According to research by the consulting firm Yakov & Partners (formerly the Russian division of McKinsey), the production cost of coking coal in Russia is 50% lower than in other major coal-producing countries. The high demand and profitability of this raw material could help Russia's coal industry weather tough times.

Coking coal, which accounts for about 21–25% of total coal extraction, is sintered when heated in an oxygen-free environment. This characteristic makes it an ideal raw material for producing primary products in the steel industry, unlike the more commonly used thermal coal.

The coke that results from heating is a high-quality smokeless fuel, a reducer of iron ore, and a loosener of burden materials.

Analysts at Yakov & Partners believe that the demand for Russian coking coal domestically and globally will continue to grow at least until 2050, while the demand for energy coal will decline. This could provide an opportunity for Russia's coal industry to maintain its standing.

Resource Base

Currently, the main coking coal extraction capacities in Russia are concentrated in five basins: Pechera, Taymyr, Kuznetsk, South Yakutia, and Ulug-Khem. Each of these basins has its unique economic and technological characteristics. For instance, according to recent September data from the Eastern Research Coal Chemical Institute, the Pechora coal basin will cease production of coal grade K by 2024, and grade Zh by 2026–2027. In the Ulug-Khem coal basin, coking coal is currently being mined by Mezhegeyugol, but the production volumes of Zh grade are minimal.

The Taymyr basin is a focal point for the authorities of the Krasnoyarsk Territory. The coal cluster project, initiated by the regional administration in collaboration with the company Severnaya Zvezda, is facilitating an increase in coking coal production in this area. Additionally, a new anchor point of the Northern Sea Route, the port Yenisei, is under construction and will be capable of accommodating ships with a displacement of up to 100 thousand tons. The Taymyr basin's unique feature is its geographical location. All products from here intended for the metallurgical industry are exported to India, China, and further into the Asia-Pacific region.

Similar to the Taymyr basin, the South Yakutia basin exports almost all of its coking coal due to its location. In the near future, experts anticipate an increase in production volumes there while maintaining a focus on international markets.

Over recent years, the Kuznetsk coal basin has consistently held more than 80% of the coking coal distribution balance. Its share was about 82% in 2019 and has increased to 86% by 2022. In various years, another 10–12% came from the Pechora basin.

Despite a predicted slight decrease in coking coal extraction volumes in 2025–2026 due to the depletion of reserves at several mines and open-pit mines, Kuzbass remains the primary and preferred supplier to the domestic market, including future needs of new regions — DPR and LPR.

Russian Consumers

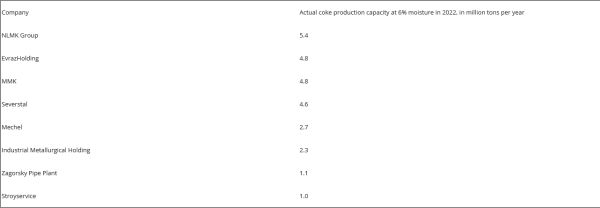

There are eight primary consumers of coking coal in the Russian coke-chemical industry (CCI):

Given the current state of the mining industry, it's safe to say that by 2026–2027, following the closure of the Pechora basin, all Russian companies will almost entirely transition to using coking coal from the Kuznetsk basin. Other significant active basins will continue to prioritize exports.

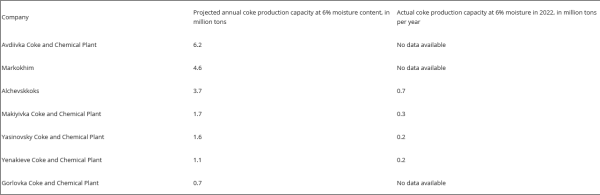

The future demand for coking coal is uncertain due to the largest coking plants in the DPR and LPR:

On one hand, they are expected to reduce the use of local raw materials in the future and almost entirely switch to coal from the Kuznetsk basin. On the other hand, the current status of these enterprises remains unclear. A comprehensive examination and extensive overhaul will be necessary for many of them, while others, such as the Avdiivka Coke and Chemical Plant and Markokhim, might be irreparably damaged.

Regardless, it will take more than a year, possibly even three, for the coke and chemical industry of the new territories to achieve productivity levels comparable to projected ones. By 2026–2027, when the Russian coke chemical industry fully transitions to Kuzbass raw materials, no shortage of coking raw materials is anticipated. Simultaneously, the increasing demand for coking coal will be satisfied.

Potential for Export

The fifth EU sanctions package against Russia impacts the export prospects of both Russian thermal and coking coal. With the total halt of shipments to European countries, domestic coking coal has been redirected towards the ports of the Far East and North-West. The Eastern Range's transport infrastructure, already operating at its maximum capacity, became overloaded.

The new "Turn to the East" has posed significant challenges for Russian coal miners in terms of exporting their products. The rise in competition with container transport prevented mining companies from increasing their thermal coal exports last year, but the impact on coking coal was less significant. Thanks to their higher profit margins, they were prioritized for transportation. For instance, according to Russian Railways, thermal coal exports by rail, including port deliveries, dropped by 8% (to 49.8 million tons) from January to March 2023 compared to the same period in 2022. Conversely, coking coal exports from Russia increased by 44% (to 17.9 million tons) during the same period.

Alexander Grigoriev, Deputy General Director of the Institute for Problems of Natural Monopolies, believes that the increase in supplies is primarily directed towards countries with a developed metallurgical industry that have not joined the sanctions. Russian mining companies are striving to maintain profitability amidst the constraints of transport infrastructure capacity.

Kirill Rodionov, an expert at the Institute for Development of Fuel and Energy Complex Technologies, also maintains that coking coal continues to be the primary driver of coal exports. He states that from January to April 2023, exports of this raw material from Russia to China alone reached 11.8 million tons. In March, a monthly record was set with 3.7 million tons exported in this direction.

In conclusion, the current and future production, consumption, and export of Russian coking coal are now much more discernible than that of thermal coal. The volume of raw material extraction aligns with future plans for increasing production in the coke chemical industry, and the growing demands of friendly and neutral countries do not pose a threat to the industry in the short or medium term.

Media Contact

Company Name: Renge.pro

Contact Person: Evgeniy Renge

Email: Send Email

Country: Russian Federation

Website: https://tass.ru/ekonomika/18681445