Air taxis are quietly moving from science fiction to city skylines. Electric vertical takeoff and landing (eVTOL) aircrafts are edging closer to commercial reality as regulators, cities, and capital line up behind urban air mobility. The idea is simple but powerful – short hops over traffic-clogged streets, cleaner, faster, and far more efficient than today’s ground-bound commute.

That is where Joby Aviation (JOBY) fits in. The company is building electric air taxis designed for commercial passenger service, aiming to stitch air travel directly into everyday urban transportation. And it is not just about aircraft anymore – it is about infrastructure. Joby recently announced a partnership with Metropolis Technologies to develop 25 vertiports across North America, tapping into an existing network of parking and mobility hubs to accelerate deployment without reinventing the wheel.

The market has noticed, with JOBY shares climbing nearly 5% on Dec. 18. Even with some ups and downs, the stock is up by double digits in 2025. With momentum like this, investors may want to buckle in.

About Joby Aviation Stock

Founded in 2009 and headquartered in Santa Cruz, California, Joby Aviation is building the backbone of next-generation urban air travel. The company designs and manufactures eVTOLs to deliver quiet, fast, and sustainable air transportation. Joby’s vertically integrated model spans aircraft engineering, flight testing, pilot training, manufacturing, and regulatory certification. With plans for app-based aerial ridesharing services, Joby is positioning air taxis as everyday mobility. The company has a market capitalization of almost $13 billion.

