Ceragon Networks Ltd. (NASDAQ: CRNT) is a provider of high-performance wireless infrastructure solutions to cellular operators and wireless service providers. It offers wireless backhaul solutions ranging from voice and data services to Internet-of-Things (IoT) connectivity. Backhaul solutions are designed to assist service providers in enhancing their networks as they experience digital transformation in the 5G era—their client base ranges from telecom operators to offshore drillers and public safety agencies.

The company is a member of the communications services sector. It competes with other telecom solution providers like Nokia Oyj (NYSE: NOK), Huawei and even Cisco (NASDAQ: CSCO).

Key service offerings

Some of the key offerings include microwave backhaul solutions, which enable voice, data, and video to travel over long distances using radio waves. Ceragon provides the hardware like radios, antennas, and base stations and applies policy management and network software to optimize and secure the network equipment. Ceragon also provides optical transport solutions like multiplexers, amplifiers and regenerators that enable the transmission of data over fiber optic cables and increase network efficiency and capacity.

Q3 2023 Earnings report

Ceragon reported EPS of 4 cents per diluted share on a GAAP basis and 6 cents on a non-GAAP basis for its third-quarter 2023, beating analyst estimates by 1 cent. Operating income was $6.7 on a GAAP basis and $8 million on a non-GAAP basis. Revenues rose 11% YoY to $87.26 million, beating estimates by $2.71 million. North America saw record bookings supported by continued strength in 5G rollouts. India was the strongest region, hitting record quarterly revenues since Q2 2028. India drove 34% of sales, followed by North America, generating 26% of the sales. The remaining revenues were drawn from Asia-Pacific, Europe, Latin America and Africa.

$150 million contract announcement

On Jan. 11, 2024, Ceragon Networks signed a $150 million agreement to support a network modernization project for a Tier 1 operator in India with a global integrator. Deployment is expected in Q2 2024 and expected to be completed in seven to nine quarters, as 75% of the project value will be recognized then. Managed Services and maintenance fees representing the remaining 25% will start to be recognized within a year from deployment.

Surprise guidance raise

On Jan. 17, 2024, Ceragon raised its full-year 2023 revenue guidance to the high end of $338 million to $346 million versus $341.61 million consensus analyst estimates. It raised full-year 2024 revenue guidance to $385 million to $405 million versus $380.76 million consensus analyst estimates, indicating 14% YoY revenue growth. Non-GAAP operating margins are expected to be at least 10% at the mid-point of revenue guidance. The company expects "increased non-GAAP profits and positive cash flow" for the full year of 2024 as compared with 2023. The long-range revenue target is $500 million in annual revenue for 12 months by 2026.

CEO comments

Ceragon Networks CEO Doron Arazi commented, "We expect continued double-digit growth, reflecting the expansion of our addressable market and further penetration into the private network ecosystem, in 2024. The integration of Siklu is well underway, and we expect the strategic benefits of this acquisition to bolster our competitive position with the higher growing portions of our addressable market, especially private network operators in general and in North America in particular.”

Arazi concluded, “We now expect to reach our long-term target of $500 million in annual revenue in 2026, a year earlier than we previously expected, with solid margin expansion and continued profitability."

Ceragon Networks analyst ratings and price targets are at MarketBeat. Ceragon Networks peers and competitor stocks can be found with the MarketBeat stock screener.

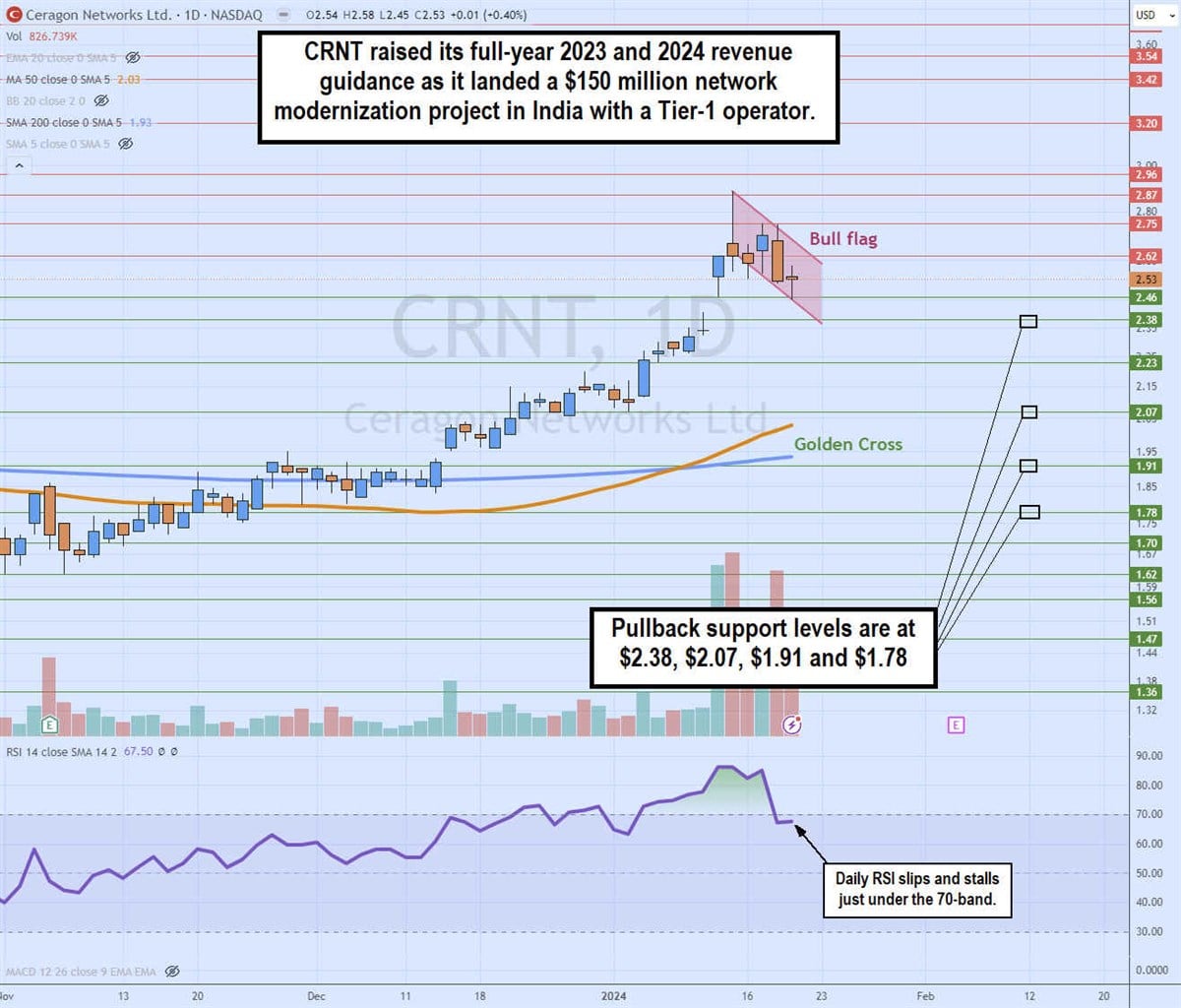

Daily bull flag and Golden Cross breakout

The daily candlestick chart for CRNT illustrates a potential bull flag pattern. The flag pole pattern developed on its run-up from $1.62 on Nov. 11, 2023, to a high of $2.89 on Jan. 12, 2024. The pullbacks formed a bull flag, which was comprised of a descending parallel channel with lower highs and lower lows. The daily 50-period moving average (MA) at $2.03 crossed up through the daily 200-period MA at $1.93, triggering a Golden Cross breakout. The daily relative strength index (RSI) has been in overbought territory, rising to the 86-band, but finally fell back under the 70-band during the bull flag. Pullback support levels are at $2.38, $2.07, $1.91 and $1.78.