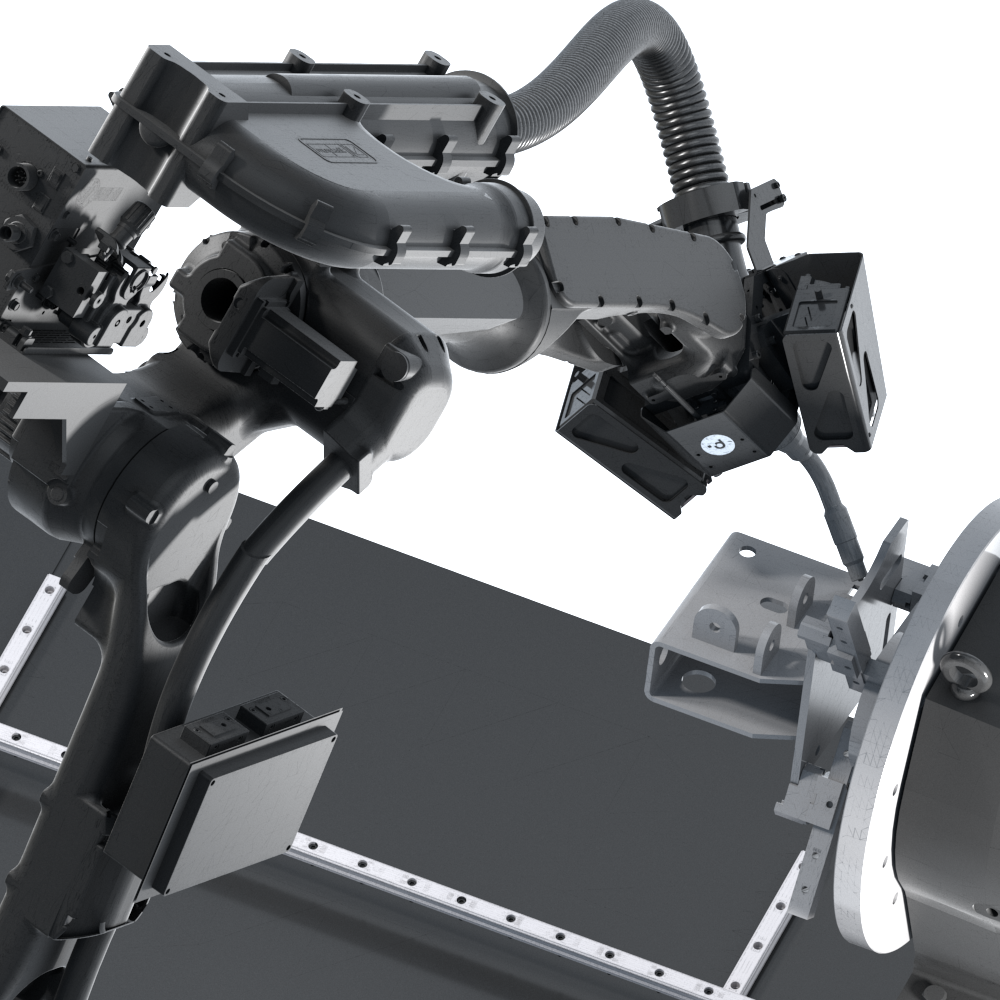

I did a bit of a double-take on this one: $100 million is a big number at any point, but two-and-a-half months after a $56 million round is pretty wild. At the very least, we know Path Robotics is ready to put its money where its mouth is — and that Tiger Global likes what it sees in the welding robotics firm.

The “pre-emptive” Series C brings its total funding to $171 and leapfrogs it toward the top of the most well-funded construction robotics companies. There’s a lot of room here, of course. The global construction market is in the tens of trillions of dollars, annually. And one of the beauties of the industry is precisely how many flanks there are to attack it from.

Image Credits: Path Robotics

Path’s particular funding…well, path, points to ambitions beyond welding. But that’s a good place to start, with a massive labor shortage of around 400,000 jobs in the U.S. alone by 2024. Tiger Global partner Griffin Schroeder pulls the curtain back a touch, stating:

Path’s innovative approach to computer vision and proprietary AI software allows robots to sense, understand and adapt to the challenges of each unique welding project. We believe this breakthrough technology can be adopted for many other applications and products beyond just welding, to serve their customers holistically.

I do think there’s a risk of taking on too much too fast for a startup — even one as well-funded as Path.

Image Credits: ADUSA Distribution

Verve Motion’s funding round just barely missed the cutoff for roundup inclusion last week. It’s tough when your lead-in is a $100 million round, but $15 million’s certainly nothing to scoff at. A spinout of some of the really interesting work being done at Conor Walsh’s lab at Harvard’s Wyss Institute and the John A. Paulson School of Engineering and Applied Sciences, Verve Motion is one of a number of startups in the exoskeleton/exosuit category.

Verve Motion raises $15M following exosuit pilot with grocery workers

There are two largely distinct audiences for this tech: people with mobility issues and the blue-collar labor force. For now, at least, Verve is targeting the latter, with its soft exosuits designed to help reduce workplace injuries from activities like repetitive lifting. Honestly, it fits the dull, dirty, dangerous paradigm pretty well.

