCU Partner Company.

- Debt-Free Nasdaq Company with No Convertible Notes or Warrants.

- Launch of IQ2Call, Delivering Vertical AI-Telecom Integration to Target the $750B Global Market.

IQSTEL, Inc. (Nasdaq: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution

On September 16th IQST announced that its Fintech Division is positioned to play a key role in achieving the Company's goal of reaching a $15 million EBITDA run rate in 2026.

IQST completed the acquisition of Globetopper on July 1, 2025, and has since been accelerating its growth as part of the Company's strategic roadmap. Globetopper is expected to contribute approximately $16 million in Q3 2025 revenue and deliver $110,000 in EBITDA, making it cash flow positive for the quarter.

IQST plans to leverage its business platform — which already reaches over 600 of the largest telecom operators worldwide — to offer Globetopper's fintech services directly to its telecom customers.

$500,000 Shareholder Dividend to Be Paid on December 30th in Free-Trading IQST Common Shares as Part of Its Long-Term Shareholder Value Strategy

On December 3rd IQST confirmed its plan to distribute a $500,000 dividend on December 30th, 2025, payable in free-trading IQST common shares.

This dividend distribution stems from the strategic agreement executed with Cycurion CYCU, which strengthened the long-term cooperation and development roadmap shared by both companies.

The news about the original agreement can be reviewed here: https://finance.yahoo.com/news/iqst-iqstel-cycurion-cycu-execute-123000434.html

The $500,000 dividend will be calculated using the August 29, 2025 closing price of $6.62, resulting in:

Total dividend shares: 75,529 free-trading IQST common shares.

Record Date: December 15th, 2025.

Payment / Distribution Date: December 30th, 2025.

Distributed by IQST Transfer Agent: V-Stock Transfer.

With 4,374,822 shares outstanding, the resulting distribution ratio is 0.0173. IQST shareholders can determine their allocation by multiplying their share count by 0.0173.

To ensure a smooth and accurate distribution, IQSTEL has instructed its transfer agent to match DTC positions with broker-reported share balances.

IQST CEO Leandro Iglesias stated:

"We are proud of who we are as a company and what we have achieved together. IQSTEL has fulfilled every promise we made to our shareholders—not only delivering strong operating results, but also tangible, measurable shareholder value. Now, as we enter a new stage with a clear path toward becoming a $1 billion revenue corporation, our commitment to our shareholders is stronger than ever. Beginning this year, IQSTEL intends to issue dividends annually, tied directly to our performance and growth. This $500,000 dividend is a testament to our vision, our execution, and our unwavering dedication to rewarding those who believe in our mission."

Record Q3 2025 Results: $102.8 Million Quarterly Revenue, 42% Sequential Growth, and Strengthened Balance Sheet

IQSTEL Reports $12.23 in Assets per Share and $4.66 in Equity per Share, Reinforcing One of the Strongest Balance Sheets Among Emerging Tech Corporations on NASDAQ — Company Plans to Distribute a $500,000 Dividend in Shares by December 31, 2025

On November 14th IQST announced its financial results for the third quarter ended September 30, 2025, delivering record revenue growth, solid profitability metrics, and further strengthening its balance sheet as it continues executing its expansion strategy.

Q3 2025 Financial Highlights

Revenue (Q3 2025): $102.8 million vs. $72.1 million in Q2 2025 (+42% QoQ) and compared to $54.2 million in Q3 2024 (+90% YoY).

Revenue (9 months ended Sept 30): $232.6 million vs. $184.3 million in 2024 (+26% YoY).

Gross Revenue: $118.5 million (including $15.7 million intercompany revenue, highlighting strong subsidiary synergy).

Adjusted EBITDA (Q3 2025): $683,189 (Telecom: $604,514 | Fintech: $78,675).

Revenue Run Rate: $411.5 million.

Adjusted EBITDA Run Rate: $2.73 million.

Assets: $46.8 million ($12.23 per share) as of September 30, 2025.

Stockholders' Equity: $17.8 million ($4.66 per share) as of September 30, 2025 which represent an increase of 50.02% with respect to $11.9 million as of December 31, 2024.

IQST and CYCU Enter a New Era of AI-Cybersecurity, Completing Phase One of Their Next-Generation Cyber Defense Rollout

IQSTEL's Reality Border and Cycurion Join Forces to Deliver AI Agents with Built-In Cyber Defense and Proactive Threat Hunting Capabilities — Marking the First Step Toward Building the Industry's Most Secure AI Ecosystem for Global Telecom and Enterprise Clients

On October 21st IQST announced that Reality Border, its AI subsidiary, has completed Phase One of its joint program with Cycurion, Inc. (NASDAQ: CYCU) to deliver a new generation of AI-enhanced cybersecurity. The milestone introduces a secure Model Context Protocol (MCP) integration for Airweb.ai (web AI agent) and IQ2Call.ai (voice AI agent), now fronted and protected by Cycurion's ARx multi-layer cybersecurity platform.

IQST Becomes a Debt-Free Nasdaq Company with No Convertible Notes or Warrants

On October 9th IQST announced it has eliminated all convertible notes from its balance sheet and fully paid for its most recent acquisitions, QXTEL and Globetopper.

With this achievement, IQST has officially become a debt-free company — with no convertible notes and no warrants outstanding — reinforcing its solid financial foundation and long-term commitment to creating shareholder value. IQST stands out with $17.41 in assets per share and a clean capital structure with zero convertible debt and no warrants outstanding.

Through this partnership, IQST has entered the cybersecurity arena with a trusted U.S. government-certified technology provider, expanding its portfolio of Telecom, Fintech, AI, and Digital services.

To enhance transparency and provide easy access to corporate updates, IQST has launched its official Investors Landing Page, a dedicated portal summarizing key financial metrics, strategic milestones, and news updates. Visit: www.landingpage.iqstel.com

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Media Contact

Company Name: IQSTEL Inc.

Contact Person: Leandro Jose Iglesias, President and CEO

Email: Send Email

Phone: +1 954-951-8191

Address:300 Aragon Avenue Suite 375

City: Coral Gables

State: Florida 33134

Country: United States

Website: www.iQSTEL.com