Shelf Asset Management Inc., the leading builder of infrastructure and software for the asset management space globally, has recently unveiled that it is gaining significant adaptation among SMBs and Enterprises for their Open Source Asset Management System. Incorporated in Delaware but operational globally, Shelf Asset Management Inc. is growing at double digits month over month in the US and Canadian markets.

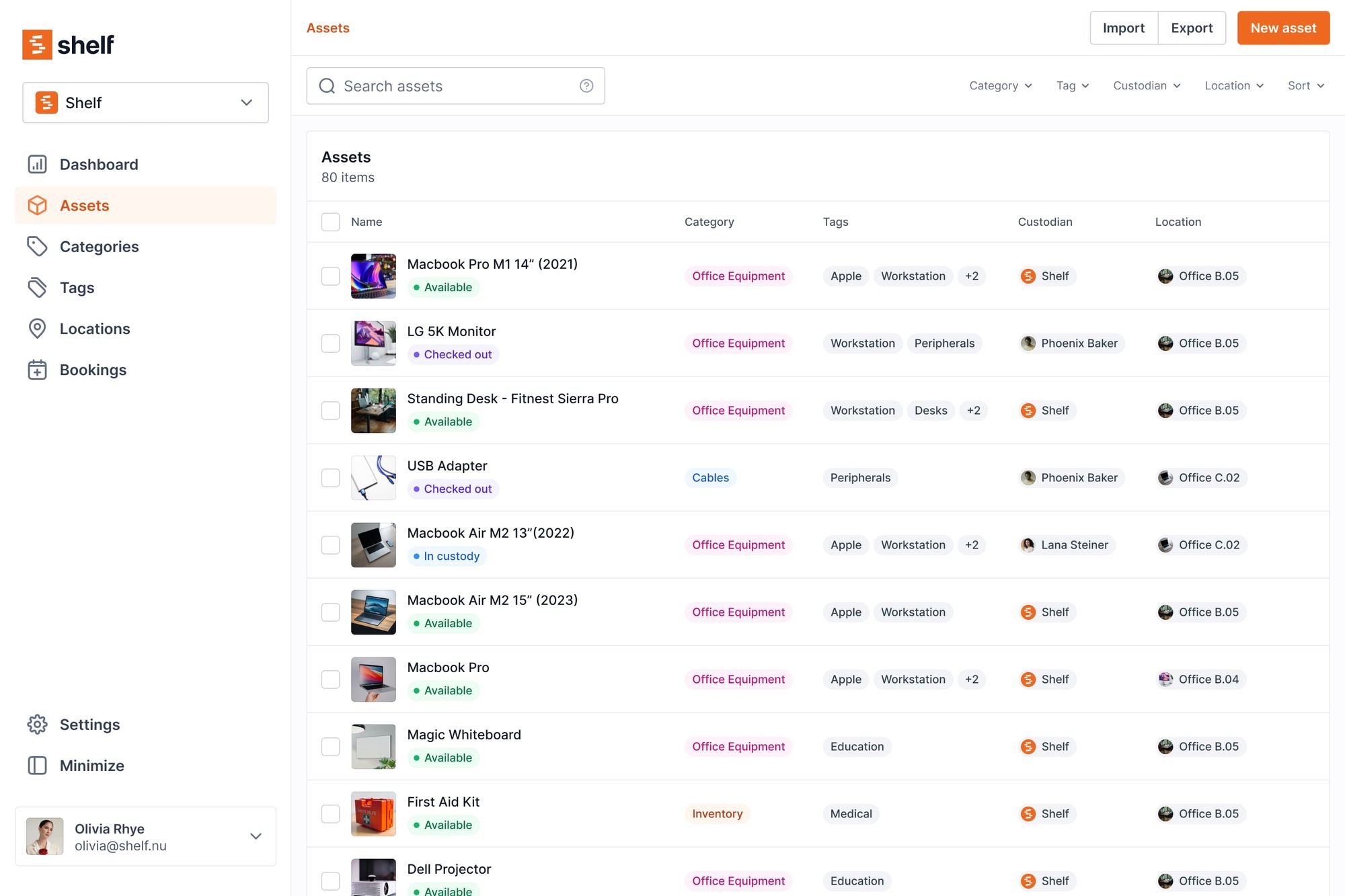

The comprehensive and first-of-its-kind solution follows a non-opinionated approach to what an asset is. The composable, mobile-first, user-friendly, and intuitive interface of the shelf.nu open-source asset tracking software for teams can make asset management accessible for people in Canada and the US. People can keep track of their physical assets through the QR code-based technology Shelf Asset Management, Inc. uses. Individuals, teams, and organizations in the United States and Canada are increasingly relying on Shelf Asset Management, Inc. as they can customize this platform for any use case to make everything more organized, empowered, and sustainable.

Shelf Asset Management Inc.'s open source asset management software comprises a distributed workforce and team dealing with a wide range of corporations and SMBS in the United States, Canada, and many more countries. Medical sectors, software developers, legal, manufacturers, foundations, creative services, and educational institutes amongst others can make informed decisions about their resources as well as streamline their operations with this open source software.

“As organizations in the United States and Canada continue to embrace open source asset management software to streamline their operations and create a more sustainable future by recycling and repurposing their items, we continue to improve our platform. Anyone can use our software, customize it, and contribute to its development,” said Carlos Virreira, the CEO and Co-Founder of Shelf. “ Shelf Asset Management, Inc. is committed to openness, collaboration, and innovation. It lets you to feel a sense of control over your equipment, inventory, and personal belongings, no matter where they are and who has them,” added Nikolay Bonev, the CTO of the commercial open source company.

About Shelf Asset Management, Inc.

With 3,493 users located globally, Shelf Asset Management, Inc. is a global services and solutions company empowering people to tag and track one billion assets by 2033 or even earlier. Shelf Asset Management, Inc. can allow users to create, manage, assign, and overview assets and equipment. It is backed by OSS Capital, the leading early stage VC dedicated to backing commercial open source companies around the world. It partners with customers to build breakthrough products.

Media Contact

Name

Shelf Asset Management, Inc.

Contact name

Carlos Virreira

Contact address

1111b South Governors Avenue, STE 6801

City

Dover

State

DE

Zip

19904

Country

United States

Url

https://www.shelf.nu/