( click to enlarge )

( click to enlarge )Meta (NASDAQ:META) had another positive day on Friday closing the week above its 50-day EMA. I called the stock as a potential bottom play earlier last week due to its low price to earnings ratio (below 9). When I made the call I noted that the gap down from $127 would be the first place to look at as the target on a rebound. So, I continue to support the idea that META is currently a gap-fill candidate in the coming days.

( click to enlarge )

( click to enlarge )Exela Technologies Inc (NASDAQ:XELA) had an amazing rally on strong volume accumulation Friday. I expect a nice gap up at the open tomorrow.

( click to enlarge )

( click to enlarge )Imperial Petroleum Inc (NASDAQ:IMPP) It is only a matter of time before this stock gets back on its feet. The current status of the company is just too positive to dismiss. I like what the company does, its transparency and its growth potential. I do think IMPP shares are undervalued and offer a great opportunity. This stock looks poised to make a run for $1 in the near future.

( click to enlarge )

( click to enlarge )I like the chart of BioXcel Therapeutics Inc (NASDAQ:BTAI) alot . Probably one of my bio favorites. As you can see the stock broke out on high volume Thursday and was able to keep the strength on Friday by closing near the highs of the day. A break of 16 next week would confirm continuation of the trend, with a short-term target area of 20. Watch it fly in the upcoming weeks.

( click to enlarge )

( click to enlarge )Broadwind Inc (NASDAQ:BWEN) is making some nice progress as it works at the bottom of its range. I think this stock could see $2 and better short term. This was trading over $3.5 recently and could see that price again medium-term.

( click to enlarge )

( click to enlarge )A quick look at WIMI's chart shows a stock that has been on the downfall for six weeks. Catching a falling knife carries tremendous risk, although risk takers can be rewarded with sizable gains. This was the reason why I took a position on Friday at 60c, before it changes its trajectory. Short-term bottom looks to be in and the risk of more bloodshed is a lot lower than it was months, weeks, or even days ago. Swing idea.

( click to enlarge )

( click to enlarge )Kidpik Corp (NASDAQ:PIK) stock was very active in the last hour of trading and after hours on Friday. It traded over 50% of its authorized shares and I think it will gain momentum in the days and weeks ahead. This was a $3.5 stock four months ago.

( click to enlarge )

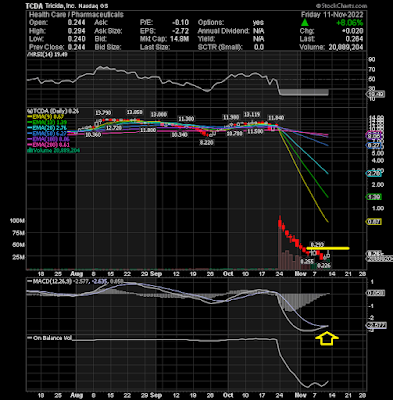

( click to enlarge )Tricida Inc (NASDAQ:TCDA) is still on watch for an impressive breakout. I'm looking for a run to 60c at least.

( click to enlarge )

( click to enlarge )Canoo (NASDAQ:GOEV) The buying was coming quickly on Friday for this stock. I am interested to see if it keeps going tomorrow.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC