The Origins of Gold Trading

Gold has captivated humanity for thousands of years — not only as a symbol of wealth and power but also as a cornerstone of trade and monetary systems. The first recorded use of gold as a medium of exchange dates back to around 560 B.C. in Lydia (modern-day Turkey), where the first gold coins were minted. These early coins marked the beginning of organized gold trading, allowing merchants and civilizations to exchange goods using a standardized form of money.

During the Roman Empire, gold became the foundation of international trade. Later, in the 19th century, the Gold Standard emerged — a monetary system where national currencies were directly linked to gold. This system brought stability to global trade, as the value of money was tied to a fixed quantity of gold. Although the Gold Standard was abandoned in the 20th century, gold continued to serve as a global store of value, hedge against inflation, and a key asset in financial markets.

The Rise of Modern Gold Trading

With the growth of technology and financial markets, gold trading has evolved far beyond physical ownership. Today, investors and traders can access gold through multiple instruments — including gold futures, ETFs, CFDs, and spot trading. These tools make it possible to trade gold 24/5 from anywhere in the world, responding instantly to changes in market conditions.

Modern gold trading is heavily influenced by:

Economic data (such as inflation and interest rates)

Geopolitical tensions (conflicts, sanctions, and global crises)

Currency movements, especially the U.S. dollar

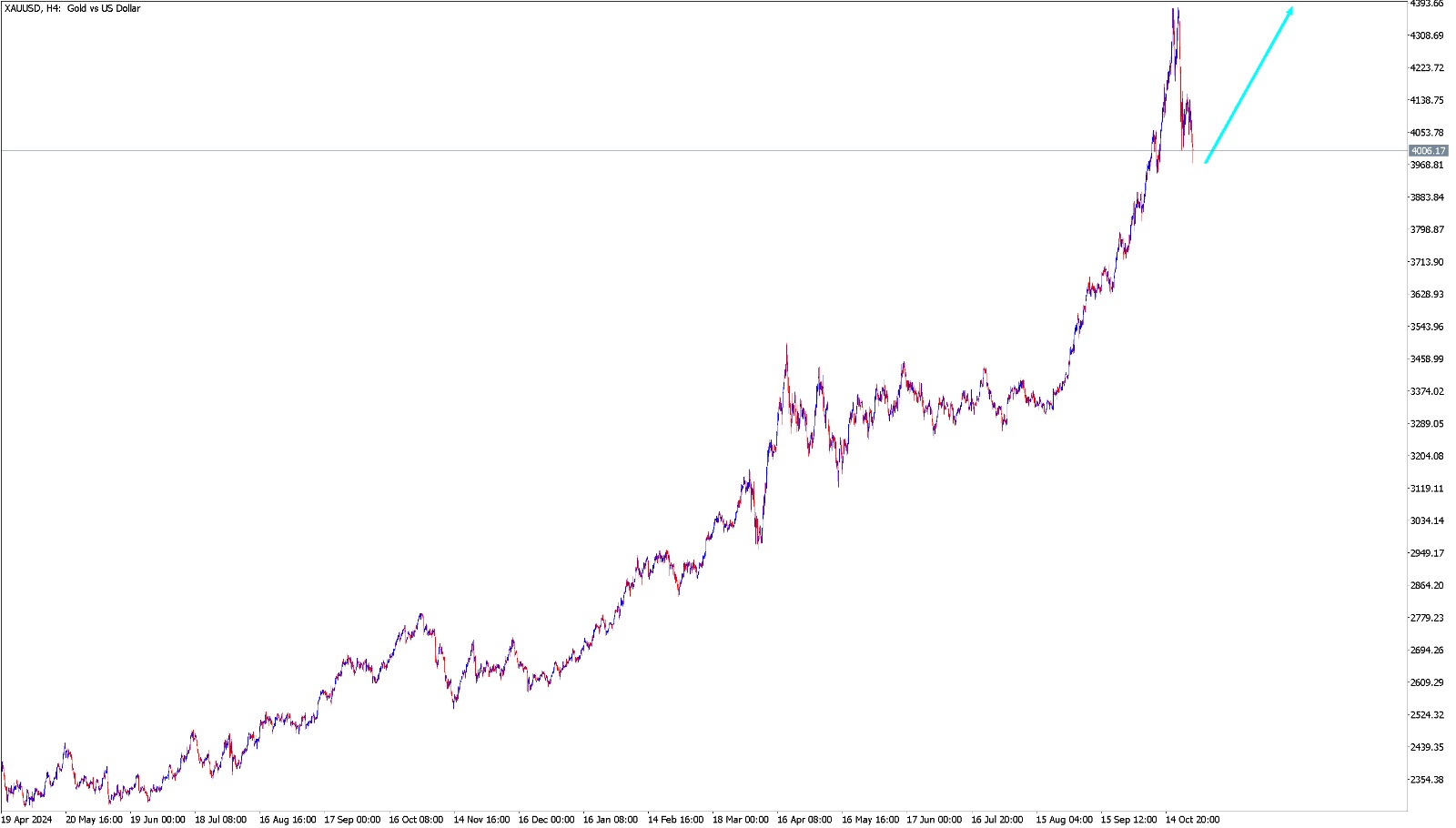

Market sentiment and technical chart patterns

Because gold often moves opposite to riskier assets like stocks, it is widely considered a safe-haven asset. During times of uncertainty, investors tend to move their capital into gold to preserve value.

What Are Gold Signals?

gold signals are actionable trading alerts that help traders identify optimal moments to buy or sell gold. These signals are generated based on technical analysis, market structure, and proven price patterns. They simplify the decision-making process for traders by providing:

Entry and exit points for gold trades

Stop-loss and take-profit levels

Trend direction and momentum confirmation

At StockStrategy.net, our gold signals are derived from a system developed through 15 years of continuous research and real market experience. Each signal is based on precise chart patterns that have consistently identified major gold market turns before they became obvious to the public.

Why Gold Signals Are Essential for Traders

Trading gold successfully requires timing and discipline. Without a structured approach, many traders fall victim to emotional decisions or false signals caused by market noise. Gold signals offer clarity and consistency by:

Reducing guesswork and emotional bias

Helping traders follow a systematic, rule-based method

Allowing faster reaction to changing trends