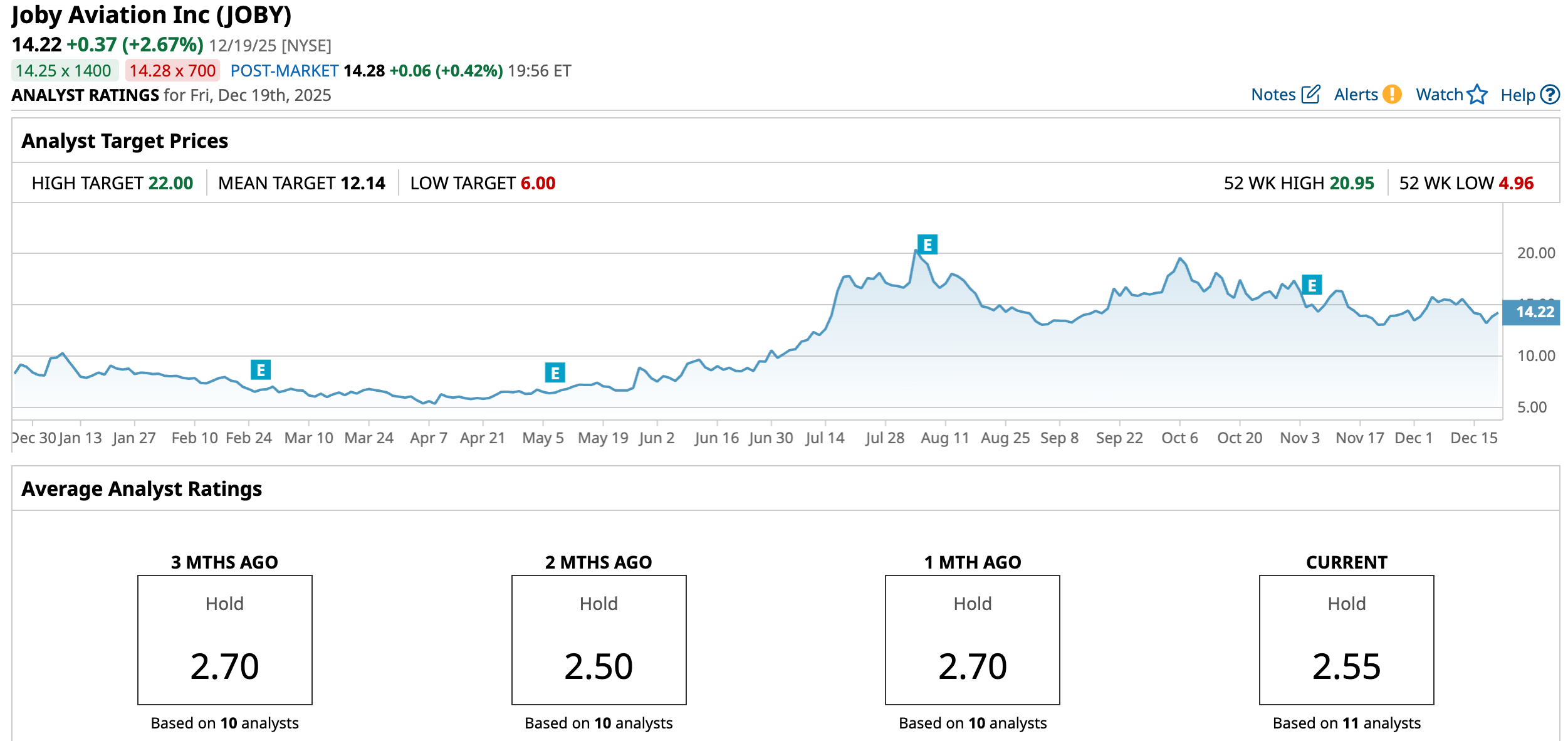

JOBY’s chart over the past year shows sharp repricing as investors recalibrate expectations around urban air mobility. The stock carved out a 52-week low at $4.96 in April, before momentum flipped decisively higher, driving shares to an August peak of $20.95. That rally cooled in the months that followed, with JOBY giving back roughly a third from its highs, yet the bigger picture remains constructive. From its floor, the stock is still up 186.7%, with strong 74.91% year-to-date (YTD), highlighting sustained investor interest.

From a technical perspective, JOBY appears to be taking a breather after a strong upward move, rather than showing signs of a sustained decline. Trading volume surged notably during the June-August breakout, validating the rally from single digits to above $20 and signaling strong institutional participation. Since then, volume has moderated, a typical sign of consolidation as early buyers digest gains, and new investors wait for clearer direction.

Meanwhile, the 14-day RSI, which pushed into overbought territory during the October run toward $19.98, has since cooled and now stands at 47.33 This level reflects neutral momentum, reducing the risk of a sharp near-term correction while leaving room for another leg higher. The MACD oscillator is strengthening again, signaling a gradual shift back toward positive momentum. The MACD line crossed above the signal line, and the histogram has flipped positive, indicating improving bullish momentum beneath the surface despite sideways price action.

Joby Aviation Posted Mixed Q3 Results

Joby reported mixed third-quarter 2025 results on Nov. 5, with losses widening versus last year and missing expectations, even as revenue finally gained traction, signaling early progress despite the financial strain.

The company posted a loss of $0.48 per share, more than double the $0.21 loss recorded a year ago, reflecting the rising cost of turning a vision into a certified, manufacturable aircraft. Yet beneath the red ink, the narrative was more nuanced. Quarterly revenue surged to $22.6 million, a dramatic leap from just $0.03 million in the year-ago quarter, largely driven by the August acquisition of Blade’s passenger business. That deal brought real-world operations into Joby’s ecosystem, transporting roughly 40,000 passengers during the quarter, most notably Ryder Cup fans who traded two-and-a-half-hour drives for 12-minute flights.

Total operating expenses climbed 30.3% year-over-year (YOY), led by an 18.2% increase in research and development and a 14.5% jump in selling, general, and administrative expenses. Adjusted EBITDA came in at a loss of -$132.8 million, reflecting heavy investment in aircraft development, certification, manufacturing readiness, and integration costs tied to Blade.

Crucially, Joby ensured it had the balance sheet to sustain this phase. Cash and cash equivalents stood at $208.4 million at quarter-end, and in October the company completed an underwritten equity offering that raised approximately $576 million in net proceeds. Management expects that capital to fund certification milestones, manufacturing scale-up, and preparations for commercial launch.

Strategically, Joby continued to expand its ecosystem. The company deepened its partnership with Uber, integrating Blade services into the Uber app and quietly positioning itself in front of millions of daily users ahead of its own commercial launch. Operationally, Joby logged more than 600 flights in 2025, completed its first point-to-point flight between Marina and Monterey, and demonstrated regular scheduled operations in Osaka during World Expo 2025, exposing its aircraft to hundreds of thousands of spectators.

For 2025, management expects to generate cash, cash equivalents, and short-term investments at the upper end of the $500 million to $540 million range.

Joby’s Vertiport Push Through the Metropolis Partnership

Vertiports are the backbone of the eVTOL revolution. They are the landing, takeoff, and passenger-handling hubs that make short urban flights feasible, safe, and seamless. Without them, even the most advanced air taxis remain theoretical. Joby is tackling this head-on.

Joby is no longer talking about the future in abstract terms, but laying down the physical groundwork. The partnership with Metropolis Technologies marks a decisive step forward, focused squarely on scale and speed. Through this deal, Joby plans to develop 25 vertiport sites across North America, strategically selected from Metropolis’ vast portfolio of more than 4,200 parking locations and aviation service sites across 350 airports.

