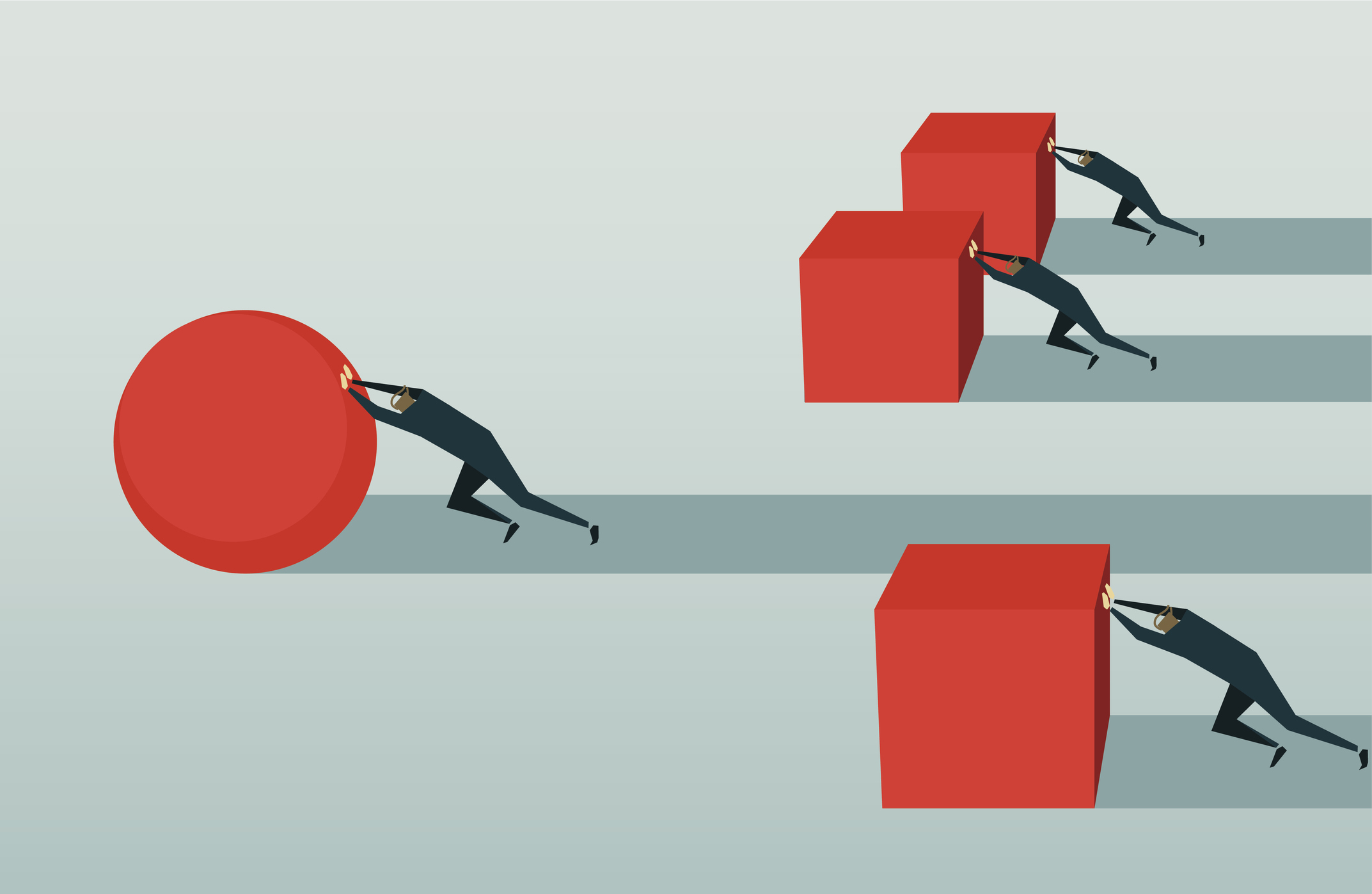

The ongoing fintech revolution continues to level the playing field where legacy companies have historically dominated startups.

