Diagnostic company Exact Sciences Corporation (NASDAQ: EXAS) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 10.9% year on year to $706.8 million. The company’s full-year revenue guidance of $3.10 billion at the midpoint came in 1.3% above analysts’ estimates. Its non-GAAP loss of $0.21 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Exact Sciences? Find out by accessing our full research report, it’s free.

Exact Sciences (EXAS) Q1 CY2025 Highlights:

- Revenue: $706.8 million vs analyst estimates of $688.5 million (10.9% year-on-year growth, 2.7% beat)

- Adjusted EPS: -$0.21 vs analyst estimates of -$0.10 (significant miss)

- Adjusted EBITDA: $63.26 million vs analyst estimates of $59.87 million (8.9% margin, 5.7% beat)

- The company lifted its revenue guidance for the full year to $3.10 billion at the midpoint from $3.06 billion, a 1.3% increase

- EBITDA guidance for the full year is $440 million at the midpoint, above analyst estimates of $422.9 million

- Operating Margin: -13.6%, up from -16.7% in the same quarter last year

- Free Cash Flow was -$365,000 compared to -$120 million in the same quarter last year

- Constant Currency Revenue rose 11% year on year (5.8% in the same quarter last year)

- Market Capitalization: $8.48 billion

Company Overview

With a mission to detect cancer earlier when it's more treatable, Exact Sciences (NASDAQ: EXAS) develops and markets cancer screening and diagnostic tests, including its flagship Cologuard stool-based colorectal cancer screening test.

