Mar22 Financial YTD Performance

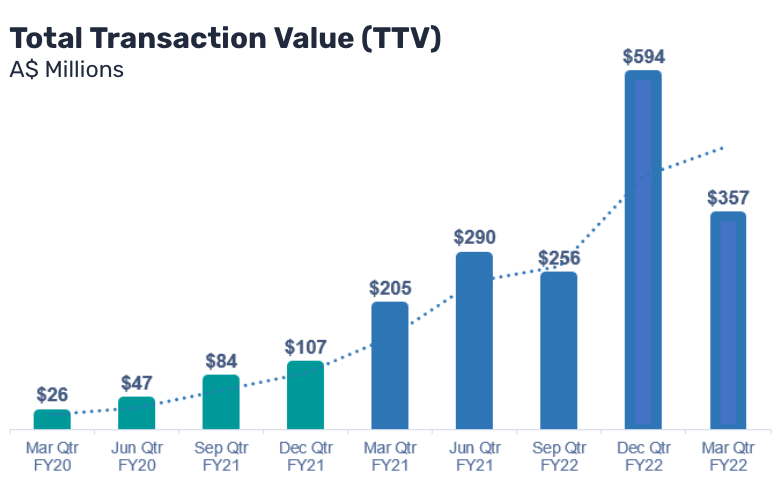

- 204% year on year growth in Total Transaction Value (TTV) to $AUD1,205 million ($US879 million) for the 9 months ending 31st March - up AUD$809 million ($US590 million)

- 99% year on year growth in Revenue of $AUD57 million ($US41 million) for the 9-months ending 31st March - up AUD$28 million (US$20.5 million)

- 171% year on year growth in Gross Profit of $AUD23 million ($US17 million) for the 9-months ending 31st March - up $14 million

- Adjusted EBITDA loss of $AUD6.6 million ($US4.8 million) for the 9-month period

Mar22 Quarter Performance

- 72% year on year growth in Total Transaction Value (TTV) to $AUD357 million ($US253 million) up from $AUD207 million ($US151 million)

- 8% year on year growth in Gross Profit to $AUD6.6 million ($US4.8 million) up from $AUD6.1 million ($US4.4million)

- $AUD19 million ($US14.2 million) in liquid assets (including cash, deposits and digital assets)

- Entities set up in 2 new regions; the USA and Turkey - continuing expansion into new growth markets.

- 12 new partners signed - support for 30 new coins/chains added

The Banxa management team will host a live webcast to discuss its quarterly results on Tuesday May 31, 2022, at 8:30am ET. The live webcast of the call can be accessed by registering at Financial Results Webcast Link. The link will also be available on the company's investor relations website at investor.banxa.com.

TORONTO, ON and MELBOURNE, TN / ACCESSWIRE / May 30, 2022 / BANXA Holdings Inc. (TSXV:BNXA)(OTCQX:BNXAF)(FSE:AC00) ("Banxa" or "The Company") has today announced its January to March 2022 quarter results. The full results including MD&A are available on Sedar.

Domenic Carosa, Founder and Chairman of Banxa, said: "The March quarter results show our continued growth not just in commercial volumes but in our ambition to be the leading fiat on- and off ramp across Web3 in the most markets. Despite the recent market conditions, we've continued to deliver another positive growth period with key milestones on our roadmap reached."

BUSINESS HIGHLIGHTS

During the January to March 2022 period, Banxa continued its geographic and local payment expansion; setting up entities in the key markets of the USA and Turkey. This continued focus on geographical expansion paired with more local payment offerings means the Banxa partner network has potential access to millions of more end users globally.

Banxa also added 22 new coins and eight new chains, the vast majority of all traded coins and chains. Highlights include Axie Infinity (AXS), the native coin for the leading crypto gaming platform - as well as PancakeSwap (CAKE), the native coin on PancakeSwap - one of the most popular automated market makers powering decentralised finance. 12 new partners were signed in the period including Pionex 1Inch and Coinex, joining the likes of existing top tier partners Binance, OKX, Kucoin and Gate.io.

Holger Arians, CEO of Banxa, said: "Our expanding partner ecosystem and ability to offer our partners support for more coins on more chains in more markets means we are able to scale faster and bring millions of more people into the crypto ecosystem sooner. Along with our enhanced product offerings, we have the ability to scale our partnerships out further into the market".

FINANCIAL REVIEW

$AUD1,205 million ($US879 million) Total Transaction Value (TTV) for the 9 months ending 31st March - up AUD$809 million ($US 590 million) or 204% period on period. Market volatility and lower Bitcoin (BTC) price were the main factors for the drop in volume from the December quarter, while the onboarding of new partners and the support of new coins, chains and layer 2 support contributed to the growing trend.

