In February, home prices across the United States rose at a slower pace than the month prior (January 2022) but continued to appreciate at higher rates than the year earlier (February 2021). According to Radian Home Price Index (HPI) data released today by Red Bell Real Estate, LLC, a Radian Group Inc. company (NYSE: RDN), home prices nationally rose from the end of January 2022 to the end of February 2022 at an annualized rate of +11.3 percent. The company believes the Radian HPI is the most comprehensive and timely measure of U.S. housing market prices and conditions.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220401005464/en/

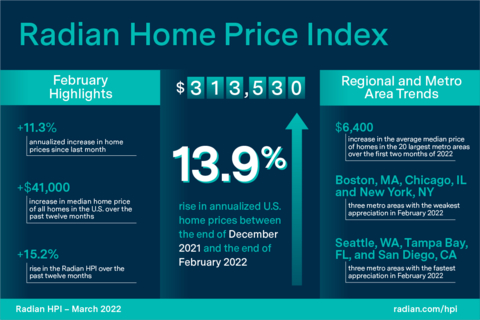

Radian Home Price Index (HPI) Infographic, March 2022 (Graphic: Business Wire)

February 2021 marked the last month that national home prices appreciated by less than 10 percent. Since then, the U.S. housing market has witnessed a prolific string of twelve consecutive months of annualized monthly home price appreciation of more than 10 percent. As a result, the median home price of all homes in the U.S. has risen by more than $41,000 in just twelve months. However, after peaking in September 2021, home price appreciation rates have slowed in each of the subsequent five months.

The Radian HPI rose 15.2 percent year-over-year (February 2021 to February 2022). In comparison, the year-over-year period from February 2020 through February 2021 recorded an 8.3 percent increase. The Radian HPI is calculated based on the estimated values of more than 70 million unique addresses each month, covering all single-family property types and geographies.

“After peaking last September, home price appreciation rates have slowed during the fall and winter months. The remainder of 2022 will likely pit opposing forces—the desired return to normalcy and spending that will come with the ending of the pandemic, and the increased cost of homeownership that has resulted from higher mortgage rates, inflation, and prior home price gains. While the future is unknown, millions of Americans saw their home value increase during a time of great personal and economic stress,” noted Steve Gaenzler, SVP of Products, Data and Analytics. “The median-priced homeowner in the U.S. gained approximately $62,000 in wealth since the onset of the pandemic closures in March of 2020. Ultimately, housing markets large and small across the country have proven that homeownership is a wealth creator that supports the “American Dream,” even in challenging times,” added Gaenzler.

NATIONAL DATA AND TRENDS

- Median home price in the U.S. rose to $313,530

- Home prices rose an annualized 13.9 percent over the last three months

Nationally, the median estimated price for single-family and condominium homes rose to $313,530. Across the U.S., home prices nationally rose 16.1 percent over the last six months, a strong increase over the prior six-month appreciation rate of just 13.2 percent.

Even during the winter months, when family-centric housing transactions are typically slow, demand remained historically strong, and supply remained at all-time lows. Currently, the U.S. has more licensed real estate agents and brokers, than active listings of homes for sale. Moreover, the largest segment of the U.S. population, millennials, are now in the traditional home buying age. Strength in other forms of housing, such as single-family rental homes, also continues to grow, adding competitive pressure on home prices in certain markets.

REGIONAL DATA AND TRENDS

- February reported slower appreciation in all Regions

- Northeast and Midwest softened while South and Southwest stayed firm

Like the national reporting, all U.S. regions reported slower price appreciation in residential markets in February 2022. The South and Southwest were particularly resilient as populations grew in these areas from out-of-state transplants and strong demand from corporate sponsors of single-family rentals. In what are normally down months for housing activity, the Northeast and Midwest, unsurprisingly slowed the most. The Northeast (6.3 percent) recorded the weakest monthly, annualized appreciation rate, followed by the Midwest (7.8 percent) and Mid-Atlantic (8.9 percent).

At the state level, home price appreciation slowed compared to the prior month in 46 of the 50 states and the District of Columbia. Only FL, HI, LA, MD, and RI saw increases in appreciation rates. When compared against February of 2021, 39 states recorded higher one-month appreciation rates versus 12 states that were slower than the year prior.

Momentum of home price appreciation differs by state. The brakes appear to have been pressed firmly in one state in particular. Idaho, a state that witnessed very strong appreciation in 2020-2021 due to significant construction of higher priced homes and increasing prices of sales of existing homes, recorded just a 3.9 percent annualized rate of appreciation in February, the weakest month in years for the state.

METROPOLITAN AREA DATA AND TRENDS

- Largest metropolitan areas outperformed smaller or rural areas in February

- Miami continues to outshine local markets

Of the 20-largest metro areas of the U.S., all of them reported positive price appreciation in February compared to January 2022. Three metros, Seattle, Tampa Bay and San Diego, recorded the fastest price appreciation, with Boston, Chicago and New York city producing the weakest appreciation. South Florida has witnessed an uptick in in-migration, attracting many from outside the region. As a result, the Miami metro area reported a record high monthly appreciation rate in February 2022—higher than any time before, during or after the pandemic.

In just the first two months of 2022, the average median estimated home price of homes in the 20-largest metros was higher by almost $6,400. That is almost 30 percent higher than the estimated increase of $5,000 in the first two months of 2021.

ABOUT THE RADIAN HPI

Red Bell Real Estate, LLC, a subsidiary of Radian Group Inc., provides national and regional indices for download at info.radian.com/hpi, along with information on how to access the full library of indices.

Additional content on the housing market can also be found on the Radian Insights page located at https://radian.com/news-and-knowledge/insights.

Red Bell offers the Radian HPI data at info.radian.com/hpi for content visualization and data extraction. The engine behind the Radian HPI has created more than 100,000 unique data series, which are updated on a monthly basis.

The Radian HPI Portal is a self-service data and visualization platform that contains a library of thousands of high-value indices based on both geographic dimensions as well as by market, or property attributes. The platform provides monthly updated access to nine different geographic dimensions, from the national level down to zip codes. In addition, the Radian HPI provides unique insights into market changes, conditions and strength across multiple property attributes, including bedroom count and livable square footage. To help enhance its customers’ understanding of granular real estate markets, the library is expanded regularly to include more insightful indices.

In addition to the services offered by its Red Bell subsidiary, Radian is ensuring the American dream of homeownership responsibly and sustainably through products and services that include industry-leading mortgage insurance and a comprehensive suite of mortgage, risk, title, valuation, asset management and other real estate services. The company is powered by technology, informed by data and driven to deliver new and better ways to transact and manage risk. Visit www.radian.com to see how Radian is shaping the future of mortgage and real estate services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220401005464/en/

Contacts

For Investors

John Damian – Phone: 215.231.1383

Email: john.damian@radian.com

For the Media

Rashi Iyer – Phone: 215.231.1167

Email: rashi.iyer@radian.com