Sales Growth

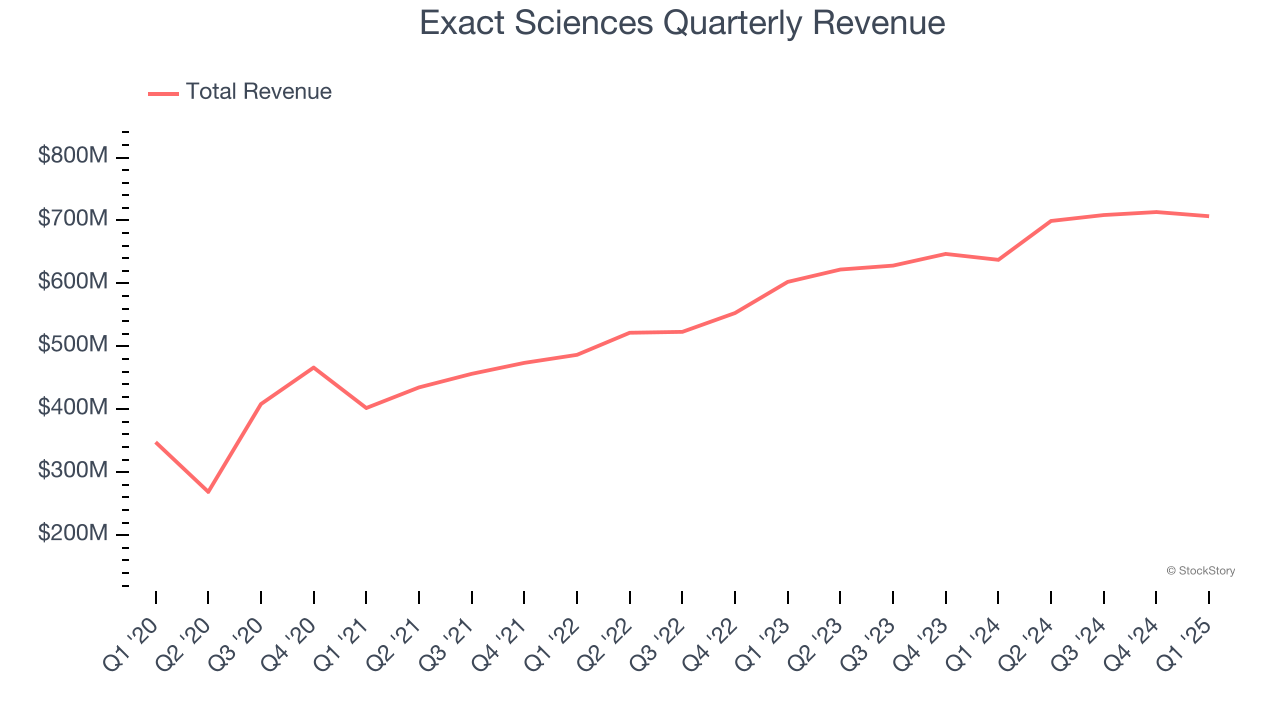

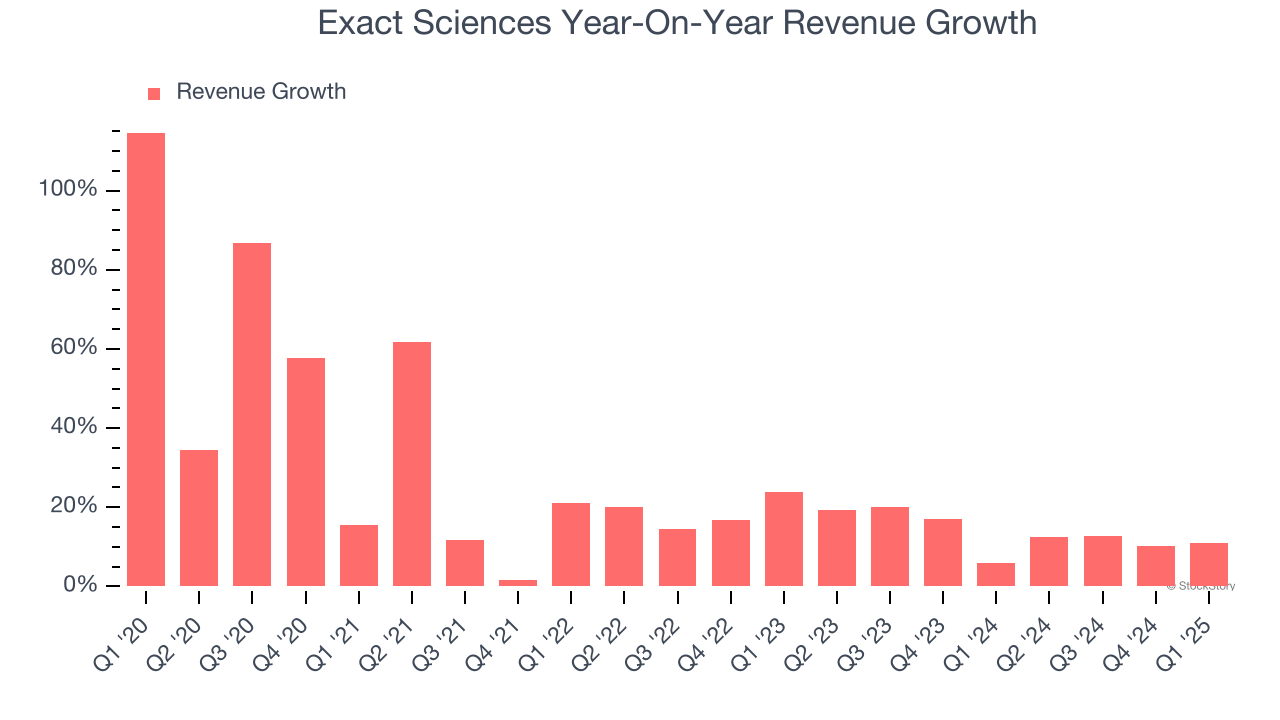

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Exact Sciences’s sales grew at an excellent 21.6% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Exact Sciences’s annualized revenue growth of 13.4% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

