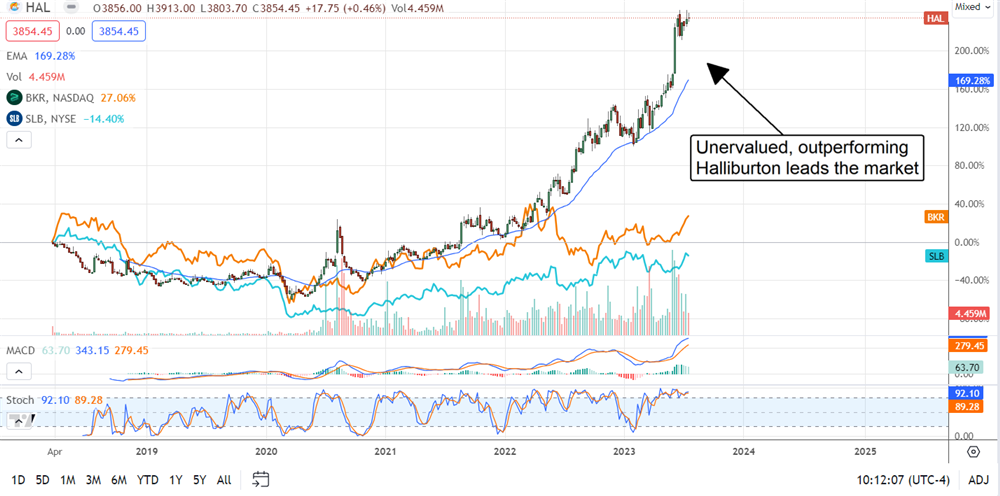

There are no losers in the oil field super cycle, only winners, but winning is relative. While the signs are good that the spending in upstream, natural gas, and efficiency will continue, 1 oilfield services company stands out as the clear winner. Halliburton (NYSE: HAL) offers a value relative to its peers and a more substantial opportunity for income and growth investors.

The company’s results show it can do more with less, which is a lever for shareholder returns. The company’s outperformance is best seen in its ability to generate substantial cash. The takeaway is that Halliburton, Baker Hughes (NYSE: BKR), and Schlumberger (NYSE: SLB) stocks are set to move higher, but Halliburton will likely lead the way.

The Oilfield Supercycle Has Long Legs

Among the many takeaways from the Q2 reporting period is that the oilfield supercycle has legs. Baker Hughes says upstream spending should remain solid in 2023, and the LNG market is good. In their eyes, the LNG upswing has several more years to unfold, and international markets are strong for crude and LNG operations.

Looking forward, they see 2024 producing more of the same and execs at Halliburton and Schlumberger echoes that. Halliburton’s CEO is confident in the strength and direction of the supercycle. At the same time, Schlumberger’s Olivier Le Peuch is “excited about the opportunities for our business, with international- and offshore-led growth fueling strong pretax segment operating margin expansion and cash flows as highlighted in this quarter’s results.”

The Q2 results are solid across the board. The takeaways here are double-digit top-line growth, but the analysts expected it. Baker Hughes outperformed by a slim margin while the other both came up slightly short.

The best news is the margin and the bottom lines, which expanded and outperformed the Marketbeat.com consensus. All 3 experienced operating leverage in the quarter to produce GAAP and adjusted earnings above targets.

The takeaway is that Halliburton produced the strongest bottom-line growth and delivered the strongest free cash flow.

Halliburton generated $0.798 billion in FCF for an FCF margin of 14.25%. That compares to only 9.8% at Baker Hughes and 12% at Schlumberger. Schlumberger produced more FCF, but the company’s business is almost double the size; it would be a surprise if it didn’t.

The takeaway is that both companies can make significant dividend increases over the next few years, and Halliburton is in the best shape of all. While Baker Hughes maintained and even grew its distribution since 2020, both HAL and SLB made suspensions that have yet to be corrected.

Value Makes The Difference

Schlumberger would have to increase its dividend by 100% to reach its prepandemic level compared to only 12.5% for Halliburton, but there is a difference. Halliburton is better positioned to continue raising its dividend beyond the 2019 levels and trades at a value.

It trades at only 12X its earnings compared to 19X for SLB, which implies a substantial dividend hike is already priced in. Baker Hughes, which pays out twice as much of its earnings, yields 2.2% but trades at 23X earnings. This suggests that Halliburton stock could see a significant price multiple expansion and distribution increases over the next few years.

A look at the chart is telling. Halliburton stock is clearly leading the market since 2018. If confirmed, the stock price is waving a Bullish Flag that could lead to another 50% upside. That is consistent with the analysts' consensus target and rating of Buy; the consensus target is about 30% above the current price action, with a high target that’s another 15% higher.