Total passenger traffic up 33.6% YoY reaching 92% of pre-pandemic levels;

Armenia and Ecuador above March 2019 levels, while Argentina and Brazil at 93% and 89%, respectively

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”) a leading private airport operator in the world, reported today a 33.6% YoY increase in passenger traffic in March 2023, reaching 91.7% of March 2019 levels.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230418006116/en/

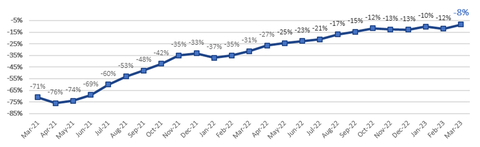

2-Year Passenger Traffic Monthly Performance (vs. 2019) (Graphic: Business Wire)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2023 vs. 2022) |

||||||||

Statistics |

Mar'23 |

Mar'22 |

% Var. |

|

YTD’23 |

YTD'22 |

% Var. |

|

Domestic Passengers (thousands) |

3,644 |

2,965 |

22.9% |

|

10,525 |

8,475 |

24.2% |

|

International Passengers (thousands) |

2,101 |

1,336 |

57.3% |

|

6,137 |

3,537 |

73.5% |

|

Transit Passengers (thousands) |

587 |

438 |

34.1% |

|

1,837 |

1,463 |

25.6% |

|

Total Passengers (thousands) |

6,332 |

4,738 |

33.6% |

|

18,498 |

13,475 |

37.3% |

|

Cargo Volume (thousand tons) |

33.4 |

30.4 |

9.8% |

|

85.2 |

81.0 |

5.2% |

|

Total Aircraft Movements (thousands) |

70.1 |

56.8 |

23.5% |

|

199.8 |

156.4 |

27.8% |

|

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2023 vs. 2019) |

||||||||

Statistics |

Mar'23 |

Mar'19 |

% Var. |

|

YTD’23 |

YTD'19(1)(2) |

% Var. |

|

Domestic Passengers (thousands) |

3,644 |

3,945 |

-7.6% |

|

10,525 |

11,545 |

-8.8% |

|

International Passengers (thousands) |

2,101 |

2,267 |

-7.3% |

|

6,137 |

6,754 |

-9.1% |

|

Transit Passengers (thousands) |

587 |

694 |

-15.4% |

|

1,837 |

2,272 |

-19.1% |

|

Total Passengers (thousands) |

6,332 |

6,906 |

-8.3% |

|

18,498 |

20,571 |

-10.1% |

|

Cargo Volume (thousand tons) |

33.4 |

38.3 |

-12.7% |

|

85.2 |

105.1 |

-19.0% |

|

Total Aircraft Movements (thousands) |

70.1 |

71.5 |

-2.0% |

|

199.8 |

212.7 |

-6.1% |

|

| (1) | Note that preliminary passenger traffic figures for 2019, as well as January 2020 for Ezeiza Airport, in Argentina, were adjusted to include additional inbound passengers not accounted for in the initial count, for an average of approximately 5% of total passenger traffic at Ezeiza Airport and 1% of total traffic at CAAP, during that period. Importantly, inbound traffic does not affect revenues, as tariffs are applicable on departure passengers. |

|

| (2) | Cargo volumes in Uruguay were rectified from January 2019 to June 2020, to reflect all cargo passing through the cargo terminal, instead of air cargo only. |

Passenger Traffic Overview

Total passenger traffic grew 33.6% compared to the same month of 2022, supported by an ongoing recovery in travel demand after the Covid-19 pandemic, as reflected by higher load factors and the gradual resumption of routes and frequencies across all countries of operations. Overall passenger traffic reached 91.7% of March 2019 levels, up from the 88.1% posted in February, with international and domestic passenger traffic reaching 92.7% and 92.4% of March 2019 levels, respectively.

In Argentina, total passenger traffic continued to recover increasing 38.9% YoY and reaching 93.0% of March 2019 levels, up from the 91.3% posted in February. International passenger traffic reached 78.8% of pre-pandemic levels, above the 77.8% recorded in February, while domestic passenger traffic surpassed March 2019 pre-pandemic levels by 1.3%.

In Italy, passenger traffic grew 34.6% versus the same month of 2022. When compared to pre-pandemic levels, total traffic stood at 91.8% of March 2019, up from the 89.8% posted in February, with international passenger traffic, which accounted for almost 77% of total traffic, reaching 96.3% of March 2019 levels, up from the 93.0% recorded in February.

In Brazil, total passenger traffic increased 16.1% YoY, and reached 88.8% of March 2019 levels, up from 82.4% recorded in February. Domestic traffic, which accounted for more than 60% of total traffic, stood at 91.8% of pre-pandemic levels whereas transit passengers reached 86.1% of March 2019 levels.

In Uruguay, total passenger traffic, which is largely international, increased 49.0% YoY and reached 86.2% of March 2019 levels, up from the 72.8% posted in February, which was impacted by a weaker-than-expected seasonal tourism, in Punta del Este.

In Ecuador, passenger traffic increased 20.2% YoY and surpassed pre-pandemic levels by 6.4%. Domestic passenger traffic exceeded pre-pandemic levels by 15.9%, whereas international passenger traffic reached 96.6% of March 2019 pre-pandemic levels.

In Armenia, passenger traffic surpassed pre-pandemic levels for the eleventh consecutive month, at 181.9% of March 2019 figures. On a YoY basis, passenger traffic increased 91.2%.

Cargo Volume and Aircraft Movements

Cargo volume increased 9.8% YoY and reached 87.3% of March 2019 levels, or to 88.2% when adjusting for the discontinuation of operations in Peru. Cargo volumes in Armenia, Uruguay and Italy were above pre-pandemic levels, whereas Argentina stood at 87.0%, and Brazil and Ecuador stood at 69.1%. Around 80% of cargo volume originated in Argentina, Ecuador and Brazil.

Aircraft movements increased 23.5% YoY reaching 98.0% of March 2019 levels, or 101.3% when adjusting for the discontinuation of operations in Peru. Around 85% of aircraft movements originated in Argentina, Brazil and Ecuador, which reached 99.5%, 100.2% and 99.8% of March 2019 levels, respectively. Aircraft movements in all countries of operations reached or exceeded March 2019 levels, with Armenia exceeding pre-pandemic levels by 79.1%, except for Italy that stood at 89.8%.

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2023 vs. 2022) |

|||||||

|

Mar'23 |

Mar'22 |

% Var. |

|

YTD'23 |

YTD'22 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

Argentina(1) |

3,481 |

2,506 |

38.9% |

|

10,269 |

7,064 |

45.4% |

Italy |

487 |

362 |

34.6% |

|

1,296 |

802 |

61.5% |

Brazil |

1,405 |

1,210 |

16.1% |

|

4,250 |

3,842 |

10.6% |

Uruguay |

160 |

107 |

49.0% |

|

497 |

323 |

53.7% |

Ecuador |

436 |

363 |

20.2% |

|

1,142 |

872 |

30.9% |

Armenia |

363 |

190 |

91.2% |

|

1,045 |

571 |

83.1% |

TOTAL |

6,332 |

4,738 |

33.6% |

|

18,498 |

13,475 |

37.3% |

(1) See Footnote 1 in previous table. (2) See Footnote 2 in previous table. |

|||||||

Cargo Volume (tons) |

|

|

||||||||

Argentina |

|

|

17,527 |

16,165 |

8.4% |

|

|

43,621 |

43,132 |

1.1% |

Italy |

|

|

1,254 |

1,536 |

-18.4% |

|

|

3,362 |

3,909 |

-14.0% |

Brazil |

|

|

6,250 |

5,352 |

16.8% |

|

|

16,047 |

13,959 |

15.0% |

Uruguay(2) |

|

|

2,920 |

2,928 |

-0.3% |

|

|

6,981 |

7,023 |

-0.6% |

Ecuador |

|

|

2,734 |

3,262 |

-16.2% |

|

|

7,915 |

9,244 |

-14.4% |

Armenia |

|

|

2,734 |

1,196 |

128.7% |

|

|

7,239 |

3,689 |

96.2% |

TOTAL |

|

|

33,418 |

30,439 |

9.8% |

|

|

85,165 |

80,956 |

5.2% |

Aircraft Movements |

|

|

||||||||

Argentina |

|

|

39,159 |

30,427 |

28.7% |

|

|

110,355 |

82,106 |

34.4% |

Italy |

|

|

4,675 |

4,071 |

14.8% |

|

|

12,520 |

10,071 |

24.3% |

Brazil |

|

|

13,397 |

11,402 |

17.5% |

|

|

38,710 |

33,683 |

14.9% |

Uruguay |

|

|

2,702 |

2,385 |

13.3% |

|

|

9,181 |

7,600 |

20.8% |

Ecuador |

|

|

6,922 |

6,458 |

7.2% |

|

|

19,652 |

17,764 |

10.6% |

Armenia |

|

|

3,271 |

2,052 |

59.4% |

|

|

9,416 |

5,151 |

82.8% |

TOTAL |

|

|

70,126 |

56,795 |

23.5% |

|

|

199,834 |

156,375 |

27.8% |

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2023 vs. 2019) |

|||||||

|

Mar'23 |

Mar'19 |

% Var. |

|

YTD'23 |

YTD'19 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

Argentina(1) |

3,481 |

3,741 |

-7.0% |

|

10,269 |

11,103 |

-7.5% |

Italy |

487 |

531 |

-8.2% |

|

1,296 |

1,420 |

-8.7% |

Brazil |

1,405 |

1,582 |

-11.2% |

|

4,250 |

4,968 |

-14.5% |

Uruguay |

160 |

185 |

-13.8% |

|

497 |

643 |

-22.7% |

Ecuador |

436 |

410 |

6.4% |

|

1,142 |

1,105 |

3.3% |

Armenia |

363 |

200 |

81.9% |

|

1,045 |

579 |

80.7% |

Peru |

|

258 |

- |

|

- |

753 |

- |

TOTAL |

6,332 |

6,906 |

-8.3% |

|

18,498 |

20,571 |

-10.1% |

(1) See Footnote 1 in previous table. (2) See Footnote 2 in previous table. |

|||||||

Cargo Volume (tons) |

|

|

|

|

|

||

Argentina |

17,527 |

20,145 |

-13.0% |

|

43,621 |

56,057 |

-22.2% |

Italy |

1,254 |

1,064 |

17.9% |

|

3,362 |

3,081 |

9.1% |

Brazil |

6,250 |

9,042 |

-30.9% |

|

16,047 |

23,524 |

-31.8% |

Uruguay(2) |

2,920 |

2,343 |

24.7% |

|

6,981 |

6,379 |

9.4% |

Ecuador |

2,734 |

3,955 |

-30.9% |

|

7,915 |

11,313 |

-30.0% |

Armenia |

2,734 |

1,331 |

105.4% |

|

7,239 |

3,558 |

103.4% |

Peru |

- |

404 |

- |

|

- |

1,191 |

- |

TOTAL |

33,418 |

38,282 |

-12.7% |

|

85,165 |

105,102 |

-19.0% |

Aircraft Movements |

|

|

|

|

|

|

|

Argentina |

39,159 |

39,347 |

-0.5% |

|

110,355 |

115,890 |

-4.8% |

Italy |

4,675 |

5,206 |

-10.2% |

|

12,520 |

14,152 |

-11.5% |

Brazil |

13,397 |

13,371 |

0.2% |

|

38,710 |

40,751 |

-5.0% |

Uruguay |

2,702 |

2,548 |

6.0% |

|

9,181 |

9,337 |

-1.7% |

Ecuador |

6,922 |

6,937 |

-0.2% |

|

19,652 |

20,636 |

-4.8% |

Armenia |

3,271 |

1,826 |

79.1% |

|

9,416 |

5,326 |

76.8% |

Peru |

- |

2,308 |

- |

|

- |

6,646 |

- |

TOTAL |

70,126 |

71,543 |

-2.0% |

|

199,834 |

212,738 |

-6.1% |

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 53 airports in 6 countries across Latin America and Europe (Argentina, Brazil, Uruguay, Ecuador, Armenia and Italy). In 2022, Corporación América Airports served 65.6 million passengers, 83.7% above the 35.7 million passengers served in 2021 and 22.1% below the 84.2 million served in 2019. The Company is listed on the New York Stock Exchange where it trades under the ticker “CAAP”. For more information, visit http://investors.corporacionamericaairports.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230418006116/en/

Contacts

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716