PROFIT AND LOSS ($AUD)

Highlights for the period

- TTV growth of $AUD809 million ($US574 million) or 204% underpinned by partner & user expansion.

- Mar22 quarter revenue of AUD$16.5 million is lower than the comparative quarter (AUD$21 million) due to a reduced mix of principal revenue (vs agency revenue)

- Net take rate of 1.9% (GP as % of TTV) based on service and geographic mix as well as cost optimization.

- Strategy execution and continued investment (in product, talent and systems) has resulted in opex increasing to $25.8 million but remaining consistent at 2% of TTV.

- Adjusted EBITDA* loss of $AUD6.6 million ($US4.8 million) post other non-cash and one-off items. Balance is negatively impacted by FX loss of $AUD6.1million ($US4.4 million) or 0.5% of TTV, of which $AUD3.0 million ($US2.2 million) is unrealized.

* Adjusted EBITDA is a non-IFRS financial measure that we calculate as net loss before tax excluding depreciation and amortization expense, share based compensation expense, realized/unrealized loss on inventory, finance expense, realized/unrealized gain on fair value of deposits, loss on fair value of derivative, and listing expenses. Adjusted EBITDA is used by management to understand and evaluate the performance and trends of the Company's operations.

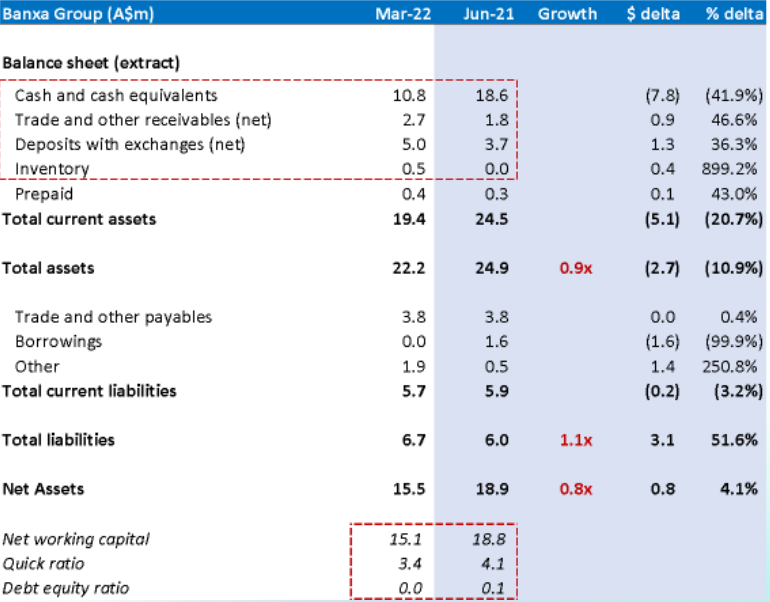

BALANCE SHEET ($AUD)

Highlights:

- Liquid assets of $AUD19.0 million ($US13.4 million) comprising cash, deposits and digital assets and net of $AUD0.8 million ($US0.6 million) provision. Gross liquid assets of $AUD19.8m ($US14m)

- The reduction in liquid assets of $AUD5.2 million ($US3.7 million) is largely driven by higher operating cash outflows inline with opex expansion.

- Liabilities of $AUD6.7 million ($US4.75 million), 1.1x growth on comparative period driven by expanding employee entitlements, lease liability and tax provisions.

- Research and development costs are expensed as incurred and not capitalised on the balance sheet

- Debt free balance sheet with c$AUD20 million (c$US 14.2 million) available in undrawn debt facilities

ON BEHALF OF THE BOARD OF DIRECTORS

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ENDS

ON BEHALF OF THE BOARD OF DIRECTORS

Per: "DOMENIC CAROSA" https://twitter.com/dcarosa

Domenic Carosa

Chairman (1-888-218-6863)

BANXA Holdings Inc. (TSX-V: BNXA) (OTCQX: BNXAF) (FSE: AC00)

Banxa's mission is to accelerate the world to Web3 with its leading global on-and-off ramp solution. Through its extensive network of local payment solutions paired with the required crypto licences, Banxa gives its partners and projects access to global audiences with less friction and higher conversions. Banxa has a global team of Web3 natives - with operating headquarters in the USA, Europe and APAC regions.

For further information go to www.banxa.com

SOURCE: BANXA Holdings Inc.

View source version on accesswire.com:

https://www.accesswire.com/703264/Banxa-Reports-99-year-on-year-Revenue-Growth-YTD-March-22