SAN FRANCISCO - Dec. 3, 2021 - PRLog -- The option trading activity for Hertz Global Holdings stock has increased lately, swinging in the positive direction. There is a feeling that Hertz stock will rise in the short term, and traders have bought call options corresponding to this expectation. Recent trades did not include put options, only call options, a sign of high expectations for the car rental company.

Traders spent $260k on call options for Hertz shares over the past three days while putting no money into put options. Call options are purchased when traders expect the stock price to trend up and put options when they expect it to go down. Here, all traders are banking on Hertz's stock rising.

What is the cause of this?

Hertz Global's car rental business was severely affected by the early stages of the Covid pandemic, but the restrictions gradually eased from mass vaccination programs and other public health initiatives. In response to the rebounding travel market, even though not back to pre-pandemic levels, and the easing of lockdowns, car rentals resumed and Hertz's business followed.

To raise money, Hertz Global decided to tap into the frothy Covid-era markets. In November, the company relisted on the stock market and raised $1.3 billion in a public offering. Investors have been bullish since then as evidenced by the unusual options activity.

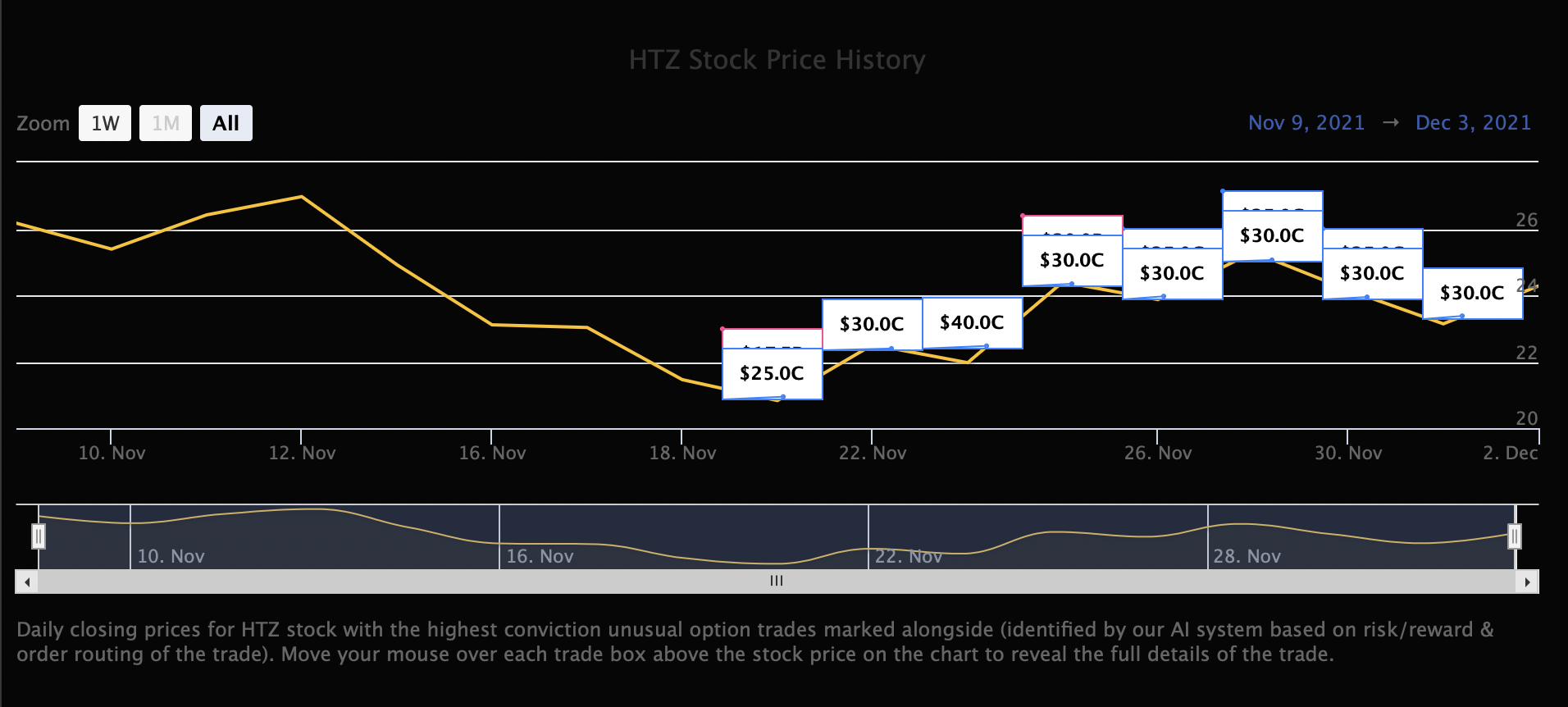

Unusual Trades

Many traders have bet that Hertz's stock will be at least $25 this month. These traders are bold in their predictions and have put their money where their mouth is by purchasing call options. Some other traders are even more optimistic, expecting Hertz stock to rise to at least $30 by the 17th of December. In fact, traders spent more money on $30 call options than $25 options over the past three days.

Hertz Global Holdings currently trades for around $24. The price is already near $25, and investors could easily push this over $30 if the company does well. It's not surprising that options traders are bullish on the company in the short term.

Why pay attention to options activity?

A common reason for investors to trade options is to hedge their bets. The price of options, however, is a good indicator of market sentiment, especially when large blocks are traded. It's important to note unusual trades, often at the asking price, because they're a good gauge of expectations among institutional investors with extensive capital. With Optionsonar's state-of-the-art machine learning and artificial intelligence, this process is incredibly easy for retail investors.

Photos: (Click photo to enlarge)

Read Full Story - Option traders think Hertz stock could reach $30 soon | More news from this source

Press release distribution by PRLog

|

Quantitative strategies, Wall Street-caliber research, and insightful market analysis since 1998. |

|||

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart Quotes delayed at least 20 minutes. By accessing this page, you agree to the following Privacy Policy and Terms and Conditions. |

|

||

|

|||