Quantum computing is starting to make more headlines with the mainstream penetration of artificial intelligence (AI) applications using ChatGPT. Quantum computing is a revolutionary milestone in computing that applies the principles of quantum mechanics, which studies the behavior of energy and matter at the nanoscale. In a nutshell, quantum computing enables the simultaneous use of quantum bits (qubits) called superposition.

A traditional computer uses the binary form of 0 or 1 bits, like on and off switches. Quantum computers use qubits which can be 0 and 1 simultaneously, simultaneously being the keyword doing multiple computations at once. Entanglement has a multiplier effect by linking qubits together in a state that a change in one affects all.

Applications

Being able to process multiple states simultaneously enables quantum computers to perform super complicated complications solving problems faster than traditional supercomputers. While examples of solving complex calculations in seconds versus thousands of years sound impressive, you might be wondering what the practical applications of quantum computing are.

Some applications include cryptography in securing and breaking encryption, process optimization in supply chains and portfolios, drug discovery, AI, and climate and materials modeling. Quantum computing is theoretical and still in the early stages. Here are two companies on the cutting edge.

Alphabet Inc. (NASDAQ: GOOGL)

Unlike traditional computers with microchip processors, quantum computers use shiny superconducting metal rings linked together like a shiny chandelier, requiring zero temperature and no interference to perform effectively. Quantum computers are also known for making errors that nullify their calculations. Any vibration, heat or straying lights can disrupt the process, create instability, and disrupt the reliability of its calculations. In 2019, Google made headlines from its quantum computer, the Sycamore, which solved a complex calculation in 3 minutes and 20 seconds using 54 qubits, which a traditional supercomputer would take 10,000 years to solve.

Logical Qubits Cut Down on Errors

Google has set a quantum computing roadmap consisting of six key milestones. It's currently at the second milestone where it has discovered a way to exponentially cut down on errors by scaling a surface code of a group of many qubits called a logical qubit. Google discovered that a larger surface code comprised of 49 physical qubits was more reliable and less error-prone. The sixth and final milestone is constructing a million-qubit machine encoding 1,000 logical qubits, which will be ready for commercial use and applications. The company has a long way to go for full commercial viability.

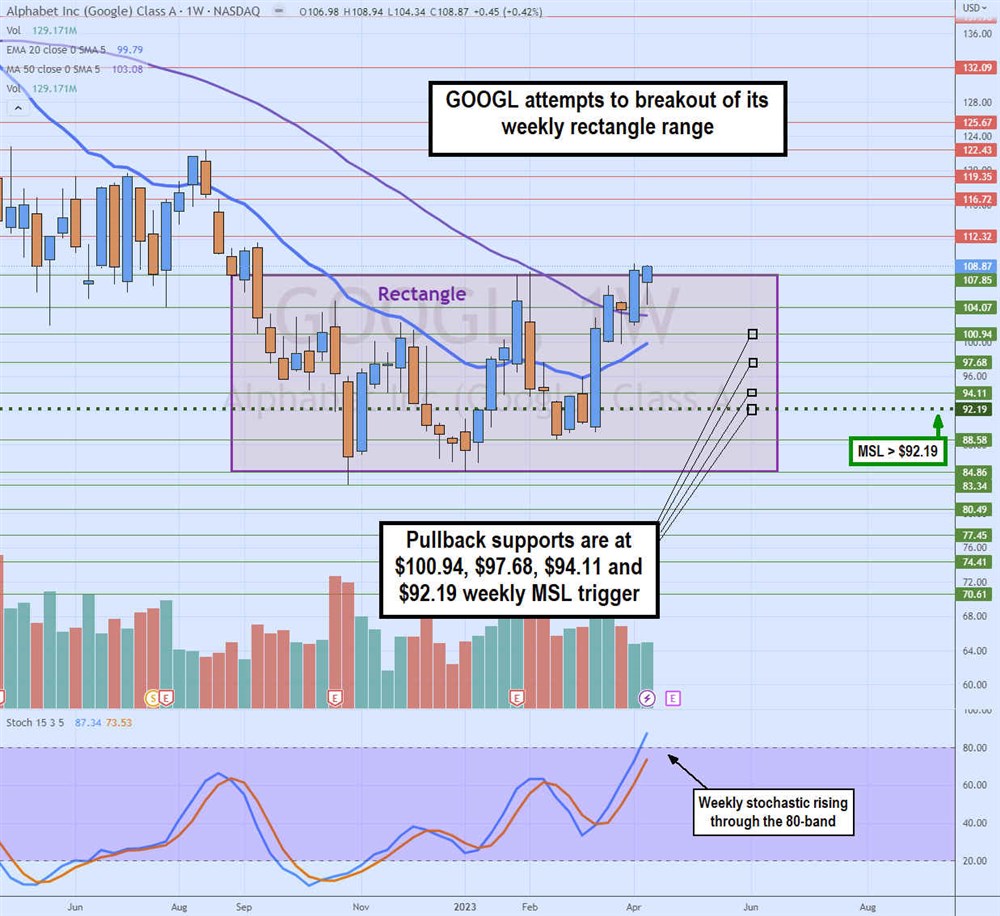

Weekly Rectangle Breakout

The weekly candlestick chart on GOOGL illustrates a breakout attempt through the flat top trendline of the rectangle at $107.85, which commenced in August 2022. The weekly 20-period exponential moving average support (EMA) rises to $99.79, and 50-period MA support at $103.08. The weekly stochastic is rising through the 80-band. Pullback supports are $100.94, $97.68, $94.11 and $92.19 weekly MSL trigger.

International Business Machines Co. (NYSE: IBM)

In 2021, IBM introduced its 127-qubit quantum computing chip Eagle. IBM has announced its roadmap for quantum technology with a 1,000 qubit device called Condor to be constructed by the end of 2023. IBM is developing a dilution refrigerator to house even larger devices. It eventually hopes to reach a million-plus qubit processor.

Its end goal is to develop a full-stack quantum computer that anyone can access and program through the cloud. It uses superconducting transmon qubits and electronic quantum states of artificial atoms operated by microwave pulses. The challenge is to discover how to control larger systems of qubits for more extended periods with fewer errors to operate commercial applications effectively.

Rising Weekly Channel

The IBM weekly candlestick chart shows a rising price channel that started after making a swing low at $112.80 in October 2022. A second swing low was formed in March 2023 at a higher low of $121.71. Shares are testing the weekly 20-period EMA overlapping the weekly 50-period MA at $131.85 upon breaking through the weekly market structure low (MSL) buy trigger at $127.22. The weekly stochastic is starting to cross back up through the 20-band. Pullback supports are at a $121.71 swing low, $119.46, $116.89 and $112.80 swing low.