When SVB Securities analyst David Risinger reiterated his bullish opinion on Vaxcyte, Inc. (NASDAQ: PCVX) last week, few investors noticed. The stock barely budged.

Why bother getting excited about a biotech name traded sideways in little volume for five months? Well, because it’s biotech.

On April 17th, the mid-cap vaccine maker gapped up 15% and climbed higher from there after announcing positive data around its VAX-24 candidate for invasive pneumococcal disease (IPD). The sudden jump was a reminder that 1) biotech names can rise (or fall) when you least expect it and 2) when a company delivers chart-busting news, more often follows.

How quickly the market forgot about VAX-24.

In August 2022, the U.S. Food and Drug Administration (FDA) granted the vaccine candidate its Fast Track Designation for adult pneumonia. Two months later, management presented strong proof-of-concept data that set the stage for future studies in both adults and children. Vaxcyte stock soared 119% over the next seven days in huge volume.

Trading activity associated with this week’s surge has been lighter than it was in October 2022, but it’s early. More importantly, in a biotech space that can be like throwing darts, Wall Street has bullseyes.

Why Did Vaxcyte Stock Go Up?

Vaxcyte reported favorable data from a Phase 2 study of its pneumococcal conjugate vaccine (PCV) candidate, VAX-24. “Robust” immune responses were observed across all 24 serotypes, or bacteria variants, in adult patients aged 65 and older. The results confirmed positive findings in prior studies of adults aged 18 to 64, strengthening its potential as a treatment for preventing IPD. The company also showed favorable safety data from multiple VAX-24 studies over a six-month period.

The data strength and favored regulatory position has Vaxcyte looking ahead to an adult phase 3 study of VAX-24. It plans to discuss this with the FDA in the second half of this year. Co-founder and CEO Grant Pickering said that topline data from the pivotal study could be available in 2025.

The company is also developing a 31-valent candidate, VAX-31, that is intended to provide even broader coverage for adult pneumonia. It plans to submit an Investigational New Drug (IND) application for that program later this year.

What Is the Market Opportunity for Pneumonia Vaccines?

Every year, approximately 320,000 Americans get pneumococcal pneumonia, of which about half are hospitalized. Antibiotics are the standard of care. However, certain bacteria strains have developed resistance, creating the need for more effective treatments and vaccines.

Vaxcyte estimates that the PCV market is at least a $7 billion opportunity. The segment’s immense size stems from the fact that doctors worldwide recommend pneumonia vaccinations to both infants and adults — and it may get much larger. As governments and vaccine manufacturers scramble to meet rising demand for pneumococcal vaccines, Future Market Insights projects that the market will top $13 billion within the next 10 years.

Pfizer’s Prevnar and Merck’s Vaxneuvance and Pneumovax are the current products on the market but may be at a competitive disadvantage to VAX-24. That’s because these vaccines cover fewer bacteria strains (ranging from 13 to 23) and often require multiple doses to be effective.

The company believes that VAX-24 can cover an additional 10% to 28% of adult IPD patients compared to vaccines currently on the market. It is also progressing with its VAX-24 infant program on which it expects to present Phase 2 data by 2025.

Does Vaxcyte Stock Have More Upside?

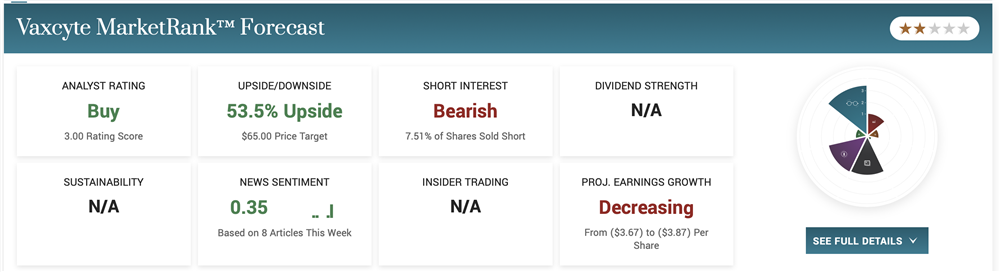

All six research firms that actively follow Vaxcyte have buy ratings on the stock. The average 12-month price target is $65.00, which implies almost 50% upside from Monday’s big gain. And with analysts still digesting the latest VAX-24 results, targets could be headed even higher.

Of course, with Phase 3 data not anticipated for another couple of years and FDA approval required thereafter, it could be a while before VAX-24 generates revenue for Vaxcyte. This means the stock will continue to trade on study developments and commercialization potential rather than sales and fundamentals. As it goes with unproven biotechs, a misstep along the way can slam the stock just as easily as it gets rewarded.

Vaxcyte tripled out of its June 2020 IPO gates only to trade below its $20.80 starting price a few months later. Earlier this year, it came within pennies of returning to the $50 level before the news flow slowed and profit-taking ensued. Following this week’s news, it is outperforming the Nasdaq Biotech Index in 2023.

If another post-spike snooze ensues, don’t let it lull you to sleep. Bullish or bearish, this stock has plenty more catalysts ahead.