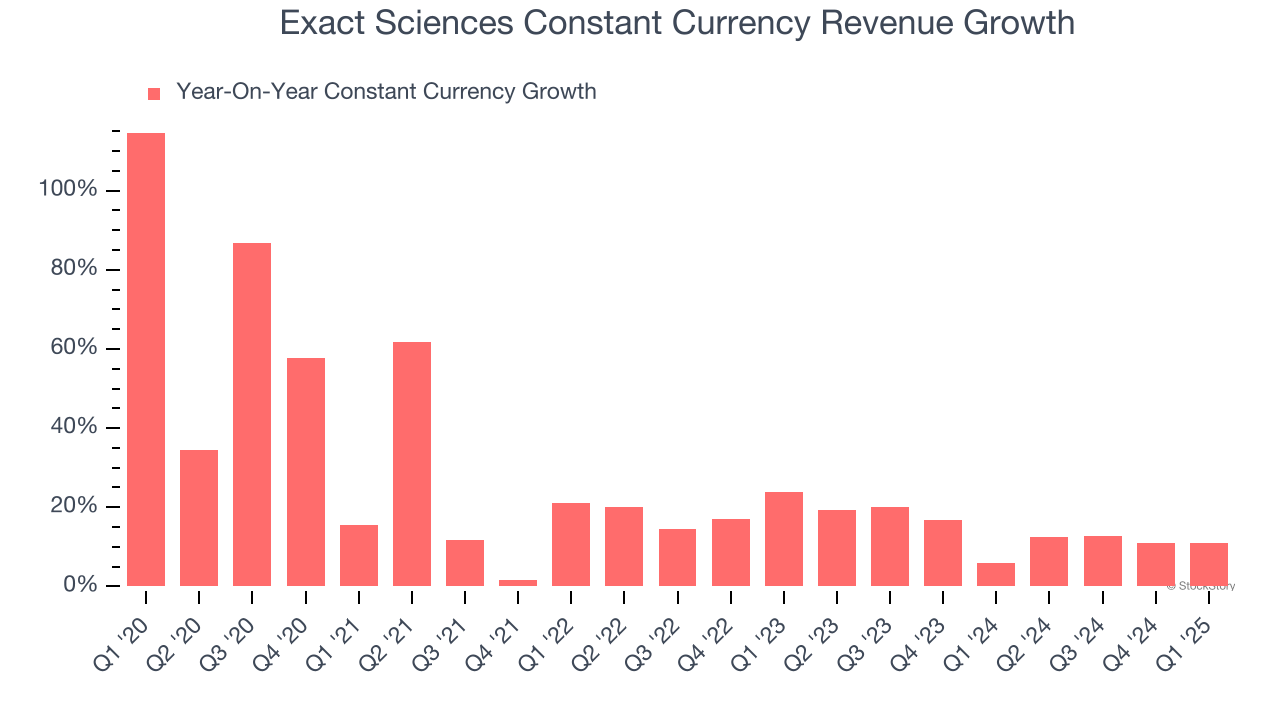

Exact Sciences also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 13.7% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Exact Sciences has properly hedged its foreign currency exposure.

This quarter, Exact Sciences reported year-on-year revenue growth of 10.9%, and its $706.8 million of revenue exceeded Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 11.6% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is commendable and indicates the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

