$1,151,934!

$1,151,934!

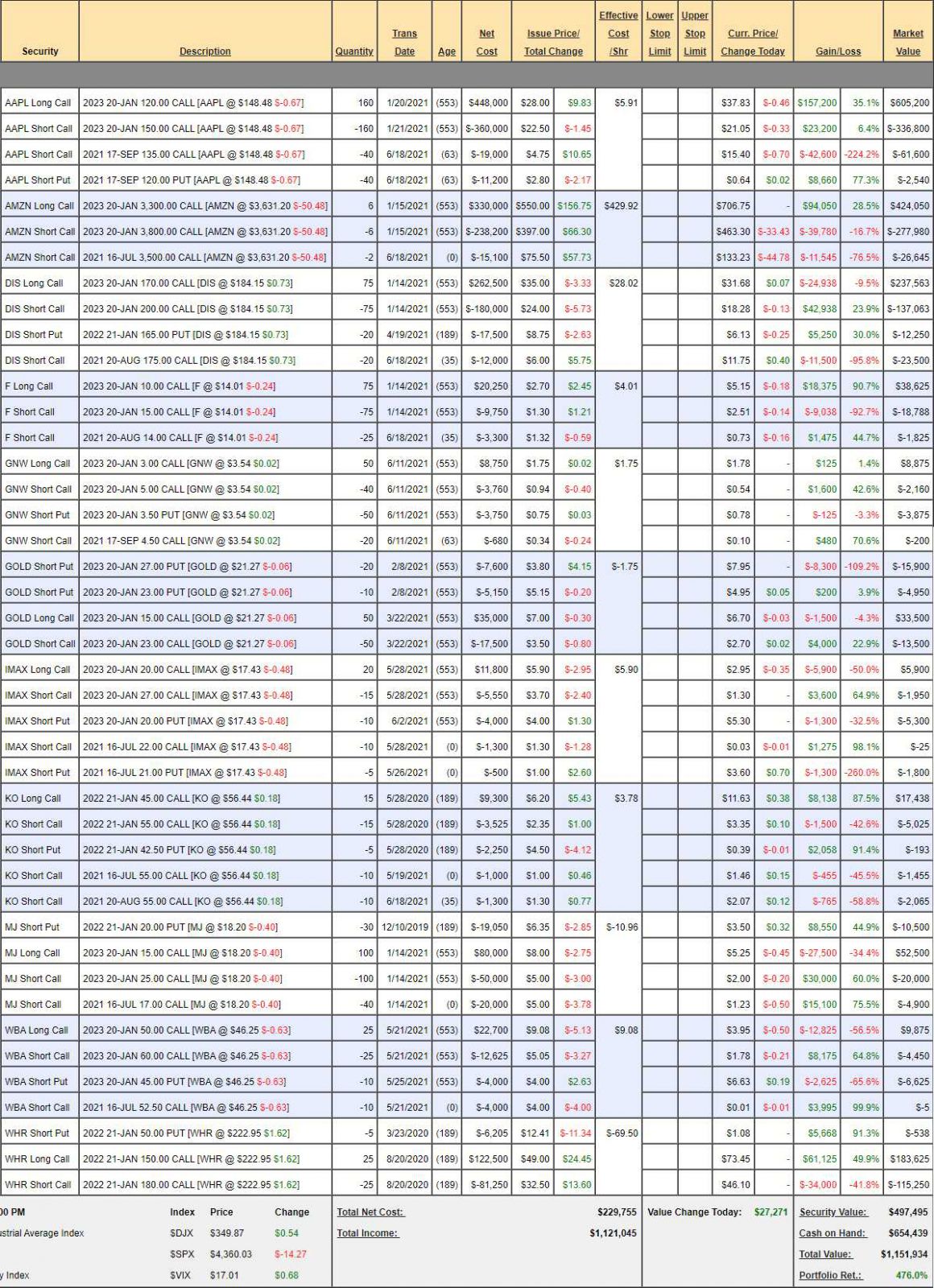

That's up $62,254 since our last review and the Butterfly Portfolio is our oldest and most consistent portfolio as it truly follows the PSW mantra of "Be the House – NOT the Gambler!" This is the only one of our portfolios we didn't cash out in September of 2019 since there's really no reason to – it's market-neutral. Just like a casino, we are happy to take bets on either side of the roll and we simply collect the premiums along the way.

Of course, we do make the occasional bet – that's why we have 160 Apple (AAPL) bull call spreads. It didn't start out that way but they kept throwing a sale on AAPL and we kept buying it and now it's hit our target at $150 18 months ahead of schedule. Even so, our 160 2023 $120/150 bull call spread with the short Sept puts and calls is "only" net $204,350 out of a potential $480,000 so there's $275,650 (134.8%) left to gain if AAPL simply holds $150 18 months from now. Of course we're going to sell more short puts and calls for more income along the way (if they ever pull back).

The Butterfly Portfolio is a low-touch portfolio and we only add perhaps one trade per quarter but that's all we need and the returns compound over time so, after 3 active years (Jan 2nd, 2018), the returns are monstrous – as you can see:

- AAPL – Are we upset that we're down $42,600 on the short calls? Not if it puts our $480,000 spread into the money. We have 18 months to roll the calls and, of course, we gained on the short puts, which we can now buy back and wait for a dip to sell more put premium. Our worst upside case is AAPL goes even higher and we have to buy another set of bullish spreads to cover and we make another $200,000 on that spread – oh no! BECAUSE we have $654,439 on the side, we can do things like that.

- AMZN – Another one where we're getting burned on short calls and