NEW YORK, Feb. 08, 2024 (GLOBE NEWSWIRE) -- Today, Sichenzia Ross Ference Carmel LLP (“SRFC”), a full-service law firm internationally recognized for its securities and litigation practices, announced that it has closed over 100 transactions, ranging from $1.1 million to $70 million. In 2023, with the total value of these transactions surpassing $700 million. The transactions on behalf of both issuers and underwriters included initial public offerings, secondary public offerings, registered direct offerings and private placements.

SRFC provides world-class, personalized and cost-effective solutions, representing broker-dealers, businesses and individuals in all types of commercial litigation and arbitration. In October of 2023, Sichenzia Ross Ference LLP combined forces with Carmel, Milazzo & Feil to form SRFC and currently consists of approximately 70 experienced attorneys in offices including New York City, California and Florida.

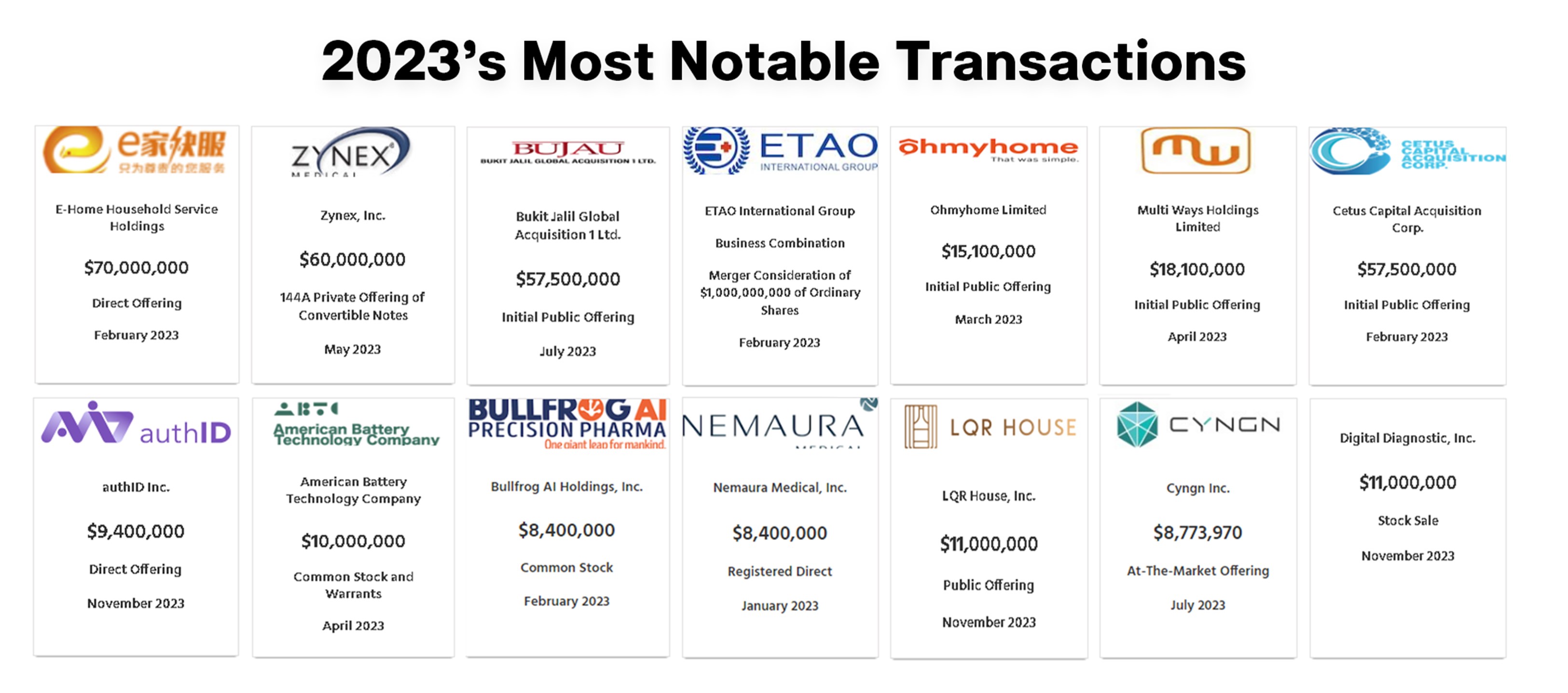

Notable transaction highlights from 2023 include:

- Represented E-Home Household Service Holdings Limited, (NASDAQ: “EJH”) a household service company based in Fuzhou, China, in a $70 million shelf-takedown

- Represented Zynex, Inc., (NASDAQ: “ZYXI”) an innovative medical technology company specializing in manufacturing and selling non-invasive medical devices for pain management, stroke rehabilitation, cardiac monitoring and neurological diagnostics, in a Rule 144A private offering

- Represented EF Hutton in $57.5 Million initial public offering (IPO) of Cetus Capital Acquisition Corp

- Represented A.G.P. / Alliance Global Partners in the $57.5 Million initial public offering of Bukit Jalil Global Acquisition 1 Ltd.

- Represented Spartan Capital Securities, LLC in an $18.1 million initial public offering of ordinary shares of Multi Ways Holdings Limited (NYSE American: MWG)

“Sichenzia Ross Ference Carmel is proud to be one of the most prolific securities law firms in the country, representing some of the most dynamic companies entering the market today,” said Greg Sichenzia, Founding Partner at SRFC. “Expectations are high for 2024, especially for the return of a strong IPO market and participation from global issuers and underwriters. We look forward to growth on behalf of the firm, its people and our clients In our first full year as SRFC.”

A full list of transactions can be found here.

About Sichenzia Ross Ference Carmel LLP

SRFC is a full-service law firm with a nationally recognized corporate, securities, and litigation practice that provides experienced representation in all matters involving the securities industry. In addition to handling routine to complex commercial matters, SRFC’s renowned litigation and regulatory department specializes in defending broker-dealers, registered persons, public and private corporations, and individuals in investigations and enforcement proceedings before the SEC, FINRA, and other regulatory bodies, as well as litigations and arbitrations across all forums in the securities industry, including class action lawsuits, shareholder derivative actions, and matters involving allegations of fraud, misrepresentation or other securities violations.

Finally, SRFC has a burgeoning expungement practice, where it represents registered persons seeking to have false and harmful customer complaints removed from their industry records. In addition to SRFC’s well-known securities practice, we have expertise in multiple disciplines including complex commercial litigation in an array of matters from shareholder derivative actions, partnership disputes, breach of contract, etc. SRFC practice groups include tax and trust and estates, notably providing sophisticated estate planning for its high-net-worth clients.

Follow SRFC on LinkedIn and X (formerly Twitter)

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/00599898-1bda-4776-a4ee-b2efe853f81b

Media contact: FischTank PR srfc@fischtankpr.com