Improving long-term profitability through disciplined execution

Whether you’re a short-term trader or a long-term investor, gold signals can help you identify high-probability trade setups with greater confidence.

The Future of Gold Trading

As global economies evolve, gold continues to play a central role in financial markets. The digital age has made access to professional analysis and real-time gold signals easier than ever before. With algorithmic trading, AI-powered analysis, and blockchain-based gold assets entering the scene, the future of gold trading is becoming more advanced — yet still rooted in the same principles of value and scarcity that began thousands of years ago.

From ancient coins to digital trading platforms, gold has maintained its reputation as one of the world’s most valuable and trusted assets. Modern traders can now leverage gold signals to navigate this timeless market with precision, combining historical wisdom with modern technology.

If you’re ready to trade gold with confidence, explore our proven Gold Trading Strategy and get access to expert gold signals developed from real market experience.

From Ancient Treasure to Modern Commodity: The History of Gold Trading

Gold's journey as a tradable asset is a story of global economics and shifting power structures.

Ancient Currency (c. 600 BCE – 1870s)

The first gold coins were minted in Lydia (modern-day Turkey) around 600 BCE. Its consistent value and scarcity made it the standard for commerce across ancient empires—from the Roman solidus to the Byzantine bezant. For millennia, gold was not just traded; it was money.

The Age of the Gold Standard (c. 1870s – 1914)

The industrial age demanded stability in international trade, leading to the Classical Gold Standard. This system fixed the value of a nation's currency to a specific amount of gold. While this created predictable exchange rates, the inherent inflexibility led to its widespread abandonment during the economic crises of World War I and the Great Depression.

The Fiat Revolution (1944 – Present)

Bretton Woods (1944-1971): Post-WWII, the US Dollar was fixed to gold at $35 per ounce, and other currencies were pegged to the dollar. This established the USD as the world's reserve currency.

The Nixon Shock (1971): The US unilaterally ended the dollar’s direct convertibility to gold, ushering in the modern era of fiat currency—money not backed by a physical commodity.

Gold as a Free-Floating Asset: Freed from the fixed $35/ounce peg, gold's price began to float freely, determined solely by market forces, making it a highly volatile yet powerful investment vehicle. Today, gold is primarily traded on global exchanges like the London Bullion Market and the COMEX in New York, often in the form of futures, options, and ETFs.

Gold’s transition from physical currency to a freely traded financial commodity highlights its remarkable adaptability and its ongoing role as the ultimate asset for wealth preservation in an uncertain world.