( click to enlarge )

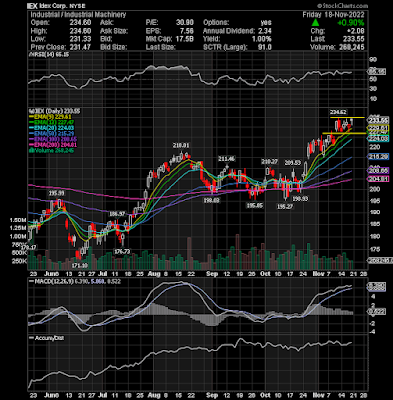

( click to enlarge )Indian Energy Exchange Ltd (NSE:IEX) looking bullish flagging on the daily chart. Next buy point when it clears 234.62 on volume with an SL around its rising EMA13

( click to enlarge )

( click to enlarge )Spirit Realty Capital Inc (NYSE:SRC) gave a pocket pivot buy point on Friday. Watch for a good follow through day next week.

( click to enlarge )

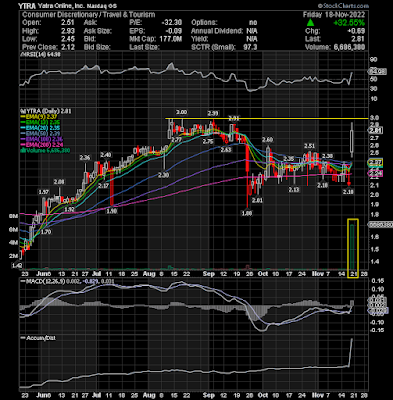

( click to enlarge )Yatra com (NASDAQ:YTRA) Big Breakout on heavy volume. Buyable on a pullback to the pivot. The technical daily chart shows a continuation of the trend with MACD and RSI in the Bullish areas. There is a good chance the stock will continue to move up next week. Next pivot point lies at $3

( click to enlarge )

( click to enlarge )Mullen Automotive Inc (NASDAQ:MULN) In a shorter time frame price is still trading sideways. Major resistance around 33c. I think it’s likely that bulls will attempt a test of that level again in the coming sessions.

( click to enlarge )

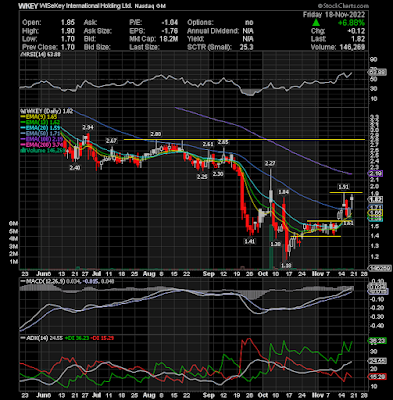

( click to enlarge )Wisekey International Holding AG (NASDAQ:WKEY) After Friday's news I think this stock is heading back over $2. I like this stock for the next few weeks. Keep it on your watchlist.

( click to enlarge )

( click to enlarge )Blue Apron Holdings Inc (NYSE:APRN) Some signs of selling exhaustion have emerged. We have all seen how quickly the stock can head higher, when the buyers come. I believe the stock is ready to post a sizable bounce from current levels. Gap fill candidate next week.

( click to enlarge )

( click to enlarge )Digi International (NASDAQ:DGII) needs to break above 42.05 next week to make a new higher high and extend the current upward trend. On watch.

( click to enlarge )

( click to enlarge )Nuwellis Inc (NASDAQ:NUWE) This penny stock is still in play for me for a swing trade. The recent offering was closed at 25c. I wouldn't be surprised to see the stock test 20c at some point over the next few weeks. The chart shows a possible reversal in trend. A breakout beyond $.132 will take the price to $.20 (it's important to remember that penny stocks are very risky, so play accordingly).

( click to enlarge )

( click to enlarge )Hour Loop Inc (NASDAQ:HOUR) Flagging with possible acceleration above $3.05 resistance

( click to enlarge )

( click to enlarge )Apple (NASDAQ:AAPL) has become increasingly bullish and is setting up for a potential swing trade. Breakout watch over 153.59

BLACK FRIDAY SALE IS BACK !! Get 30% off Trade Ideas when you use code FRIDAY30 for a new subscription or Upgrade to Premium by Clicking HERE. Trade Ideas is my favorite intraday scanning tool. Have a great weekend everyone !!

Thanks for visiting AC Investor Blog.

AC