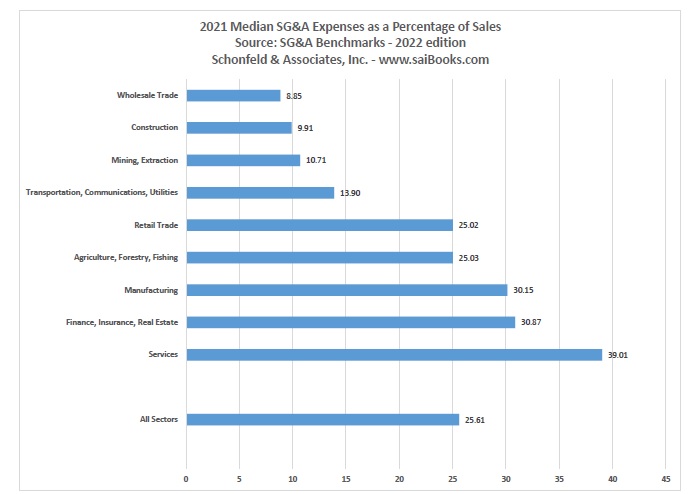

VIRGINIA BEACH, Va. - April 18, 2022 - PRLog -- Schonfeld & Associates, publisher of business information products for 40+ years, offers three recently updated reports in its series, SG&A Benchmarks. The PDF reports are designed for use as convenient sources of information for professional managers seeking benchmark information on Selling, General & Administrative spending by major public corporations. These metrics provide important insight for all firms within the sector. SG&A expenses are all direct and indirect selling expenses plus all general and administrative expenses, also called Operating Expenses. Frequently, SG&A to Sales ratios are used to judge efficiency of management spending.

Benchmarks for SG&A spending are hard to find. Averages may be available but are generally too broad to be useful. Each title within the SG&A Benchmarks series is produced for a specific industry sector. Individual companies are listed with SG&A to Sales percentage and growth rates for fiscal years 2020 and 2021. The sector summary charts provide side by side comparison of values for each industry within the sector for 2019, 2020 and 2021. Individual companies are grouped by size based on fiscal 2021 sales. Total sales for fiscal 2021 and headquarters city are also provided.

2022 editions of following sector reports are now available:

SG&A Benchmarks – Manufacturing provides SG&A spending information for 1994 publicly traded companies in twenty industries.

SG&A Benchmarks –Retail Trade provides SG&A spending information for 256 publicly traded companies in eight industries.

SG&A Benchmarks – Services provides SG&A spending information for 1162 publicly traded companies in eleven industries.

Within each report, the industry sector summary displays median SG&A to Sales ratio by industry to illustrate the range of values reported by firms within each industry. The tabulations for each individual industry present both fiscal 2020 and 2021 SG&A as a percentage of sales and the annual percentage growth rate in SG&A spending as well as in sales for each company within the industry. Comparing the growth rate of SG&A expenses and sales gives a snapshot of where the profitability of the firm may be heading. The firms are presented in three groups as defined by sales of less than $100 million, sales between $100 million and $1 billion, and sales of more than $1 billion.

Two sets of industry tabulations are presented. Alphabetical order by company name aids in locating a firm. Order by SG&A to Sales ratio showcases the 'leaner and meaner' firms in each industry.

These reports will benefit anyone seeking competitive benchmark intelligence including corporate staff, financial analysts, investment professionals, lenders, M&A advisors, appraisers and industry consultants.

Visit https://saibooks.com/product-category/sga-2020/ for more information and to place a secure order for immediate download.

Contact

Carol Greenhut

***@saibooks.com

Photos: (Click photo to enlarge)

Read Full Story - 2022 edition of SG&A Benchmarks Reports now available for Manufacturing, Retail and Services sectors | More news from this source

Press release distribution by PRLog

|

Quantitative strategies, Wall Street-caliber research, and insightful market analysis since 1998. |

|||

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart Quotes delayed at least 20 minutes. By accessing this page, you agree to the following Privacy Policy and Terms and Conditions. |

|

||

|

|||