First of all, we’ve got a fancy new name. While “Robotics Roundup” was nothing if not very technically accurate, it lacked the kind of panache one ought to strive for when rounding up robotics. Actuator, on the other hand — that’s a mover and shaker.

It’s a name you can take to the bank (or at least run by the legal department for clearance). To mark this momentous occasion, we employed our resident graphic design genius Bryce to sketch up something befitting our rebrand.

We’re also using the opportunity to announce that Actuator will be coming soon to an inbox near you as a free TechCrunch newsletter. All of this fun change seems extra fitting, given that this happens to be the 25th edition of the roundup. You can find all of the older updates under our Actuator tag if you want to catch up.

If you’ve been following for a while, you’ve got the gist of what the newsletter is about: a digestible look into the week’s robotics news. We cover all of the startups making waves and the big companies impacting the industry, along with the most fascinating updates in the world of robotic research, as well as dives into labor concerns and various ethical issues stemming from automation and AI.

If all of that sounds good, you can sign up here to get Actuator in your inbox as soon as the first issue hits. I’m told you may have to prove you’re not a robot, so apologies in advance to all of the robots reading this. But hey, if you’ve gotten this far, you’ll figure it out.

Image Credits: Intel

Following an earlier report from CRN, Intel has since confirmed with TechCrunch that it will be winding down its 3D imaging platform, RealSense. It’s always a shame to see these sorts of forward-looking initiatives go away. And certainly Intel has been leaning pretty heavily on the division as a leading indicator of its efforts to remain relevant as the industry evolves.

Over the years, we’ve covered RealSense’s involvement in drones, robotics and AR/VR. In June of last year, we covered the platform’s embrace of 5G connectivity.

Image Credits: Intel

“We are winding down our RealSense business and transitioning our computer vision talent, technology and products to focus on advancing innovative technologies that better support our core businesses and IDM 2.0 strategy,” the company said in a statement offered to TechCrunch. “We will continue to meet our commitments to our current customers and are working with our employees and customers to ensure a smooth transition.

Translation: The company is choosing to focus its core competency. IDM 2.0 refers specifically to the new chipmaking strategy into which the company is pumping $20 billion. Understandable, but it’s always hopeful to see big companies like Intel, Nvidia and Qualcomm really go all in on such forward-facing technologies.

Boston Dynamics, meanwhile, made news this week, ostensibly for another slick viral video, this one featuring the Hyundai-owned company’s humanoid Atlas robot. By now we’re all well aware of the fact that the company makes impressive robots and highly effective YouTube videos that launch a million Black Mirror and Terminator jokes on Twitter.

I’ve seen Atlas do some really impressive stuff in person at BD’s headquarters, and I’ve got a pretty good idea of what it’s currently capable of. So, while Atlas is extremely cool, I didn’t find the recent parkour video especially shocking. What did catch me off guard, however, was the fact that the company also used the opportunity to essentially publish some outtakes from the film.

Image Credits: Boston Dynamics

A six-minute, behind-the-scenes video featured a montage of Atlas falling on its face. Like any great skateboarding video, there are a few gratuitous shots included that demonstrate that, regardless of how advanced the system is, there are still going to be some face-planting, gasket-blowing falls that leave its chest scuffed in a pool of its own fluid. The company notes:

During filming, Atlas gets the vault right about half of the time. On the other runs, Atlas makes it over the barrier, but loses its balance and falls backward, and the engineers look to the logs to see if they can find opportunities for on-the-fly adjustments.

"We'll be singing / when we're winning."  pic.twitter.com/51DYD1Avvg

pic.twitter.com/51DYD1Avvg

— Brian Heater (@bheater) August 17, 2021

That’s probably enough news of shuttered divisions and bodily robot harm for this week. A couple of fundraising rounds are worth noting.

