Chandler, Arizona-based Microchip Technology Incorporated (MCHP) develops, manufactures, and sells smart, connected, and secure embedded control solutions. With a market cap of $33.8 billion, the company's operations span various countries in the Americas, Europe, and Asia.

The semiconductor developer has significantly underperformed the broader market over the past year. MCHP stock prices have gained 8.2% in 2025 and plunged 17.9% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 16% gains on a YTD basis and 17.4% returns over the past year.

Further, the stock has also underperformed the industry-focused First Trust Nasdaq Semiconductor ETF’s (FTXL) 44.9% surge on a YTD basis and 38% gains over the past 52 weeks.

MCHP stock prices plunged 6.6% in the trading session following the release of its lackluster Q1 results on Aug. 7. The company’s sales have remained under constant pressure, along with a steady contraction in margins. Microchip’s net sales for the quarter dropped 13.4% year-over-year to $1.1 billion. While on a GAAP basis, the company reported a net loss of $46.4 million, significantly down from the net income of $129.3 million reported in the year-ago quarter.

For the full fiscal 2026, ending in March, analysts expect MCHP to deliver an adjusted EPS of $1.18, up 16.8% year-over-year. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed the projections on one other occasion.

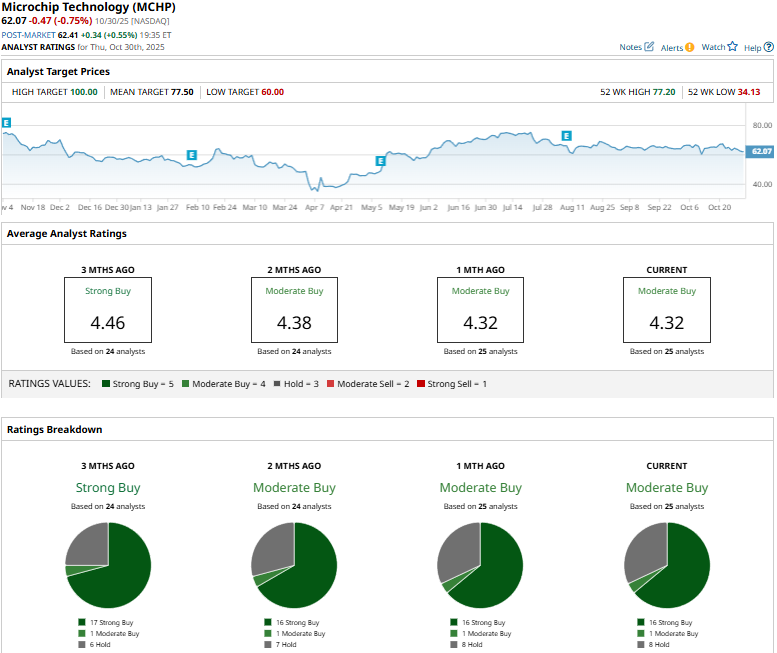

MCHP has a consensus “Moderate Buy” rating overall. Of the 25 analysts covering the stock, opinions include 16 “Strong Buys,” one “Moderate Buy,” and eight “Holds.”

This configuration is notably less optimistic than three months ago, when the stock had a consensus “Strong Buy” rating overall.

On Sept. 15, Wells Fargo (WFC) analyst Joe Quatrochi initiated coverage on MCHP with an “Equal-Weight” rating and set a price target of $60.

MCHP’s mean price target of $77.50 suggests a 24.9% upside potential. Meanwhile, the street-high target of $100 represents a staggering 61.1% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- PayPal Is Paying Its First-Ever Dividend. Should You Snap Up PYPL Stock Now?

- Use This Treasury Strategy to Invest in US Bonds for Steady Income

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- 1 Fintech Stock Under $400 to Buy and Hold Forever