Atlanta, Ga.-based Floor & Décor Holdings Inc. (FND) is a prominent high-growth specialty retailer of hard-surface flooring, with 166 warehouse-format stores and five design studios in 34 states as of March 31, 2022.

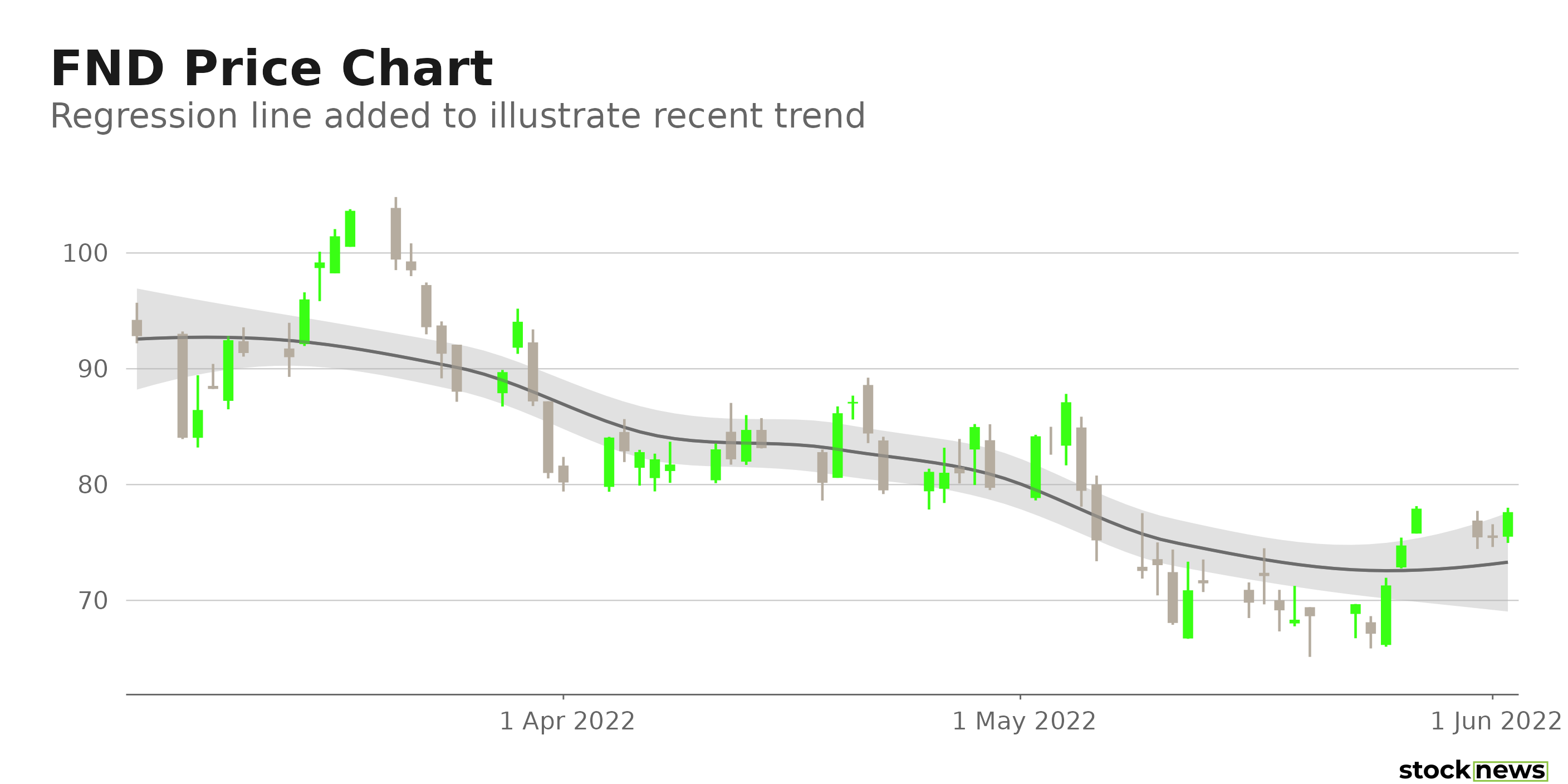

The company's shares are down 22.9% in price over the past year and 42% year-to-date to close yesterday's trading session at $75.39. While the company exhibited solid top-line performance in its recent earnings report, its declining bottom line and lofty valuations are concerning.

In addition, last month, the stock was downgraded by equity researchers at Gordon Haskett to an "accumulate" rating from a "buy" rating, making its near-term prospects look uncertain.

Here is what could shape FND's performance in the near term:

Inadequate Financials

FND's net sales increased 31.5% year-over-year to $1.03 billion for the first quarter, ended March 31, 2022. However, its operating expenses grew 30.3% from its year-ago value to $314.09 million. Its operating income declined 2.1% from the prior-year quarter to $93.97 million. And the company's net income decreased 6.4% year-over-year to $70.95 million. Its loss per share amounted to $0.66 over this period. In addition, its cash and cash equivalents came in at $31.83 million, representing a 77.2% decline for the three months ended March 31, 2022.

Premium Valuation

In terms of forward non-GAAP P/E, the stock is currently trading at 26.24x, which is 115.6% higher than the 12.17x industry average. Also, its 20.21x forward EV/Sales is 96.4% higher than the 1.10x industry average. Furthermore, FND's 1.84x forward Price/Sales is 106.2% higher than the 0.89x industry average.

POWR Ratings Reflect Bleak Outlook

FND has an overall D rating, which equates to a Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. FND has a D for Value which is justified given the company's higher-than-industry valuation.

Among the 63 stocks in the C-rated Home Improvement & Goods industry, FND is ranked #57.

Beyond what I have stated above, one can view FND ratings for Growth, Quality, Stability, Momentum, and Sentiment here.

Bottom Line

FND's deteriorating bottom-line performance and stretched valuations could raise investors' concerns over its prospects. Also, the company continues to struggle with pandemic’s impact on associates, customers, business partners, and the supply chain. Furthermore, the stock is currently trading below its 50-day and 200-day moving averages of $8.01 and $108.82, respectively, indicating a downtrend. So, we think the stock is best avoided now.

How Does Floor & Décor Holdings Inc. (FND) Stack Up Against its Peers?

While FND has an overall D rating, one might want to consider its industry peers, Acuity Brands Inc. (AYI), which has an overall A (Strong Buy) rating, and Builders FirstSource Inc. (BLDR) and Haverty Furniture Companies Inc. (HVT) which have an overall B (Buy) rating.

Note that BLDR is one of the few stocks handpicked by our Chief Growth Strategist, Jaimini Desai, currently in the POWR Growth portfolio. Learn more here.

FND shares were trading at $77.68 per share on Thursday morning, up $2.29 (+3.04%). Year-to-date, FND has declined -40.25%, versus a -13.32% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post Should You Add Floor & Decor Holdings to Your Investment Portfolio? appeared first on StockNews.com