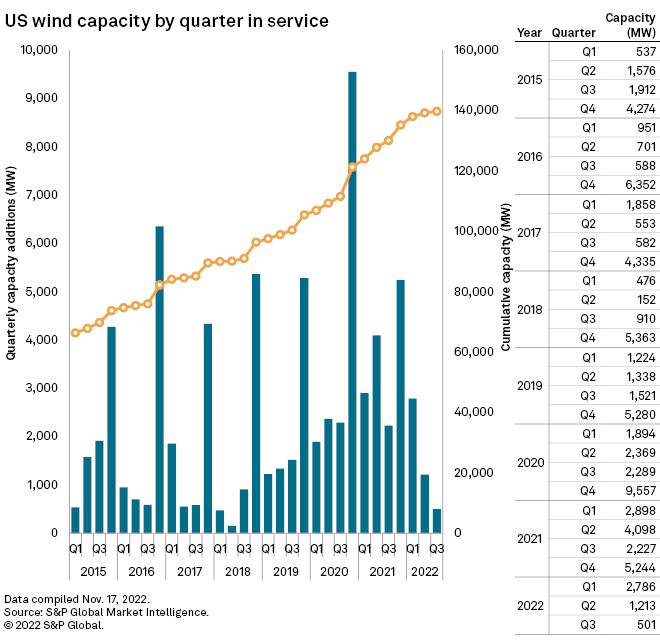

Developers added 501 MW of new wind power capacity in the U.S. from July to September, marking one of the slowest third quarters on record for project completion.

The figure was 22% of the 2,227 MW of wind capacity energized in the third quarter of 2021, according to S&P Global Market Intelligence data. No other third quarter recorded lower wind capacity additions since at least 2015, the first year of the dataset.

The quarter was no anomaly for 2022, the report said. The roughly 4,500 MW of new wind capacity added in the first three quarters of 2022 was less than half of that added by the end of last year’s third quarter, 9,223 MW, data showed.

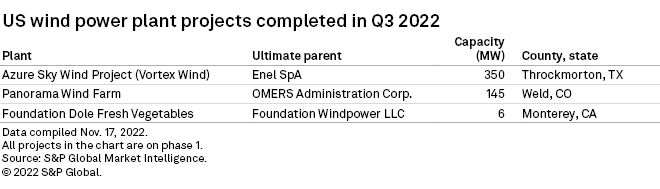

Three projects went online in the third quarter of this year. The largest was Enel SpA subsidiary Enel Green Power North America Inc.’s 350 MW Azure Sky Wind Project (Vortex Wind) in Texas. The wind turbines are paired with a 137 MW/205 MWh battery system, creating a facility that is expected to produce approximately 1.3 TWh of renewable energy annually for a variety of corporate buyers.

Dallas-based Leeward Renewable Energy LLC, owned by Canadian pension fund OMERS Administration Corp., in July commissioned its 145 MW Panorama Wind Farm in Colorado. The wind farm’s output is sold to wholesale power provider Guzman Energy LLC.

Also in the quarter, San Francisco-based Foundation Windpower, LLC, which develops wind projects for industrial and commercial facilities, energized its 5.6 MW Foundation Dole Fresh Vegetables in California.

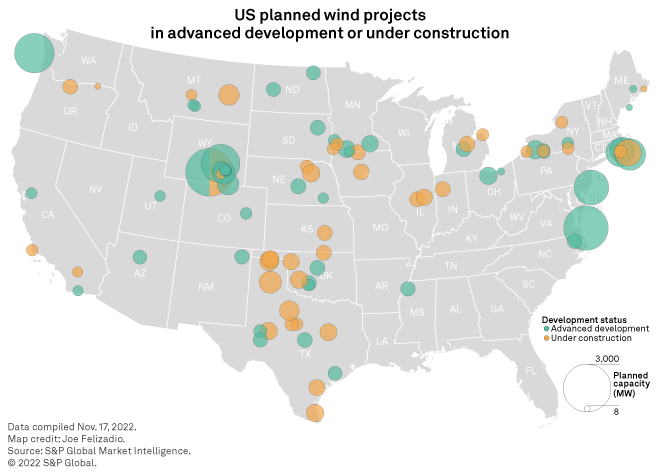

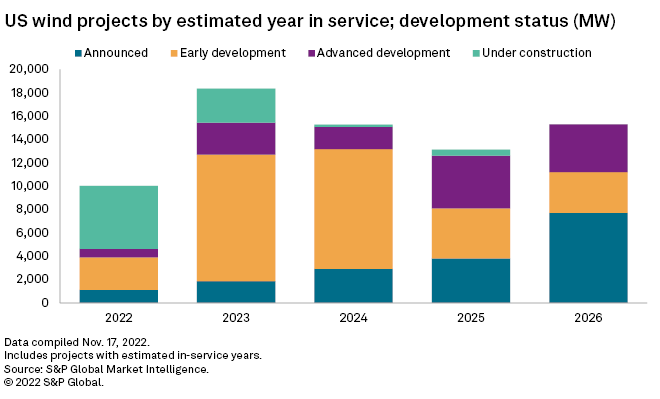

Looking ahead, developers have a 72,079 MW project pipeline, the data showed. That includes 9,009 MW under construction.

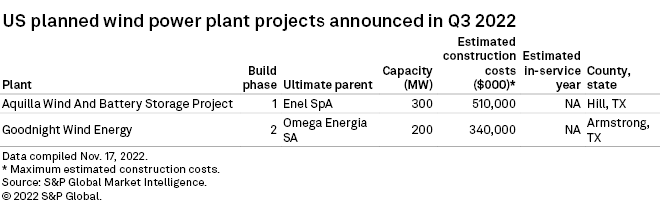

Texas leads the nation in wind power capacity under construction, with 3,179 MW underway. The only two projects developers announced in the quarter are slated to be built in the Lone Star State, which also leads the nation in installed wind power capacity.

The largest third-quarter proposal was Enel’s 300 MW Aquilla Wind And Battery Storage Project in Texas, which S&P Global Market Intelligence estimates will cost $510 million to construct. Brazilian developer Omega Energia SA also announced a 200 MW addition to its Goodnight Wind Energy project in Texas, which will cost an estimated $340 million.