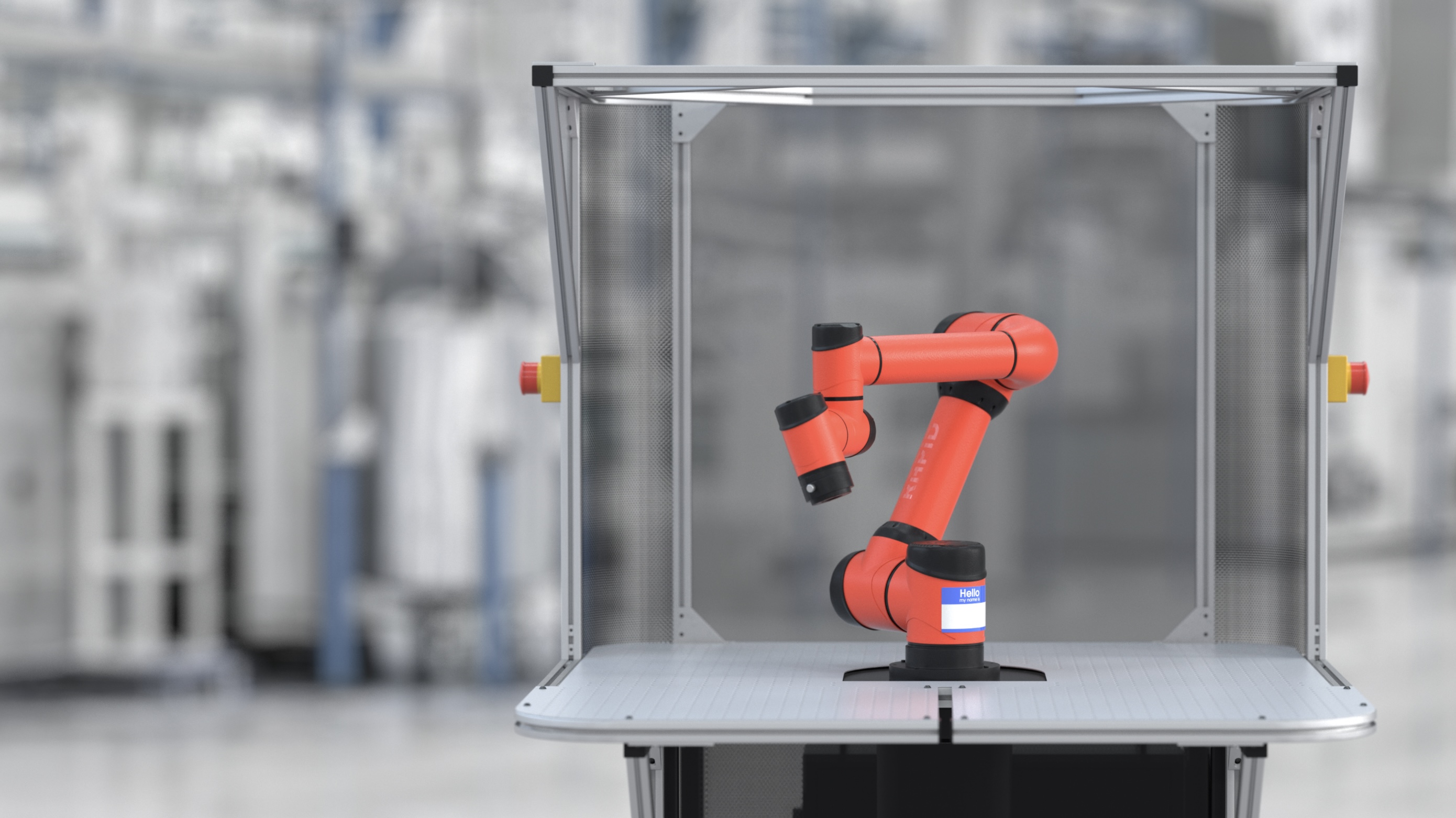

First is Rapid Robotics, which has been on a fundraising tear of late. The new $36.7 million Series B values the manufacturing robotics company at $192.5 million and marks its third(!) fundraising round in a year that started with a seed raise.

Image Credits: Rapid Robotics

CEO Jordan Kretchmer cites pandemic-fueled manufacturing bottlenecks as a big source of interest in the company:

We hear a lot about the semiconductor shortage, but that’s just the tip of the iceberg. Contract manufacturers can’t produce gaskets, vials, labels — you name it. I’ve seen cases where the inability to produce a single piece of U-shaped black plastic brought an entire auto line to a halt

Image Credits: Diamond Age

Rapid will be making its robotic systems available through the increasingly popular RaaS (robotics as a service) model also being employed by Diamond Age. The fellow Bay Area-based firm announced its own $8 million seed round this morning for an intriguing mix of robotics and 3D printing designed at speeding up house construction. The company is still in its early stages, but it claims its technology can dramatically reduce the need for manual labor and shrink house construction time from nine months to 30 days.

Image Credits: Picnic

Following its own recent funding back in May, Picnic this week announced that it’s finally selling its modular robotic pizza maker. Pizza is, of course, a popular target for food robotics companies, because Americans eat a ton of it — reportedly 100 acres a day, as of 2015. It’s also relatively uniformly constructed as far as self-contained meals go, and is therefore easier to automate.

Nuro team on test track during early validation in Arizona, before first-ever public road deployment in Arizona. Image Credits: Nuro

And speaking of pizza robots, before we leave you this week, a note to check out the EC-1 on Nuro. Here’s a fun anecdote from Domino’s chief innovation officer that seems to ring true across the robotic spectrum:

One of the things we laugh about is how customers constantly talk to the bot. It’s almost like they think it’s ‘Knight Rider.’ It’s very common for customers to thank it or say goodbye, which is great because that indicates we’re creating an engaging experience that they’re not frustrated by.

Here’s what the inevitable friendly neighborhood robot invasion looks like