GXO Logistics, Inc. (GXO) provides warehousing and distribution, order fulfillment, e-commerce, and reverse logistics or returns management services worldwide. The Greenwich, Conn., company recently announced that it expects to add more than 3,000 positions in France over the next two years to meet the strong demand for its e-commerce solutions. It will also handle logistics for Majestic Wine's nationwide e-commerce.

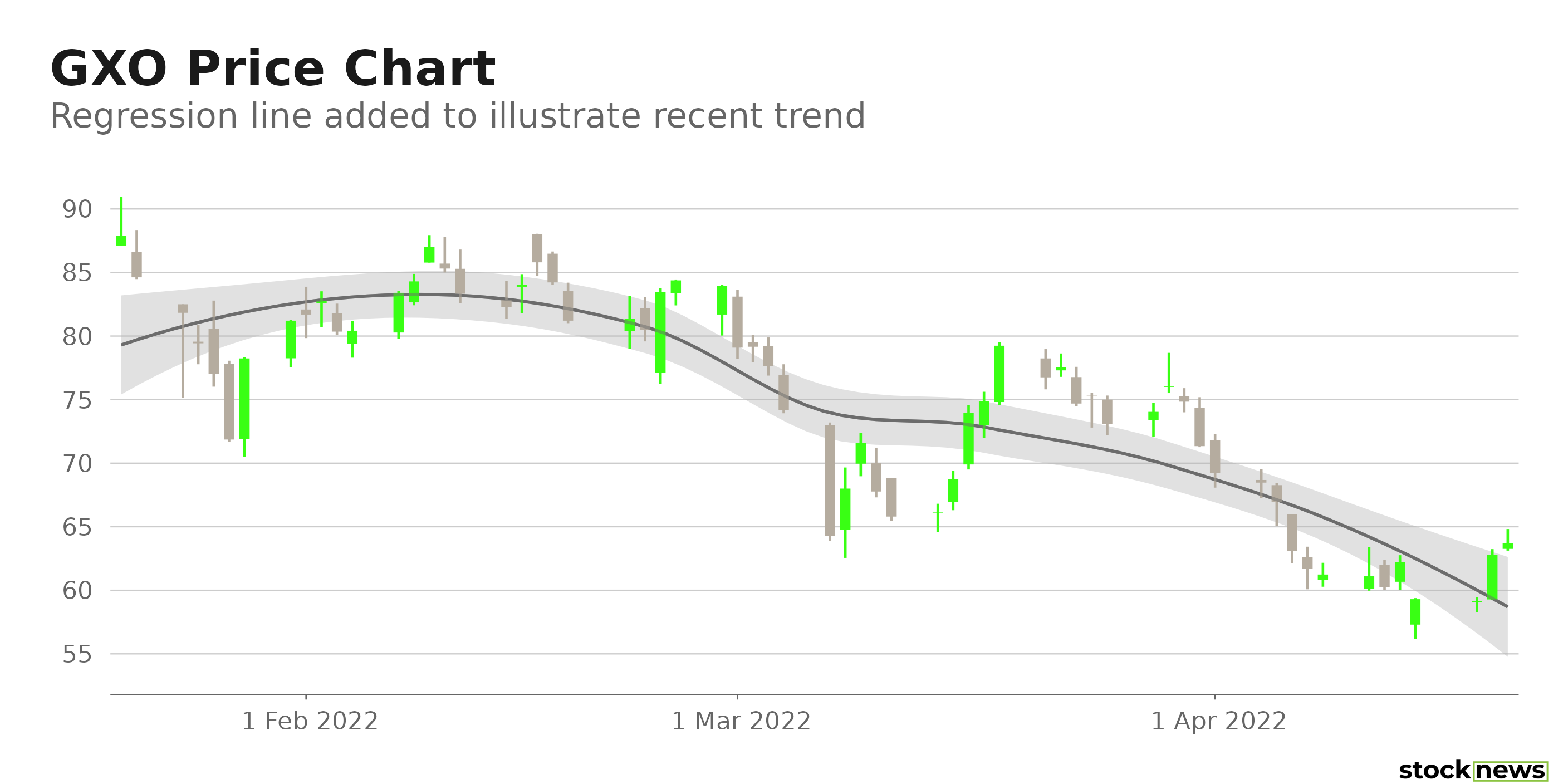

The stock has declined 20.8% in price over the past month and 30.9% year-to-date to close yesterday’s trading session at $62.77. In addition, it is currently trading 40.7% below its 52-week high of $105.92, which it hit on Nov. 18, 2021.

Also, increasing COVID-19 cases worldwide and rising energy prices make the stock’s near-term prospects look uncertain.

Here is what could influence GXO’s performance in the upcoming months:

Solid Financials

GXO’s revenues surged 48.7% year-over-year to $2.26 billion for its fiscal fourth quarter, ended Dec.31, 2021. In addition, its adjusted EBITDA grew 21% year-over-year to $167 million. The company’s adjusted net income came in at $84 million, representing a 71.4% year-over-year increase. Also, its adjusted EPS was $0.73, up 69.8% year-over-year.

Favorable Analyst Estimates

For its fiscal year 2022, analysts expect GXO’s EPS and revenue to grow 32.5% and 11.2%, respectively, year-over-year to $2.77 and $8.83 billion. In addition, its EPS is expected to grow at 18.9% per annum over the next five years. Wall Street analysts expect the stock to hit $98.25 in the near term, indicating a potential upside of 53.9%.

Low Profitability

In terms of trailing-12-month net income margin, GXO’s 1.93% is 70.4% lower than the 6.50% industry average. Likewise, its 3.20% trailing-12-month EBIT margin is 66.5% lower than the 9.56% industry average. Moreover, the stock’s 2.10% and 5.91% respective trailing-12-month ROTA and ROCE are lower than the 5.17% and 13.81% industry averages.

