( click to enlarge )

( click to enlarge )Bright Minds Biosciences Inc (NASDAQ:DRUG) The stock finally broke the hourly falling wedge formation on large volume. The technical chart shows buyers are back. With the surge on Friday %K line is again on top over %D line showing the stock is back to a new rally. A move towards $2.50 can be expected as long as $1.52 holds.

( click to enlarge )

( click to enlarge )I have been following SuperCom Ltd. Ordinary Shares (NASDAQ:SPCB) for a few days now and surprisingly it showed some strength in the final hour on Friday in a depressed market. On the momentum front, I'm seeing some positive divergences in several key momentum indicators, but this is not confirmed yet, as prices have not shown a confirmed reversal. At the bottom of the chart is the accumulation/distribution line, and readings on the indicator suggest the stock has been under strong accumulation lately. The stock needs to break Wednesday’s high of $.41 to expect a strong rally at this point. I took a strong/long position last week. Note: The company already awarded several contracts in the last few months that are worth several million.

( click to enlarge )

( click to enlarge )Kidpik Corp (NASDAQ:PIK) Another interesting small cap for the month of September. The company continues to form a base around the $1.9's as we get ready for another major move higher. A break of $2.39 EMA100 with force might give the stock room to $4

( click to enlarge )

( click to enlarge )Mullen Automotive Inc (NASDAQ:MULN ) Friday’s action in the share price leads me to believe that we may see a reversal trend at this level. To sustain this point of view, stock needs to sustain actual levels in the days to come. Watching if this can go into $.74's next week to test/break the long downtrend line.

( click to enlarge )

( click to enlarge )BioXcel Therapeutics Inc (NASDAQ:BTAI) is showing positive momentum as the stock tests a basing pattern breakout level. Breakout watch over $15

( click to enlarge )

( click to enlarge )Reviva Pharmaceuticals Holdings, Inc. (NASDAQ:RVPH) decisively broke the bull flag formation with a big bullish engulfing candle and might soon find itself in next resistance at the 3.10 area

( click to enlarge )

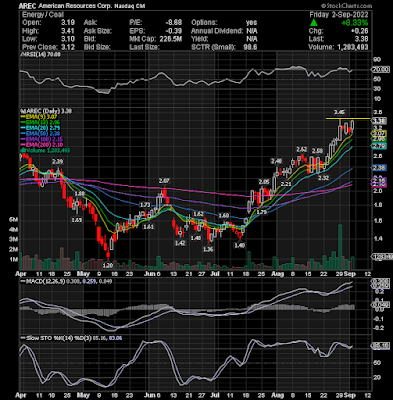

( click to enlarge )American Resources Corp (NASDAQ:AREC) has been on a nice uptrend recently and could be ready to breakout again. Waiting for a break and closing above the $3.45 level for a long position.

LABOR DAY SALE: Trade Ideas is my favorite stock screener for many reasons. It is fast, accurate, flexible and helps me to increase my profitability by quickly finding stocks. Enjoy 20% off the 1st month or year of any subscription by using the code BREAKTIME20 and CLICK on the Banner Below. The code expires Midnight on Tuesday, September 6th. The Must Have Technology for All Active Traders.

Thanks for visiting AC Investor Blog.

AC