As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at electronic components stocks, starting with Bel Fuse (NASDAQ: BELFA).

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

The 10 electronic components stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was 0.8% below.

Luckily, electronic components stocks have performed well with share prices up 33.4% on average since the latest earnings results.

Bel Fuse (NASDAQ: BELFA)

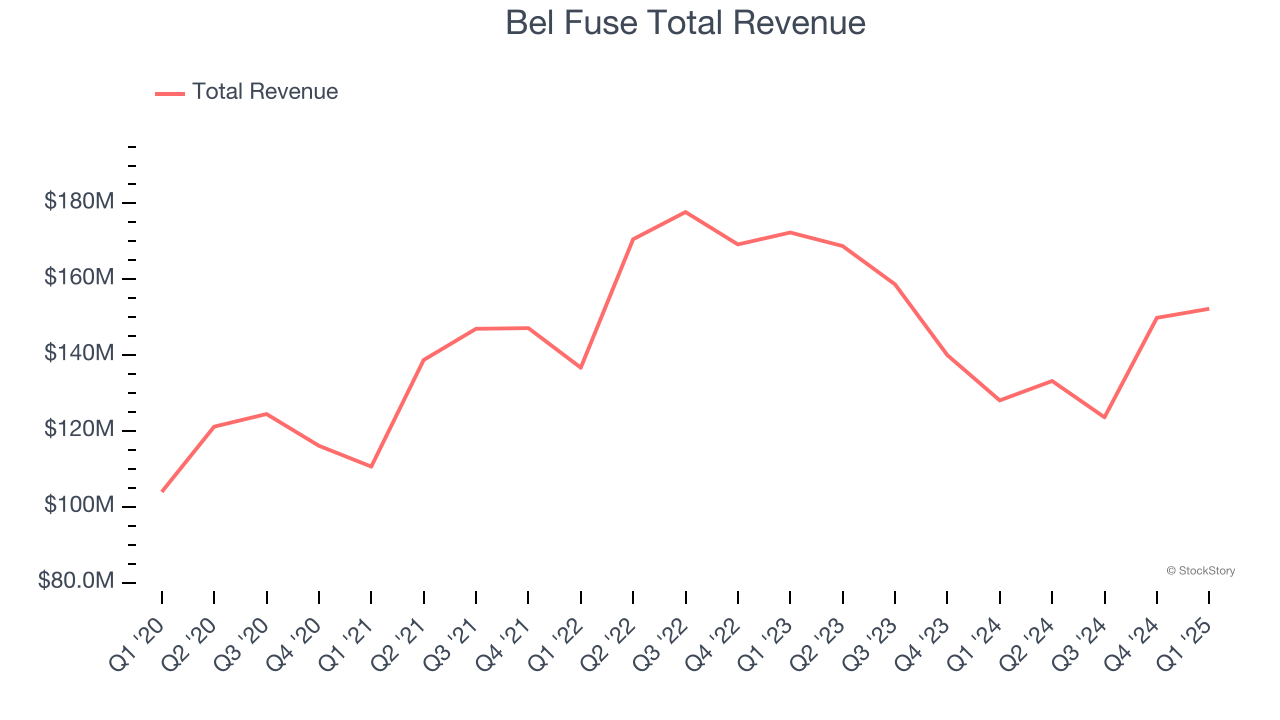

Founded by 26-year-old Elliot Bernstein during the electronics boom after WW2, Bel Fuse (NASDAQ: BELF.A) provides electronic systems and devices to the telecommunications, networking, transportation, and industrial sectors.

Bel Fuse reported revenues of $152.2 million, up 18.9% year on year. This print exceeded analysts’ expectations by 1.6%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

“We are pleased with our first quarter results, which benefitted from our increased exposure within the defense and commercial aerospace industries and strength in the emerging AI end market,” said Daniel Bernstein, President and CEO.

Interestingly, the stock is up 38% since reporting and currently trades at $89.85.

Is now the time to buy Bel Fuse? Access our full analysis of the earnings results here, it’s free.