Stretched Valuation

In terms of forward EV/EBIT, GXO’s 22.93x is 50.4% higher than the 12.24x industry average. Likewise, its 22.70x forward non-GAAP P/E is 28.3% higher than the 17.69x industry average. Also, the stock’s 12.72x and 14.91x respective forward EV/EBITDA and P/CF are higher than the 10.68x and 13.89x industry averages.

POWR Ratings Don’t Indicate Enough Upside

GXO has an overall C rating, which equates to a Neutral in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. GXO has a C grade for Value, which is in sync with its higher-than-industry valuation ratios.

The stock has a C grade for Quality, in sync with its lower-than-industry profitability ratios.

GXO is ranked #67 of 89 stocks in the Industrial - Services industry. Click here to access all of GXO’s ratings.

Bottom Line

GXO is currently trading below its 50-day and 200-day moving averages of $73.88 and $81.09, respectively, indicating a downtrend. So, the stock looks overvalued at the current price level, and we think it could be wise to wait for a better entry point in the stock.

How Does GXO Logistics (GXO) Stack Up Against its Peers?

While GXO has an overall POWR Rating of C, one might want to consider investing in the following Industrial - Services stocks with an A (Strong Buy) rating: Koç Holding A.S. (KHOLY), DLH Holdings Corp. (DLHC), and PT United Tractors Tbk (PUTKY).

GXO shares were trading at $64.08 per share on Wednesday afternoon, up $1.31 (+2.09%). Year-to-date, GXO has declined -29.45%, versus a -5.86% rise in the benchmark S&P 500 index during the same period.

About the Author: Nimesh Jaiswal

Nimesh Jaiswal's fervent interest in analyzing and interpreting financial data led him to a career as a financial analyst and journalist. The importance of financial statements in driving a stock’s price is the key approach that he follows while advising investors in his articles.

The post Should You Buy GXO Logistics on the Dip? appeared first on StockNews.com