Since April 2025, Payoneer has been in a holding pattern, posting a small return of 1.6% while floating around $6.28. The stock also fell short of the S&P 500’s 33.2% gain during that period.

Does this present a buying opportunity for PAYO? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free for active Edge members.

Why Is PAYO a Good Business?

Founded during the early days of global e-commerce in 2005 to solve international payment challenges, Payoneer (NASDAQ: PAYO) provides financial technology services that enable small and medium-sized businesses to send and receive payments globally across borders.

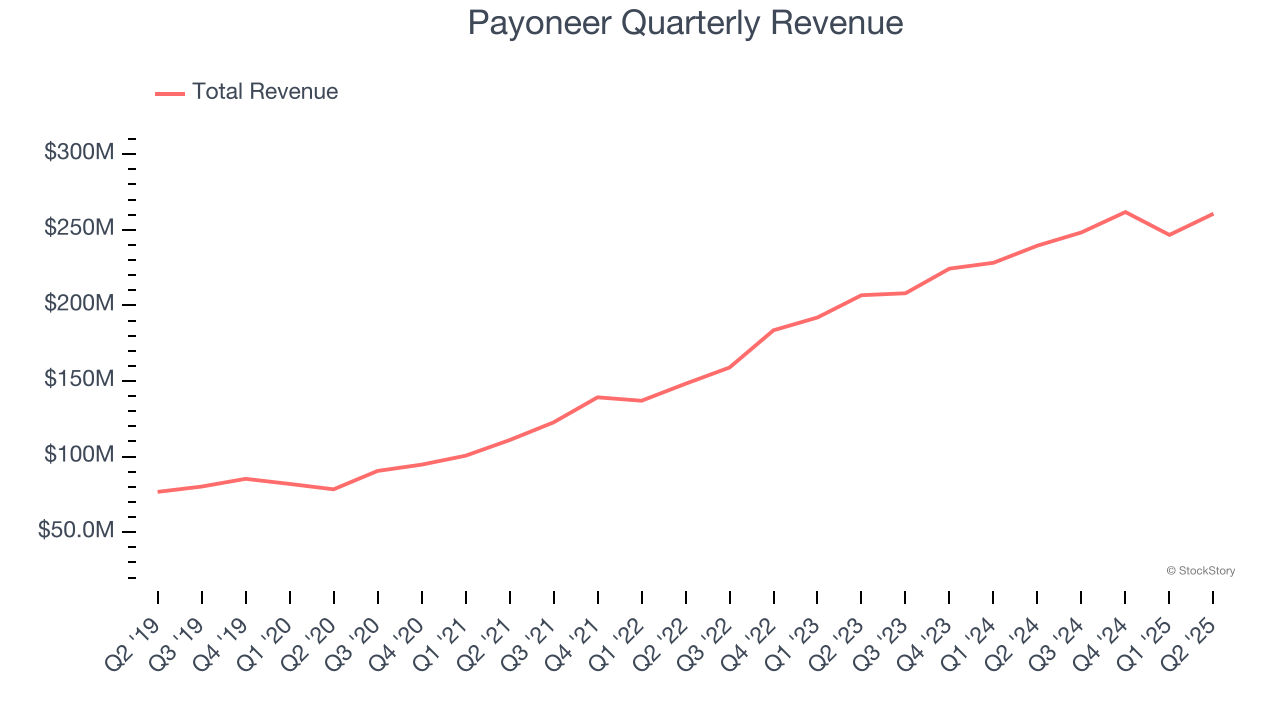

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Over the last five years, Payoneer grew its revenue at an incredible 25.6% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers.

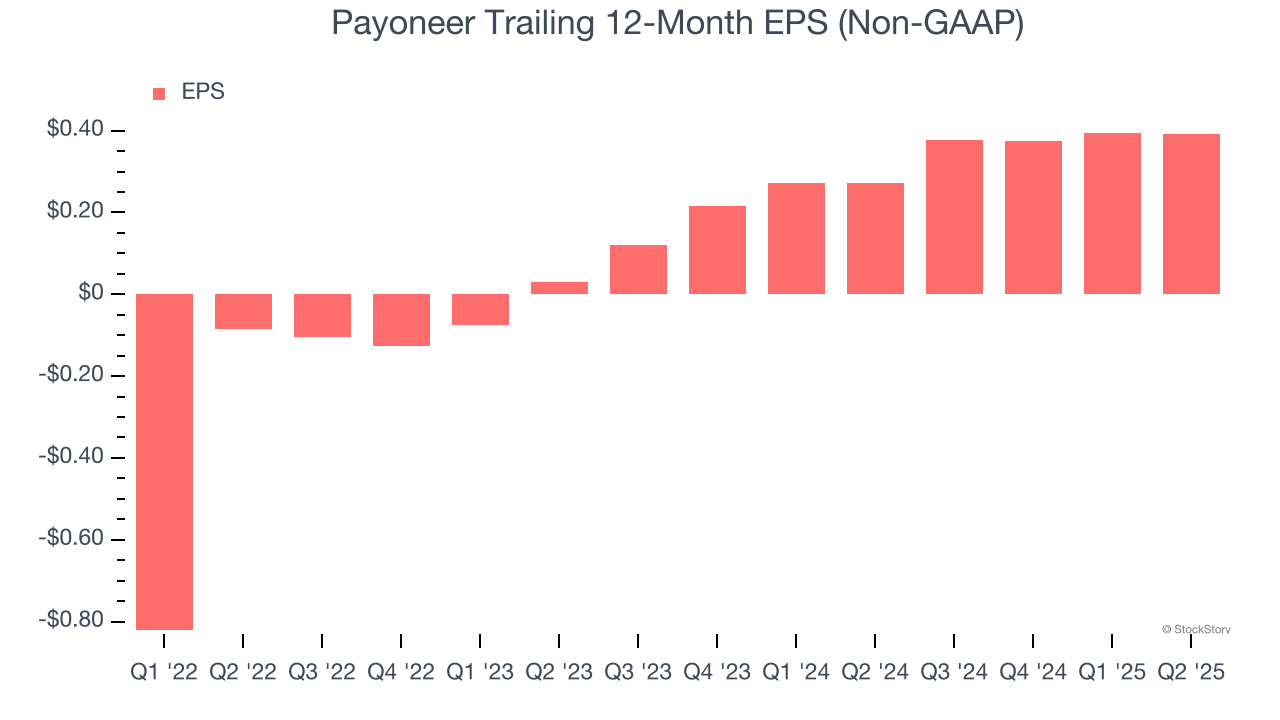

2. Outstanding Long-Term EPS Growth

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Payoneer’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons Payoneer is a high-quality business worth owning. With its shares underperforming the market lately, the stock trades at 22.9× forward P/E (or $6.28 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Payoneer

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.