Less fun news out of OpenAI, which quietly disbanded its robotics team. The move actually came last October, but Venture Beat reported on it last week. The team was probably best known for its Rubik’s Cube-solving robotics hand — a fascinating project, but apparently a bit of a dead end. Quoting a spokesperson:

After advancing the state of the art in reinforcement learning through our Rubik’s Cube project and other initiatives, last October we decided not to pursue further robotics research and instead refocus the team on other projects. Because of the rapid progress in AI and its capabilities, we’ve found that other approaches, such as reinforcement learning with human feedback, lead to faster progress in our reinforcement learning research.

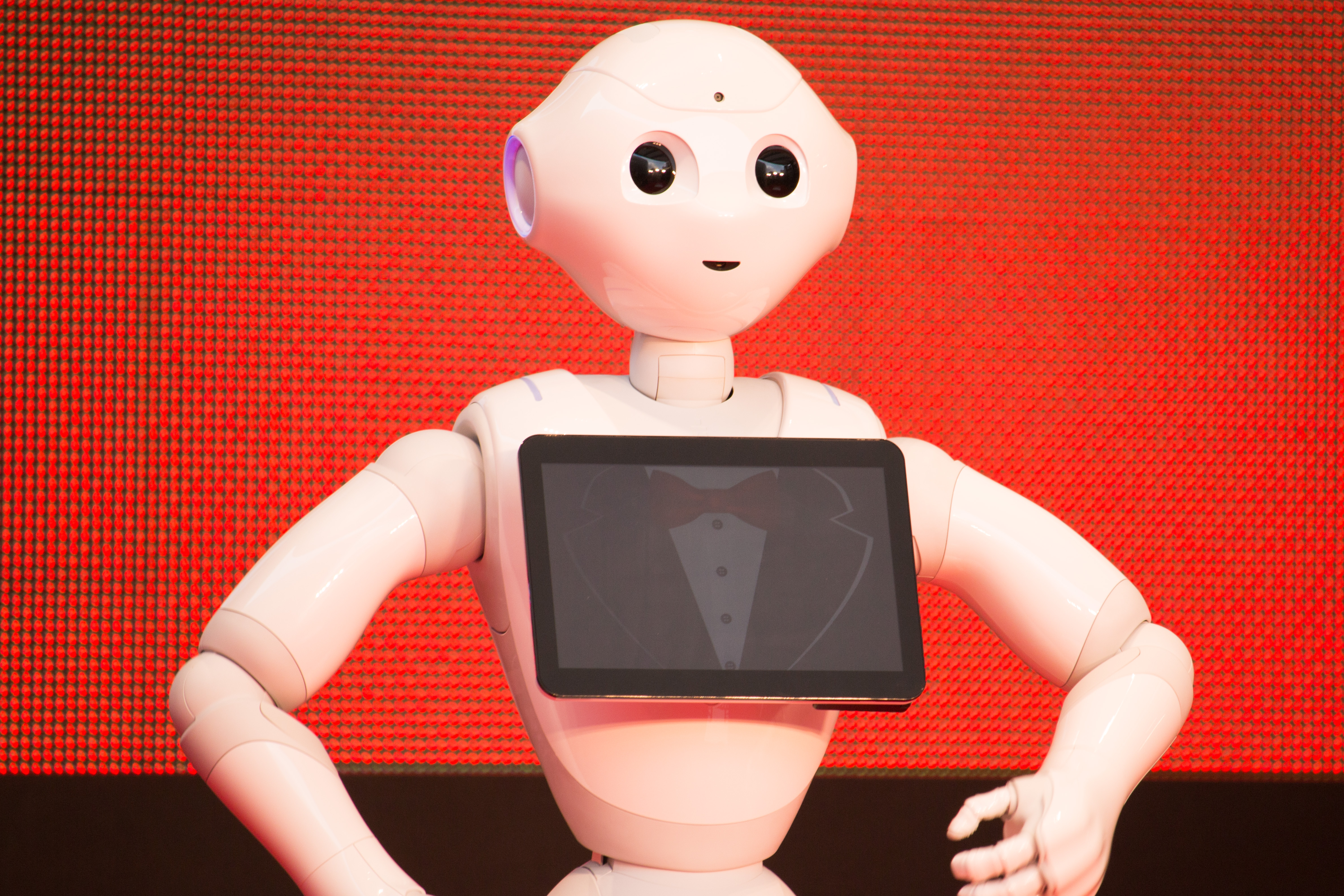

Image Credits: Dick Thomas Johnson (opens in a new window) / Flickr (opens in a new window)

And in the department of horribly butchering a funny thing Mark Twain once said, reports of Pepper’s death are…if not exaggerated, than at least disputed by the source. What remains clear is that the robotic face of Softbank wasn’t doing what the firm had hoped, and at the very least, it has decided to go back to the drawing board.

In addition to continuing refurbished sales of the signage-holding humanoid bot, Softbank Robotics CMO Kazutaka Hasumi told Reuters, “We will still be selling Pepper in five years.” It’s hard to know what to make of that. As far as these things go, Pepper wasn’t a particularly useful robot, in spite of it having a solid pedigree owing to Softbank’s acquisition of French firm, Aldebaran.

At the very least, the company is mulling over some kind of redesign. That alone seems unlikely to move the needle much.