Instead of building from scratch, Joby is plugging into existing, high-traffic mobility hubs. Metropolis will bring its AI-driven computer vision, biometrics, and baggage-handling capabilities to streamline passenger flow and meet safety and regulatory standards. The collaboration also extends to Blade’s urban air mobility routes, starting in New York, where baggage services remove a major friction point. It is a practical, infrastructure-first approach that accelerates commercialization.

What Do Analysts Think About Joby Aviation Stock?

Wall Street remains cautious on Joby Aviation’s path to profitability. Analysts expect losses to deepen in the near term, with the current quarter’s loss per share widening 5.3% YOY to -$0.20. For the full fiscal year, losses are projected to expand 7.6% annually to -$0.85 per share. Looking ahead, however, expectations turn slightly more constructive, with losses projected to narrow by 11.8% to -$0.75 per share next year.

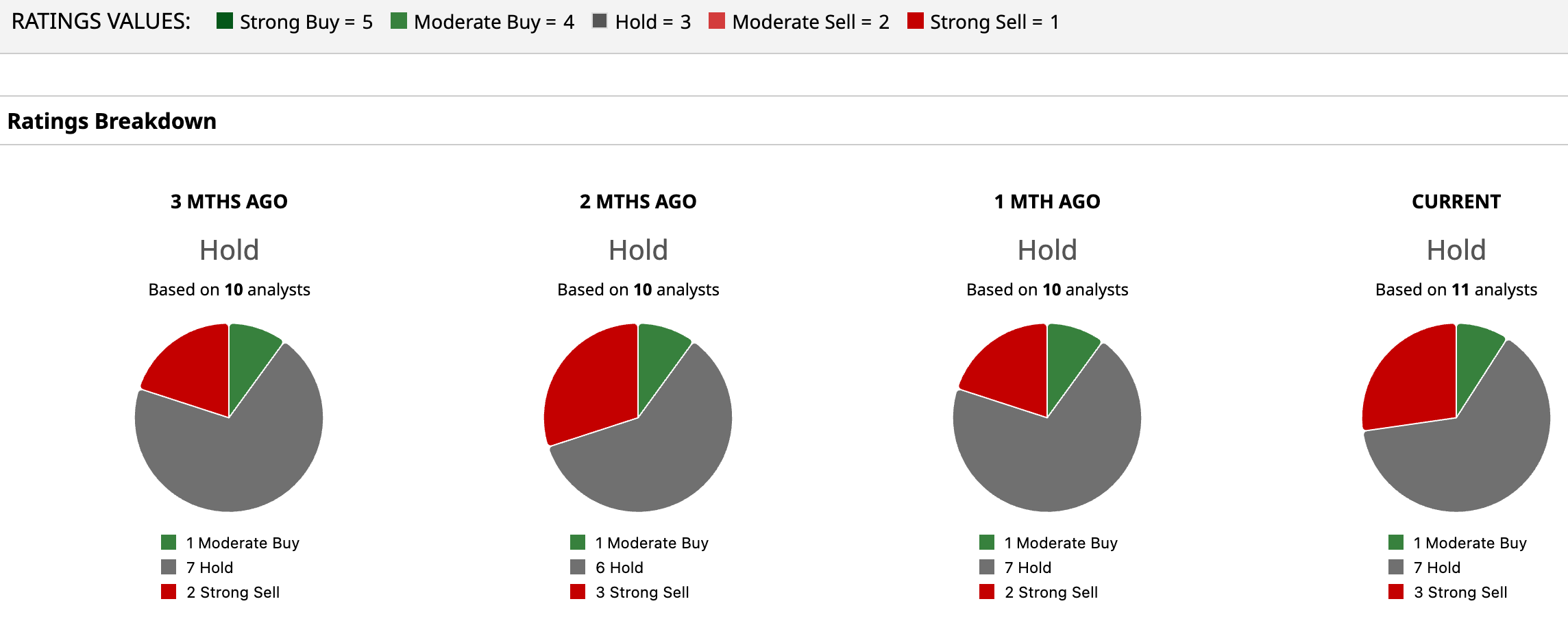

Wall Street analysts are cautious on JOBY, giving a consensus “Hold” rating overall. Of the 11 analysts covering the stock, one analyst has a “Moderate Buy” rating, seven analysts are on the sidelines with a “Hold,” and the remaining three have a “Strong Sell” rating.

JOBY’s rally this year has pushed the stock above the consensus price target of $12.14, but the Street-high price target of $22 indicates 54.7% potential upside from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart