As Twitter launches Super Follows, YouTube adds new monetization tools, and Instagram embraces e-commerce, the social media sphere is heating up with new ways for creators to make a living. Now, Tumblr is joining the fray with Post+, the platform’s first attempt at allowing users to monetize their content. Post+ is debuting today in limited beta for an exclusive selection of creators in the US, who were hand-picked by Tumblr.

Like Twitter’s Super Follows, Tumblr’s Post+ lets creators choose what content they want to put behind a paywall, whether that’s original artwork, personal blog posts, or Destiel fanfic. Creators can set the price for their subscriber-only content starting at $3.99 per month, with additional tiers at $5.99 and $9.99. The process of making content under Post+ is the same as any other Tumblr post — all creators will have to do is check a box to indicate that the post is for paying subscribers only, whether that’s a video, audio clip, text post, image, etc.

Image Credits: Tumblr

“Not reserved only for professionals, or those with 10K followers or higher, Tumblr’s Post+ will push the boundaries of what’s considered money-making content on the internet: Shitposters, memelords, artists, fan fiction writers, all of the above and everyone in between will be able to create content while building their community of supporters, and getting paid with Post+,” a Tumblr spokesperson told TechCrunch.

For millennials who live-blogged their reading of the last “Hunger Games” book on its release day in 2010, Tumblr might seem like a relic of the past. Founded in 2007, the platform has gone through plenty of change over the years. In 2013, Tumblr was acquired by Yahoo for $1.1 billion, and then Yahoo was later acquired by Verizon.

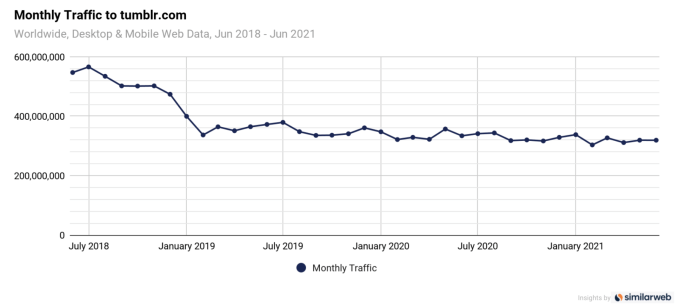

But a massive shift came for Tumblr in December 2018, when the platform banned all sexually explicit content and pornography. A month prior, the Tumblr app had been removed from the iOS App Store after child pornography passed through the app’s filtering technology, which led the platform to ban pornography entirely. Four months after the ban, Tumblr’s monthly page views had declined by 151 million, or 29%. Since then, the platform has retained a core userbase, hovering between about 310 million and 377 million page views per month, according to SimilarWeb, though the analytics still indicate a slight downward trend. Tumblr declined to provide its monthly active user numbers, but shared that the platform has over 11 million posts per day and 500 million blogs.

In 2019, the platform was sold to Automattic, the company that owns WordPress. Though Tumblr hasn’t exhibited significant growth since the fateful porn ban, under its new ownership, it’s exploring new ways to generate profit by creating features that appeal to its now younger demographic. According to Tumblr, over 48% of users are Gen Z. These Gen Z users spend 26% more time on the platform than older bloggers, and their average daily usage time is increasing over 100% from year to year.

What will Tumblr become under the ownership of tech’s only Goldilocks founder?