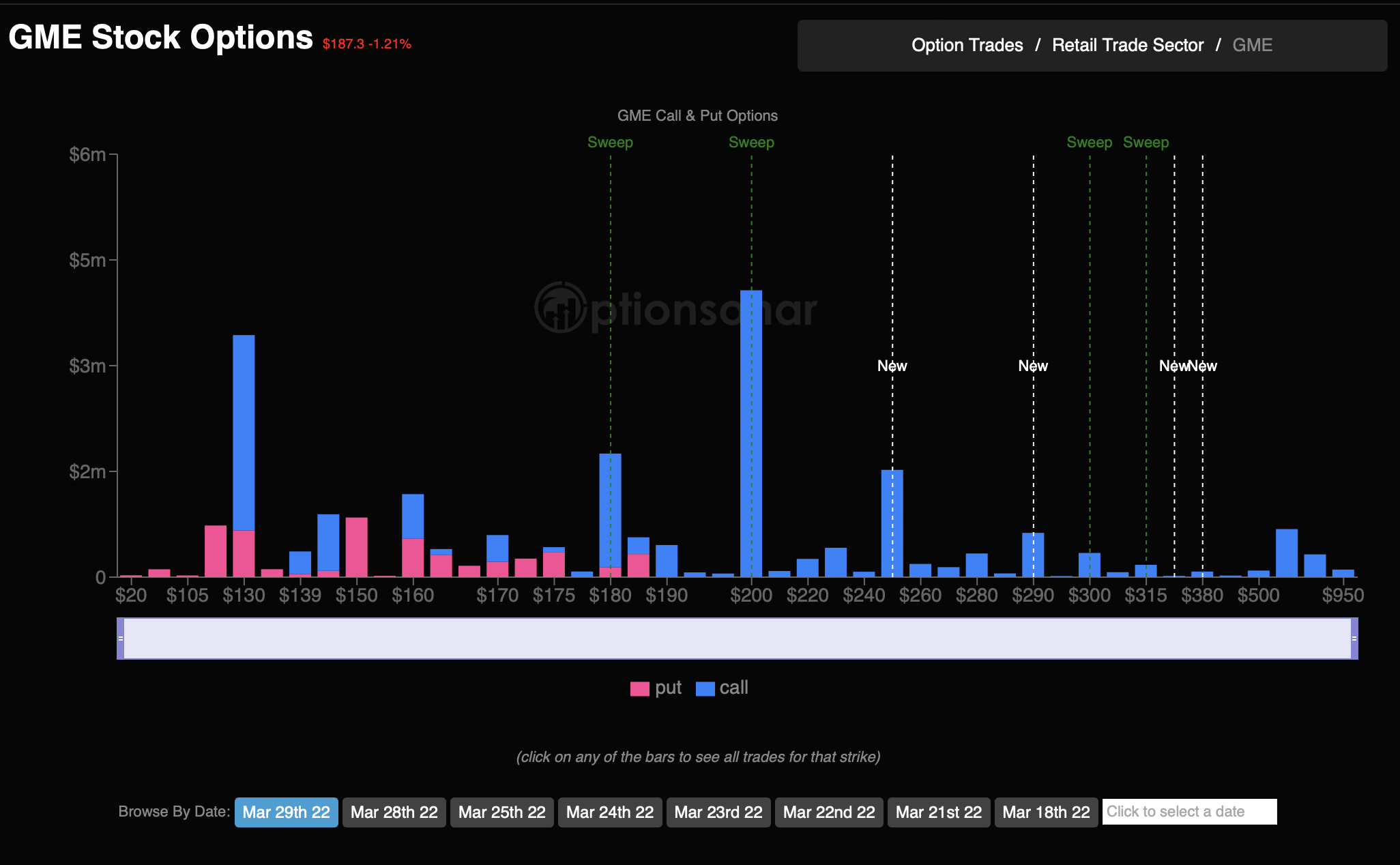

SAN FRANCISCO - March 29, 2022 - PRLog -- In the past few weeks, GameStop stock (ticker: GME) unusual option trading activity has increased. There is an expectation that GameStop's stock will rise soon, and traders have taken advantage of this opportunity by buying call options. Recently, Wall Street traders did not trade many put options, only call options, to bet on the future expectations of the stock, signaling high expectations for the video game retailer.

Just this week, traders spent over $4 million on speculative out of the money call options. Traders purchase call options when the stock price is expected to rise and put options when it is expected to fall. With GameStop's stock, most option traders are hoping the stock of GameStop will rise.

What is the cause of this?

Insiders recently bought a very large amount of the stock.

The larger one was by Chairman Ryan Cohen, who paid $10.2 million for 100,000 shares on March 22. He was followed by director Larry Cheng.

According to a filing with the Securities and Exchange Commission, Cheng paid $383,355 for 4,000 GameStop shares, with an average price of $95.84 each. He now owns 8,022 shares of GameStop, which he joined last year.

This series of insider purchases has fueled new optimism in the stock by active traders.

Unusual Option Trades

Many traders have bet that GameStop's stock will be at least $200 by end of April. These traders are bold in their predictions and have put their money where their mouth is by purchasing call options.

GameStop currently trades for around $190. The price is already near $200, and investors could easily push this over $200 if the company does well. It's not surprising that options traders are bullish on the company in the short term.

Why pay attention to options activity?

Investors often trade options to hedge their bets. However, options are a good indicator of market sentiment, especially when large blocks are traded. It's important to note unusual trades, often at the asking price, because they're a good gauge of expectations among institutional investors with extensive capital. With Optionsonar's state-of-the-art machine learning and artificial intelligence, this process is incredibly easy for retail investors to discover unusual options.

Photos: (Click photo to enlarge)

Read Full Story - GameStop stock sees large influx of unusual options activity from traders yet again | More news from this source

Press release distribution by PRLog

|

Quantitative strategies, Wall Street-caliber research, and insightful market analysis since 1998. |

|||

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart Quotes delayed at least 20 minutes. By accessing this page, you agree to the following Privacy Policy and Terms and Conditions. |

|

||

|

|||