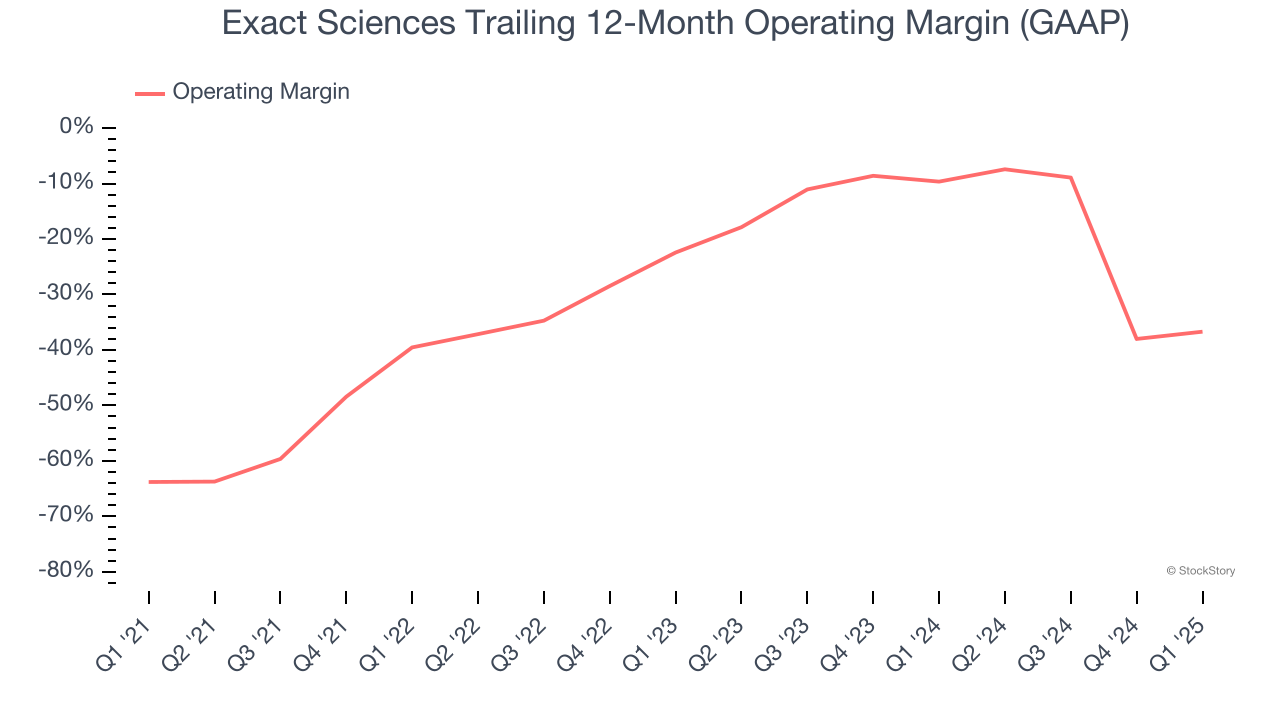

Exact Sciences’s high expenses have contributed to an average operating margin of negative 31.9% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Exact Sciences’s operating margin rose by 27.1 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming into its more recent performance, however, we can see the company’s margin has decreased by 14.3 percentage points on a two-year basis. If Exact Sciences wants to pass our bar, it must prove it can expand its profitability consistently.

This quarter, Exact Sciences generated a negative 13.6% operating margin.

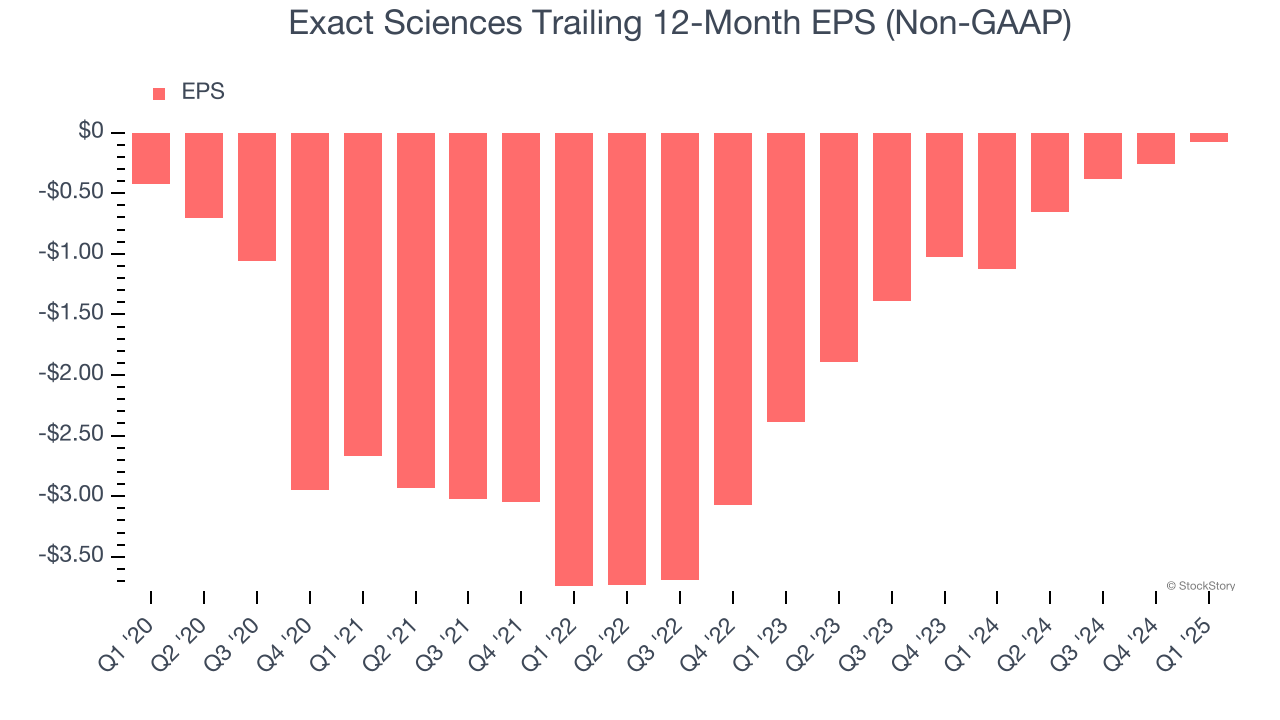

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Exact Sciences’s full-year earnings are still negative, it reduced its losses and improved its EPS by 29.3% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q1, Exact Sciences reported EPS at negative $0.21, up from negative $0.40 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Exact Sciences’s full-year EPS of negative $0.07 will flip to positive $0.66.

Key Takeaways from Exact Sciences’s Q1 Results

We enjoyed seeing Exact Sciences beat analysts’ revenue and EBITDA expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 8.6% to $51.20 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.