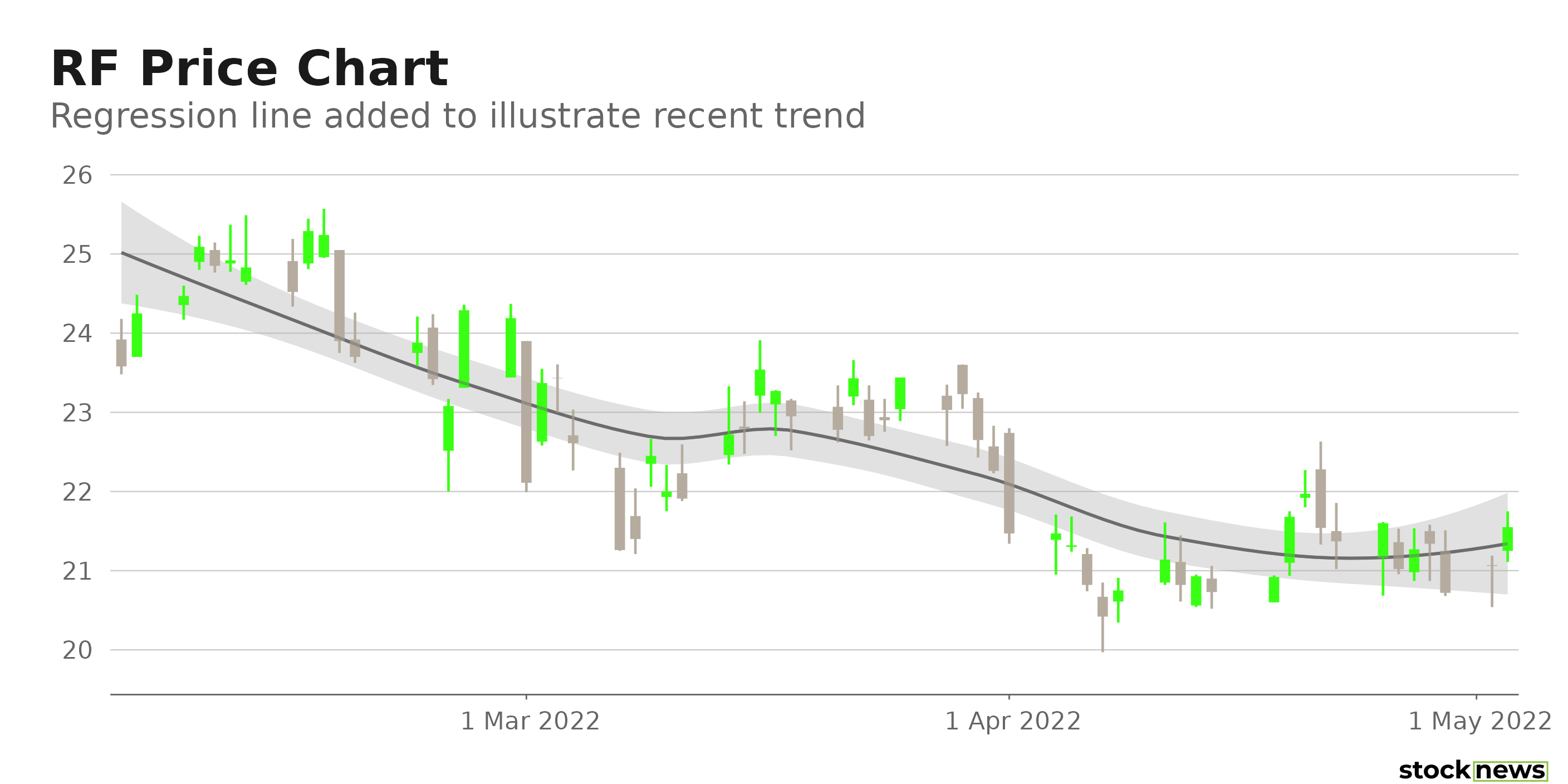

With $163 billion in assets, Regions Financial Corporation (RF) in Birmingham, Ala., is a member of the S&P 500 Index and one of the nation's biggest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services. Although the stock has gained 9.8% in price over the past nine months, it is down 8.6% over the past three months to close yesterday's trading session at $21.55.

In addition, RF's dividend payouts have grown at a 20.7% CAGR over the past five years. While its four-year average dividend yield is 3.5%, its current dividend translates to a 3.2% yield. It paid a $0.17 per share dividend on Jan. 07, 2022.

The company recently reported its first-quarter earnings. Its loan and deposit balance growth fueled the results. Its credit metrics were also strong in the first quarter. However, decreased fee income hampered its total revenue growth, while an increase in expenses impacted the company’s bottom line. Its capital ratios continued to decline in the quarter, and its net income available to common shareholders was $524 million, representing a 15% decrease from the prior year.

Here is what could shape RF's performance in the near term:

Mixed Valuation

In terms of forward non-GAAP PEG, RF is currently trading at 1.15x, which is 7.9% higher than the 1.07x industry average. Also, its forward Price/Books of 1.21x is 8.1% higher than the 1.12x industry average.

However, RF’s 9.78x non-GAAP forward P/E is 6.1% lower than the 10.41x industry average, and its trailing-12-months Price/Cash Flow is 15.7% lower than the 7.87x industry average.

Strong Profitability

RF's 37.2% trailing-12-months net income margin is 24.3% higher than the 30% industry average. Also, its 19.1% and 28.3% respective ROC and ROA are higher than the industry averages. And its $2.11 billion cash from operations is significantly higher than the $131.62 million industry average.

POWR Ratings Reflect Uncertainty

RF has an overall C rating, which equates to a Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. RF has a C grade for Stability and Value. The stock’s 1.31 beta is consistent with the Stability grades. In addition, its mixed valuation is in sync with the Value grade.

Among the 26 stocks in the D-rated Southeast Regional Banks industry, RF is ranked #9.

Beyond what I have stated above, one can view RF ratings for Growth, Momentum, Quality, and Sentiment here.

Bottom Line

Although the company beat analysts' earnings estimates, its revenue was down slightly compared to the previous year's quarter. In addition, the stock is currently trading below its 50-day and 200-day moving averages of $22.14 and $22.14, respectively, indicating a bearish sentiment. Moreover, analysts expect its EPS to decline 31.2% in the current quarter (ending June 30, 2022) and 13.8% next quarter (ending Sept. 30, 2022). Therefore, we believe investors should wait before scooping up its shares.

How Does Regional Financial Corporation (RF) Stack Up Against its Peers?

While RF has an overall C rating, one might want to consider its industry peers, Peoples Bancorp of North Carolina Inc. (PEBK), Community Trust Bancorp Inc. (CTBI), and Republic Bancorp. Inc. (RBCAA), which have an overall B (Buy) rating.

RF shares were unchanged in premarket trading Wednesday. Year-to-date, RF has declined -0.39%, versus a -12.06% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post Is Regions Financial a Smart Dividend Stock to Invest In? appeared first on StockNews.com