Best Q1: Allient (NASDAQ: ALNT)

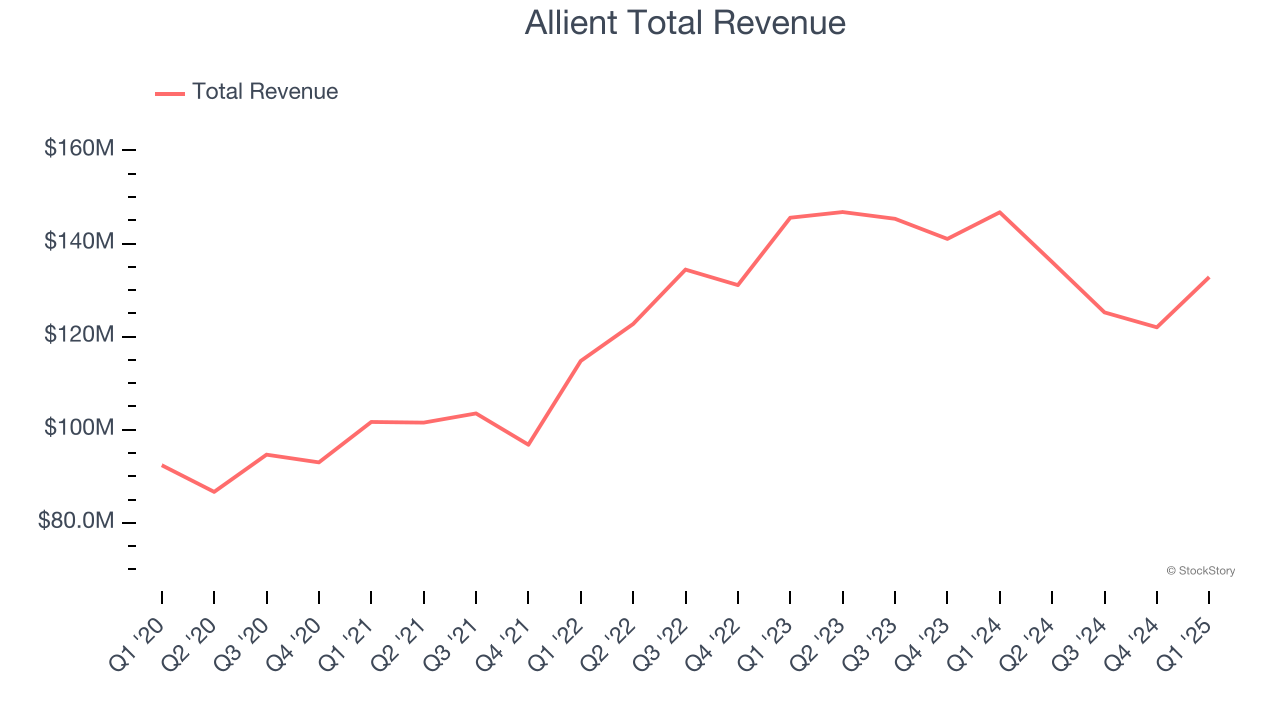

Founded in 1962, Allient (NASDAQ: ALNT) develops and manufactures precision and specialty-controlled motion components and systems.

Allient reported revenues of $132.8 million, down 9.5% year on year, outperforming analysts’ expectations by 5.7%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 61.7% since reporting. It currently trades at $35.88.

Is now the time to buy Allient? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Vicor (NASDAQ: VICR)

Founded by a researcher at the Massachusetts Institute of Technology, Vicor (NASDAQ: VICR) provides electrical power conversion and delivery products for a range of industries.

Vicor reported revenues of $93.97 million, up 12% year on year, falling short of analysts’ expectations by 2.8%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Vicor delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 12.8% since the results and currently trades at $45.36.

Read our full analysis of Vicor’s results here.

Corning (NYSE: GLW)

Supplying windows for some of the United States’s earliest spacecraft, Corning (NYSE: GLW) provides glass and other electronic components for the consumer electronics, telecommunications, automotive, and healthcare industries.

Corning reported revenues of $3.68 billion, up 23.7% year on year. This print beat analysts’ expectations by 5.8%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ EBITDA estimates.

Corning scored the fastest revenue growth among its peers. The stock is up 20.1% since reporting and currently trades at $52.87.

Read our full, actionable report on Corning here, it’s free.

Littelfuse (NASDAQ: LFUS)

The developer of the first blade-type automotive fuse, Littelfuse (NASDAQ: LFUS) provides electrical protection and control components for the automotive, industrial, electronics, and telecommunications industries.

Littelfuse reported revenues of $554.3 million, up 3.5% year on year. This number topped analysts’ expectations by 2.2%. It was an exceptional quarter as it also logged a solid beat of analysts’ EBITDA estimates.

The stock is up 26.4% since reporting and currently trades at $226.73.

Read our full, actionable report on Littelfuse here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.