Dolphin Entertainment Inc. (DLPN) in Coral Gables, Fla., is a leading independent marketing and production business in the entertainment industry. It provides strategic marketing and publicity services to many of the best brands, both individual and corporate, in the film, television, music, gaming, and hospitality sectors through its subsidiaries 42West, The Door, Shore Fire Media, and B/HI (a branch of 42West).

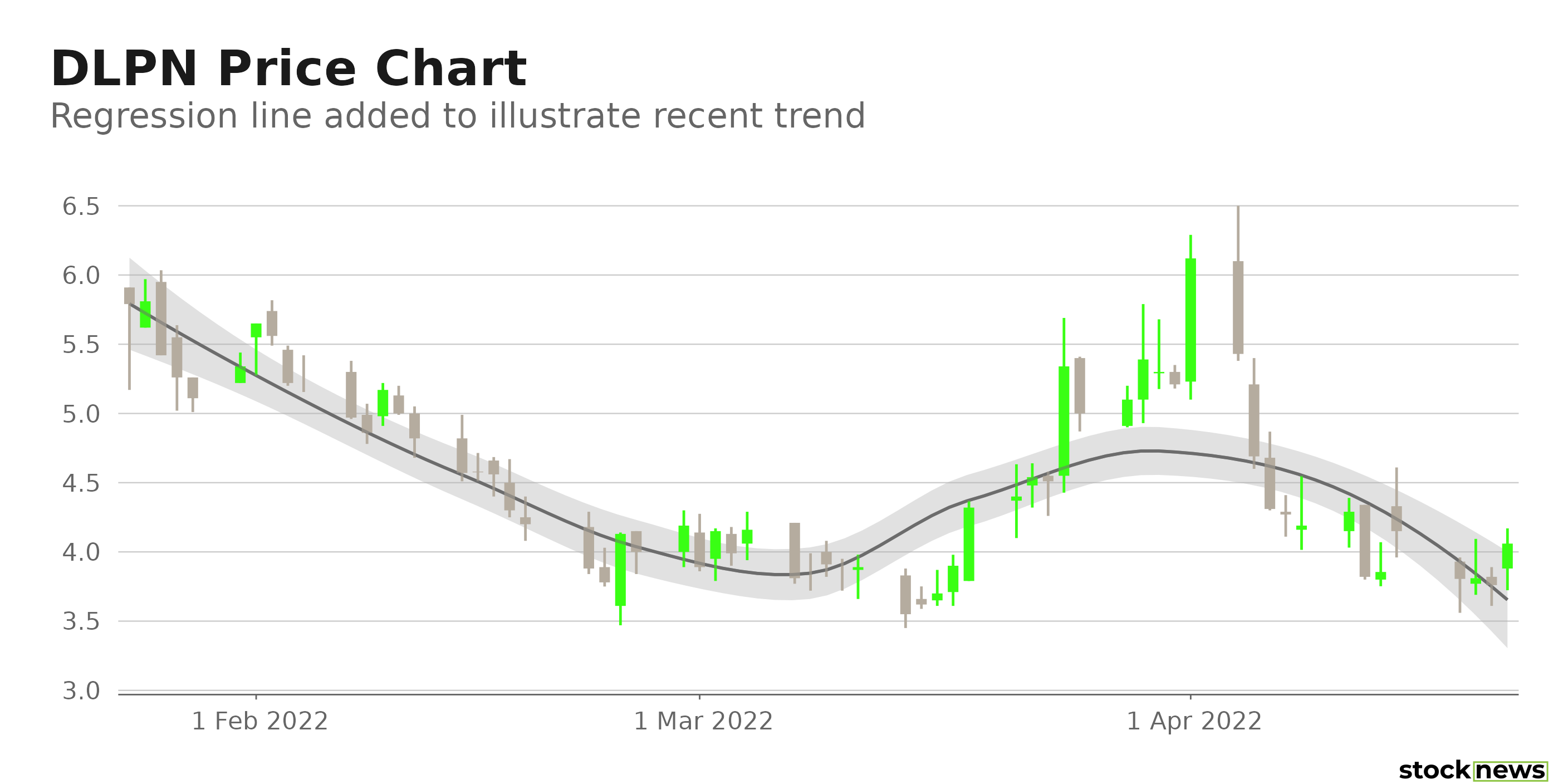

The stock is down 52.4% in price year-to-date and 7.7% over the past month to close yesterday's trading session at $4.06. Furthermore, it is currently trading 73.4% below its 52-week high of $15.25, which it hit on Aug. 26, 2021.

While the NFT space has garnered significant investor attention, it has several risks, given its tremendous volatility. In addition, because the long-term prospects of digital collectibles are uncertain, investors' risks may be heightened by confusing marketing, the whims of affluent collectors, and the possibility of fraudulent players. This could weigh on the long-term prospects of DLPN.

Here is what could shape DLPN's performance in the near term:

Poor Bottom line Performance

DLPN's total revenue increased 48.5% year-over-year to $35.73 million for the three months ended Dec. 31, 2021. However, its income before other expenses increased 109.9% from its year-ago value to $5.48 million. Its net loss grew 233.2% from the prior-year quarter to $6.46 million, while its loss per share came in at $0.85 over this period. In addition, its cash and cash equivalents declined 2.5% from their year-ago value to $7.7 million for the year ended Dec. 31, 2021.

Poor Profitability

DLPN's 0.21% trailing-12-months CAPEX/Sales multiple is 95.1% lower than the 4.2% industry average. Its trailing-12-months cash from operations stood at negative $378,640 compared to the $299.40 million industry average. Also, its trailing-12-months ROA, net income margin, and ROC are negative 8.7%, 14.8%, and 3.2%, respectively.

POWR Ratings Reflect Uncertainty

DLPN has an overall D rating, which equates to Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. DLPN has a D grade for Stability. The stock’s 2.12 beta is consistent with the Stability grade.

Among the 20 stocks in the F-rated Entertainment – Media Producers industry, DLPN is ranked #15.

Beyond what I have stated above, one can view DLPN ratings for Value, Momentum, Growth, Quality, and Sentiment here.

Bottom Line

While the company reported solid revenue growth in its last quarter, investors could become concerned about DLPN's long-term prospects based on its negative profit margin. In addition, analysts expect its EPS to decline 38.5% next quarter (ending June 30, 2022). Furthermore, the stock is currently trading below its 50-day and 200-day moving average of $4.34 and $8.40, respectively, indicating a downtrend. Given its lofty valuation, we believe the stock is best avoided now.

How Does Dolphin Entertainment Inc. (DLPN) Stack Up Against its Peers?

While DLPN has an overall D rating, one might want to consider its industry peers, News Corporation (NWSA) and AMC Networks Inc. (AMCX), which has an overall B (Buy) rating.

What To Do Next?

If you would like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners?

First, because they are all low-priced companies with explosive growth potential, that excel in key areas of growth, sentiment and momentum.

But even more important is that they are all top Buy rated stocks according to our coveted POWR Ratings system, Yes, that same system where top-rated stocks have averaged a +31.10% annual return.

Click below now to see these 3 exciting stocks which could double (or more!) in the year ahead:

DLPN shares were unchanged in premarket trading Friday. Year-to-date, DLPN has declined -52.35%, versus a -7.48% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post Is Dolphin Entertainment a Buy Under $5? appeared first on StockNews.com