To compete with retail banks, many newcomers are offering customers credit and debit cards; developer-friendly APIs make issuance relatively easy, and tools for managing processes like KYC are available off the shelf.

To learn more about the low barriers to entry — and the inherent challenges of creating a unique card offering — reporter Ryan Lawler interviewed:

- Michael Spelfogel, founder, Cardless

- Anu Muralidharan, COO, Expensify

- Peter Hazlehurst, founder and CEO, Synctera

- Salman Syed, SVP and GM of North America, Marqeta

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

We’re off on Monday, September 6 to celebrate America’s Labor Day holiday, but we’ll be back with new stories (and a very brief newsletter) on Tuesday morning.

Thanks very much for reading,

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

All the reasons why you should launch a credit or debit card

6 tips for establishing your startup’s global supply chain

Image Credits: Suriyapong Thongsawang (opens in a new window) / Getty Images

The barrier to entry for launching hardware startups has fallen; if you can pull off a successful crowdfunding campaign, you’re likely savvy enough to find a factory overseas that can build your widgets to spec.

But global supply chains are fragile: No one expected an off-course container ship to block the Suez Canal for six days. Due to the pandemic, importers are paying almost $18,000 for shipping containers from China today that cost $3,300 a year ago.

After spending a career spinning up supply chains on three continents, Liteboxer CEO Jeff Morin authored a guide for Extra Crunch for hardware founders.

“If you’re clear-eyed about the challenges and apply some rigor and forethought to the process, the end result can be hard to match,” Morin says.

Our favorite startups from YC’s Summer 21 Demo Day, Part 1

Image Credits: Bryce Durbin / TechCrunch

Twice each year, we turn our attention to Y Combinator’s latest class of aspiring startups as they hold their public debuts.

For YC Summer 2021 Demo Day, the accelerator’s fourth virtual gathering, Natasha Mascarenhas, Alex Wilhelm, Devin Coldewey, Lucas Matney and Greg Kumparak selected 14 favorites from the first day of one of the world’s top pitch competitions.

Virtual events startups have high hopes for after the pandemic

Image Credits: Yuichiro Chino / Getty Images

Few people thought about virtual events before the pandemic struck, but this format has fulfilled a unique and important need for organizations large and small since early 2020. But what will virtual events’ value be as more of the world attempts a return to “normal”?

To find out, we caught up with top executives and investors in the sector to learn about the big trends they’re seeing — as the sequel to a survey we did in March 2020.

We surveyed:

- Xiaoyin Qu, founder and CEO, Run The World

- Rosie Roca, chief customer officer, Hopin

- Hemant Mohapatra, partner, Lightspeed Venture Partners India

- Paul Murphy, former investor in Hopin with Northzone (currently co-founder of Katch)

Virtual events startups have high hopes for after the pandemic

Tracking startup focus in the latest Y Combinator cohort

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm and Anna Heim wrapped up TechCrunch’s coverage of the summer cohort from Y Combinator’s Demo Day with an evaluation of how the group fared in comparison to their expectations.

They were surprised by the number of startups focusing on no-and low-code software, and pleased by the unanticipated quantity of new companies focusing on space.

“It seems only fair to note that some categories of startup activity simply met our expectations in terms of popularity,” noting delivery-focused startups including dark stores and kitchens.

Popping up less than expected? Crypto and insurtech.

Read on for the whole list of startups that caught the eye of The Exchange.

Use cohort analysis to drive smarter startup growth

Image Credits: erhui1979 / Getty Images

Cohort analysis is what it sounds like: evaluating your startup’s customers by grouping them into “cohorts” and observing their behavior over time.

In a guest column, Jonathan Metrick, the chief growth officer at Sagard & Portage Ventures, offers a detailed example explaining the value of this type of analysis.

Questions? Join us for a Twitter Spaces chat with Metrick on Tuesday, September 7, at 3 p.m. PT/6 p.m. ET. For details and a reminder, follow @TechCrunch on Twitter.