With the April 15, 2024, deadline now past, Jeff Badu, a distinguished CPA and tax advisor, emphasizes the importance of post-deadline tac filing actions and preparing for any necessary extensions. Known for his expert tax preparation services in Chicago, IL and all throughout the US, Jeff advises those who have not yet filed their 2023 tax returns to take immediate steps to rectify their situation. “Even though the initial deadline has passed, it’s crucial to act quickly to minimize potential penalties and interest,” says Jeff.

For taxpayers who missed filing by the deadline, Jeff outlines the immediate steps they should take, including filing IRS Form 4868 to secure an extension. “Filing for an extension grants you until October 15, 2024, to file your tax return. However, it’s important to remember that this extension does not apply to any taxes owed,” Jeff explains. He stresses the importance of estimating and paying any owed taxes as soon as possible to avoid additional charges, leveraging his extensive experience as a tax professional in Chicago, IL and beyond.

Jeff also highlights special considerations for different groups, such as military personnel and those living abroad, who are typically eligible for an automatic two-month extension without needing to file an extension form. “Those serving or living outside the U.S. can utilize this additional time, though it’s critical to understand that interest may still accrue on taxes owed after April 15,” notes Jeff, showcasing his expertise as a tax accountant in Chicago, IL.

To help taxpayers who owe more than they can pay immediately, Jeff recommends contacting the IRS to discuss payment plan options. “Filing your return and paying as much as you can reduces the risk of higher penalties and sets the stage for a manageable payment plan arrangement,” he advises.

For comprehensive support in handling your tax filing needs, whether catching up post-deadline or planning for the next tax season, visit https://www.badutaxservices.com/. Jeff Badu, now offering his services nationwide, offers detailed guidance and professional assistance, ensuring that all clients navigate their tax obligations with expert care. Contact Jeff today to secure the detailed and personalized accounting services in Chicago, Illinois, or any other area of the US, necessary for effective tax management.

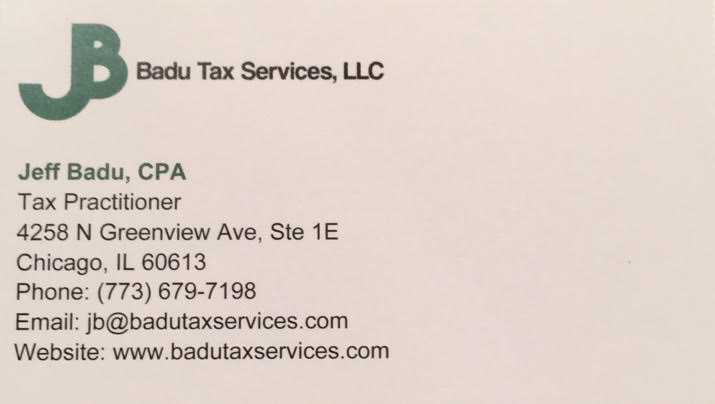

Media Contact

Company Name: Badu Tax Services LLC

Contact Person: Jeff Badu

Email: Send Email

Phone: 773-819-5675

Address:4258 N Greenview Ave Ste 1E

City: Chicago

State: Illinois 60613

Country: United States

Website: http://badutaxservices.com