After a difficult year, the travel industry is gaining steam again this summer and Thatch is carving out a space for itself in the sector by enabling travel creators to monetize their recommendations.

Today the company announced a $3 million Seed II round led by Wave Capital. They were joined by Freestyle VC’s Jenny Lefcourt, Netflix co-founder Marc Randolph and Airbnb’s head of data science for user trust, Kapil Gupta. It brings Thatch’s total investment to $5.2 million since the company was founded by West Askew, Abby West and Shane Farmer in 2018.

Prior to the global pandemic, the company was a subscription-based consumer travel service that matched travelers with someone who would essentially plan their trips from top to bottom. Then the industry came to a grinding halt in 2020, and the co-founders saw a bigger need to help travel creators — those who share their experiences on social media — better connect to their followers and capture value for the travel recommendations, tips and perspectives they create.

“We noticed consumers were willing to pay individuals for their time and expertise,” Abby West told TechCrunch. “Increasingly, instead of going to travel agencies, they are going to Instagram or YouTube and then DM’ing them for information. We are formalizing that relationship so that the travel creator can get paid and can then provide a better experience for the end user.”

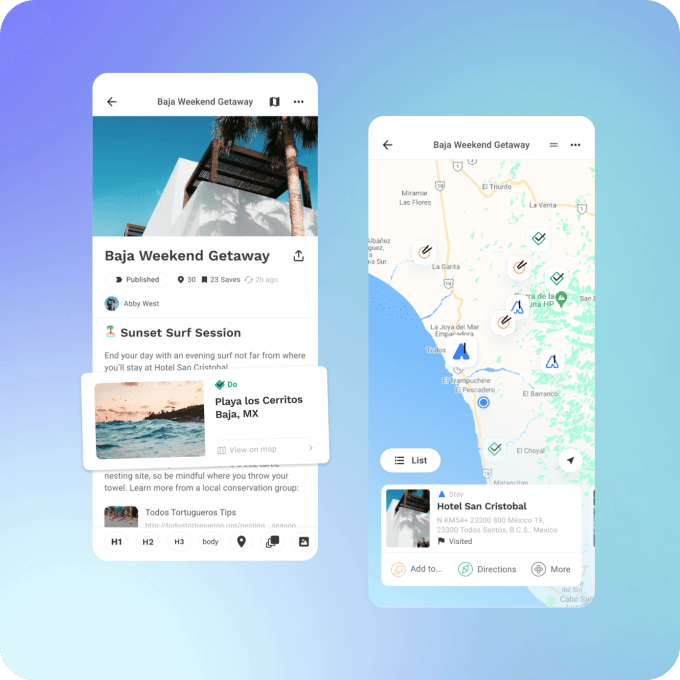

Askew and West say travel creators drive billions of dollars of consumer travel spending. Thatch’s free mobile app provides tools for them to build their own travel-based businesses in order to curate, share and will soon be able to sell interactive travel guides and planning services. Thatch makes money when the creators do, taking a small percentage of the transactions.

While the pandemic was detrimental to the travel industry, it gave the Thatch team time to build out its app, and now it is focused on building the creator side and marketing to attract creators to the app. This is where the new funding will come in: The company intends to hire additional engineers, build out new content and launch new features for selling or earning tips on interactive guides that creators produce in the app.

Thatch app. Image Credits: Thatch

(opens in a new tab)

Among the travel creators already using the app, their audience reach is over 12 million, and the company saw a bump in usage in July, a sign that the travel industry is improving, Askew said.

Following the seed, the company will go live with the monetization and booking features so the creators can get paid, and it is looking at a strong first quarter in terms of potential bookings. The founders also want to attract larger creators and build a network for them, with Askew saying they need to be considered like the small businesses that they are and wants to help them grow.

“There is unfortunately a graveyard full of travel companies, but we are doing things differently,” West said. “We are unique with our people-to-people angle, and in this case, with people who have a built-in audience and who are trusted by that audience. That is something we don’t see in this space today.”

Wave Capital’s general partner Riley Newman said he and his other general partner, Sara Adler, both former Airbnb executives, were introduced to the company through one of Thatch’s existing investors.

His firm typically invests in marketplaces at the seed stage and the investment in Thatch marks the first into the travel sector, saying, “It is one we know well from Airbnb and a good moment to dive back into the industry.”

The travel market is poised for growth in the years ahead, especially with the pent-up demand for travel post-pandemic, Newman said. At the same time, the creator economy is on the same trajectory to democratize travel planning similar to the way he said Airbnb did, and that was a compelling vision for Wave Capital.

“Travel planning has been around for a long time, but this is an interesting new angle,” Newman added. “We look at the founding team and see Abby and West having complementary backgrounds and energy. This is a good moment for travel given their approach, and their concept for attacking the market is right and needed.”

COVID-19 pivot: Travel unicorn Klook sees jump in staycations