VIRGINIA BEACH, Va. - June 6, 2022 - PRLog -- According to a newly released study from Schonfeld & Associates, Inc., R&D Ratios & Budgets, the pharmaceutical industry continued to be the biggest R&D investor in fiscal 2021 with budgets of drug companies increasing by 24% to $168 billion. Software companies increased their spending by a total of over $158 billion.

The biggest single R&D investor in 2021 was Alphabet at over $31 billion, followed by Meta (Facebook) at $24 billion, and then Microsoft and Apple at $21 billion. Firms involved with digital content are investing much more heavily than those in more traditional arenas.

Pharmaceutical firms continued significant R&D spending in 2021. Johnson & Johnson, the top spender at $15.6 billion, is followed by Pfizer, Merck, Bristol Myers Squibb, Astrazeneca and Novartis, each spending over $9 billion. The biotech industry, led by Amgen, grew R&D by over 8% to over $34 billion. Electromedical apparatus makers, led by Medtronic, spent a total of over $3.6 billion, an increase of over nine percent.

R&D budgets of semiconductor makers grew to over $59 billion, an increase of 18.3%. Intel had the largest R&D budget, $15.1 billion, a 12% increase over 2020. R&D budgets within the industries that are major suppliers to the infrastructure of the Internet cloud also have increased R&D spending.

The 2021 R&D spending of the automotive industry, led by Toyota, General Motors and Ford each spending over $7 billion, was up over 26% from the 2020 total with industry revenues up 17.8%.

About the Study

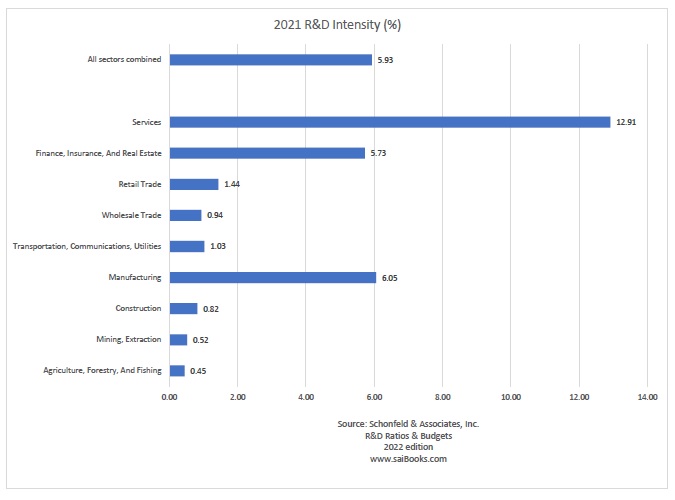

R&D Ratios & Budgets contains fiscal 2020 and 2021 R&D spending, 2021 revenue and R&D intensity ratio, as well as 2020 and 2021 annual growth rates in R&D spending and sales for over 2,500 firms. Over 290 industry summaries of the same information are provided. The study reports for each company a low and high value for the R&D-to-sales ratio (also known as R&D intensity) for the last five years to indicate stability of R&D spending.

R&D Ratios & Budgets is used for budget planning, monitoring competition, identifying joint venture partners, and spotting acquisition candidates.

The 2022 edition of the PDF report is $ 395 and the report along with Excel datafiles is $ 495. Five years of revenue, R&D spending and ratio information is provided within the datafiles to allow for additional analysis. Contact Schonfeld & Associates, Inc., 1932 Terramar Lane, Virginia Beach, VA 23456. Call for more information: 800-205-0030 or visit the company's web site for immediate download at www.saiBooks.com under Area of Expertise: Research & Development Spending.

Contact

Carol J. Greenhut

***@saibooks.com

Photos: (Click photo to enlarge)

Read Full Story - 2021 R&D Spending and Intensity Benchmarks | More news from this source

Press release distribution by PRLog

|

Quantitative strategies, Wall Street-caliber research, and insightful market analysis since 1998. |

|||

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart Quotes delayed at least 20 minutes. By accessing this page, you agree to the following Privacy Policy and Terms and Conditions. |

|

||

|

|||